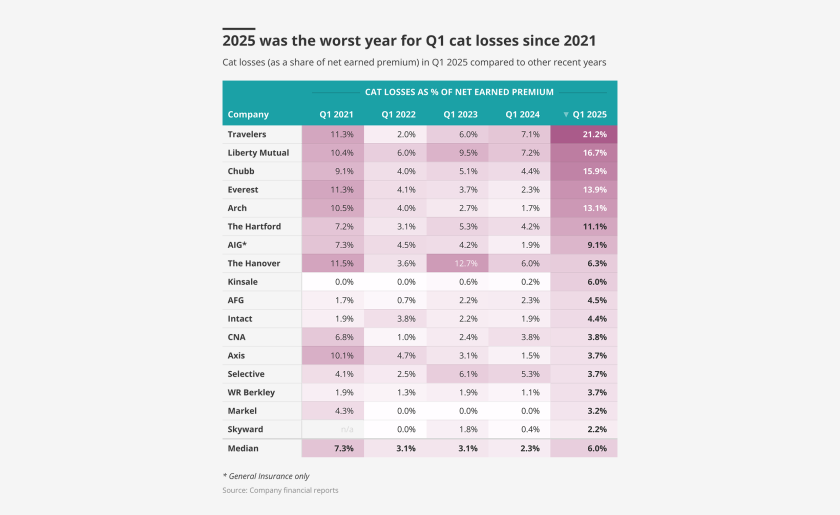

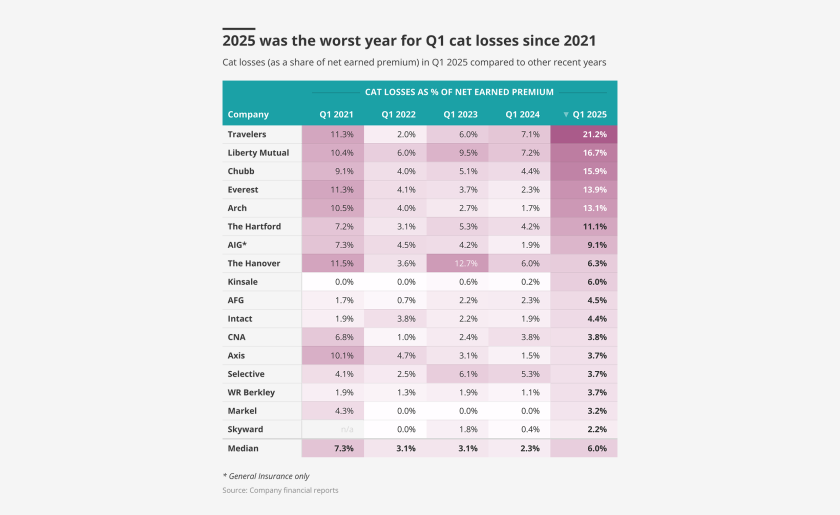

California’s historic wildfires led the insurance industry to rack up its worst Q1 cat loss ratios in several years, according to data compiled by Insurance Insider US, but the damage was not felt equally across all carriers.

The

California’s historic wildfires led the insurance industry to rack up its worst Q1 cat loss ratios in several years, according to data compiled by Insurance Insider US, but the damage was not felt equally across all carriers.

The