Berkshire Hathaway

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

The reinsurer said the deals would enhance its abilities to provide innovative solutions for clients.

-

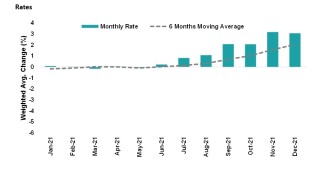

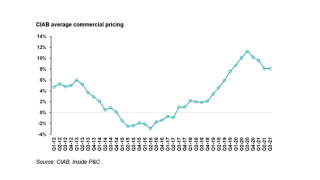

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

Berkshire Hathaway reduced its shareholding in Marsh McLennan by 35% during the third quarter, as the Warren Buffet-led business continued to sell down across its portfolio, an analyst note from Morgan Stanley shows.

-

The Colombian executive joined BHSI in 2018 as a vice president, property underwriting manager for the firm’s Middle East regional practice based in Dubai.

-

Reinsurance ops had $1.5bn in cat claims, BHSI NPW is up 42% YTD, while the conglomerate also said spiking inputs costs from supply disruptions have weighed on earnings.

-

Trucking companies, having already increased self-insured retentions by millions, will need to contend with further rate increases into 2024.

-

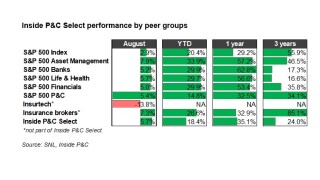

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

Berkshire Hathaway’s Aon holding rose 7.3% in Q2, with the Marsh McLennan stake down 21%.

-

Geico’s loss ratio jumped by nearly 18 points in the quarter on higher claims frequency, on par with results at personal auto rival Allstate.

-

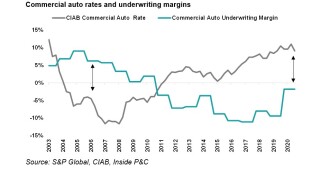

While the pandemic offered some relief to commercial auto insurers, maintaining margins will be tricky to achieve given rate moderation.

Related

-

MGA Fusion Specialty appoints Underhill head of Americas

July 16, 2025 -

BHSI global head of TL Underhill to leave

May 15, 2025