-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

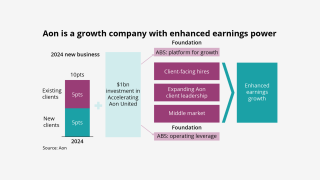

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Earlier this week, The Baldwin Group said it will merge with CAC Group in a deal valued at $1.026bn.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

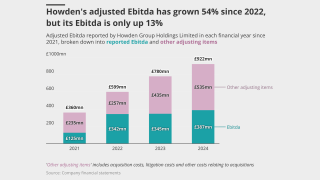

The hire advances Howden’s growth push in the US.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

The deal is slated to close in the first quarter of 2026.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Last month, Insurance Insider US revealed that MMA was set to buy Atlas following a sale process.

-

The executive was most recently head of US casualty at Aon.

-

In September, Insurance Insider US revealed that the firm had instructed a recruiter to search for Kinney’s successor.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

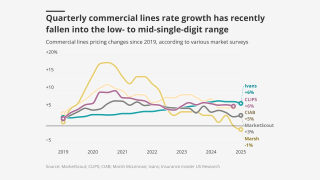

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

Softening rates amid worsening loss costs paints an uncertain future for the industry.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

Finance and insurance hiring is 27% below 2022’s peak, compared with 37% nationwide.

-

A motion by defendants to dismiss the case was also denied.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

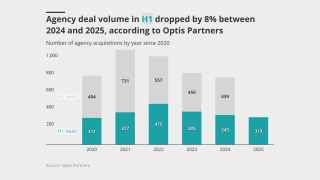

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The executive most recently served as the company’s chief broking officer.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Sources said that the platform drafted in Ardea Partners to advise on the recap.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Marsh is also suing a second tier of former Florida leaders.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

HNW family offices are now among investors considering the US MGA segment.

-

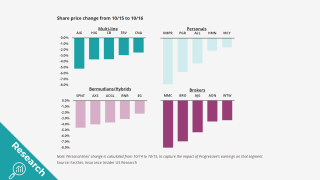

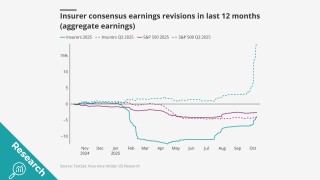

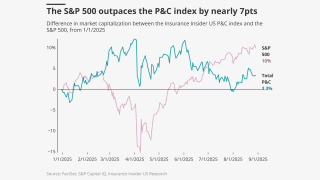

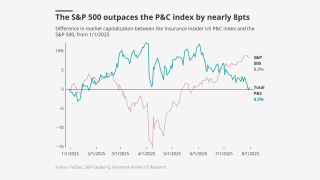

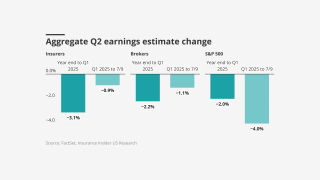

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

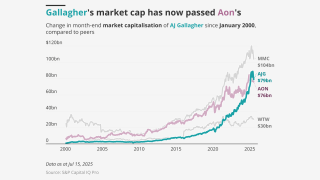

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

A quiet wind season is also expected to further soften the property market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The hire comes a few months after Nick Greggains was promoted to CEO.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Early Q3 earnings reports point to worsening market conditions.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker will report to Howden US CEO Mike Parrish.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The selloff may hint at headwinds for equity investors.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

An average of 81% of property accounts renewed flat or down.

-

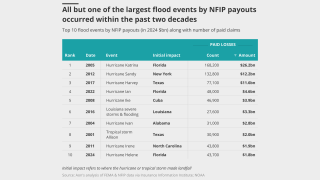

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

Dale Krupowicz was also named head of operations for the segment.

-

The motion claims the New York court has no jurisdiction in the case.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Founder Chad King will transition to chairman but continue leading M&A efforts.

-

The layoffs will mostly affect workers in Michigan.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

Jeremiah Bickham will be a strategic adviser until the end of the year.

-

JP Morgan and RBC are advising the brokerage on its options ahead of an eventual IPO.

-

The executive was formerly EVP and central regional leader at Aon.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The executive has been at the broker for over 20 years.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal will give the broker access to an M&A war chest to fuel inorganic growth.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

The executive has worked for Aon for almost two decades.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

The business is beginning to integrate following a $9.8bn acquisition.

-

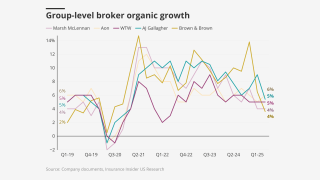

Industry stocks were firmly behind the S&P 500 in Q3.

-

She previously served as Hub’s North American casualty practice leader.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Superintendent Harris is stepping down this month after four years of service.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The New York City gala paid tribute to the industry’s top talent.

-

The executive joins the company after 17 years at Aon.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

The executive has also held senior positions at Lockton and Marsh.

-

The executive will join Howden’s new US retail broking operation.

-

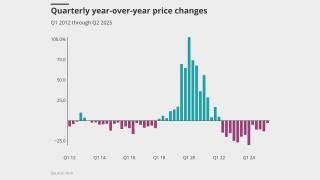

Global pricing is now 22% below the mid-2022 peak.

-

The executive met with UK colleagues to discuss plans for the US business.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

The succession could take some time, and the current CEO could also move to exec chairman.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

Other parties that looked at the business include CPPIB, Permira and Carlyle, sources said.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

Sources said the agency first considered a debt raise but recently pivoted to a sale process.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

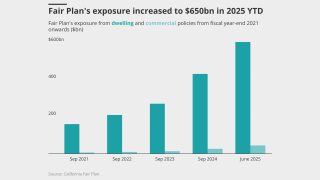

The measures also seek to encourage greater wildfire mitigation efforts.

-

Her predecessor will become head of US excess casualty and operations.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

-

The platform aims to “bend the loss curve”.

-

The team previously operated with Sheerin and Woodruff but will grow to five brokers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

Both executives will be based in New York City.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

The executive stepped down from Oneglobal in July after five years leading the firm.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The executive has been serving as COO since February.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

-

Sources said Atlas’ owner is selling the retail agencies but will retain the Hawaii carrier Island Insurance.

-

Kerr will begin a new role as CEO at Market Innovators.

-

The lawsuit is the third filed by MMA against Alliant in the past year.

-

Parrish, now CEO of Howden US, and his colleagues said they didn’t violate contracts.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

A key hearing in the poaching case is set for September 4 in New York.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Ongoing pricing headwinds stand to weigh on carriers’ returns and valuations.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

Insurance Insider US takes a closer look at tuck-in activity as valuations continue to hold steady.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The move is a retaliation to Howden’s US retail launch.

-

Sales velocity ticked up to 12.2% in Q2 but has remained steady in the past five years.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

Appointments include leadership in transportation, energy, marine and others.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The executive has been with the brokerage since 2004.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Group CEO David Howden says: ‘Our doors are open’.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

An industry veteran of 34 years, the executive is known for placing US healthcare business in London.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

The president expects to see benefits from the deal in H2 2026.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

The novel product appears to have been pitched to multiple clients.

-

AmeriLife and OneDigital are in the market while Relation is preparing for a liquidity event.

-

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

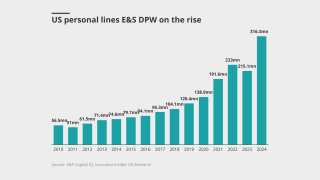

Some E&S business is flowing back to the admitted market but so far it is “anecdotal”.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Matthew Flynn joins from RenaissanceRe.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive left Lockton Re in June after almost six years.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

A timeline for the process has yet to be determined, but the base case is H1 2026.

-

Sources said the Atlanta-based platform retained Evercore to run the auction.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Sources said that Evercore is running the process, which went through first-round bids earlier this month.

-

Softer market conditions are likely to create a wave of consolidation favoring large brokers.

-

Jim Franson joins from Validus Re, where he was US president.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive briefly exited the firm last month for a role at Marsh.

-

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The technology will help analyze growing and emerging risks, especially climate change.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

The executive had been Stone Point’s representative on Higginbotham’s board.

-

This publication revealed the planned stake purchase earlier this week.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

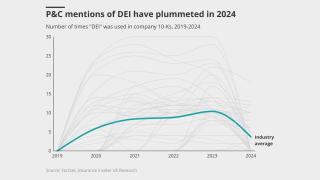

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

US events accounted for more than 90% of global insured losses.

-

In May, this publication revealed that Warburg was among the PE bidders for KAP.

-

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

The executive has spent 13 years in the broker’s marine division.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

While official return to office mandates have gathered steam, what they look like in practice can vary widely.

-

Apax and Carlyle will continue to back the broker consolidator.

-

In the US, the index fell 6.7% year on year.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

The broker also alleges a coordinated effort undermine client confidence.

-

Although overall compensation has gone up, analysis shows divergence versus value creation.

-

She joins the brokerage after 18 years at Canada’s Intact.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The broker has expanded the number of global industry verticals to seven from four.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The soft market continued through H1 2025, especially on shared programs.

-

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

Premium rose across the top 15 P&C risks in 2024.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The broker noted a “significant variation” in renewal outcomes.

-

The executive has experience as both an attorney and a broker.

-

The deal, revealed by this publication in December, values the firm at $14bn.

-

A second look at the services deals boom powered by this publication’s M&A Tracker.

-

The measure could have landed insurers with extra tax on US business.

-

The restructuring affected less than 5% of its workforce, according to the company.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

Sources said BMO was retained earlier this year to advise on the strategic process.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

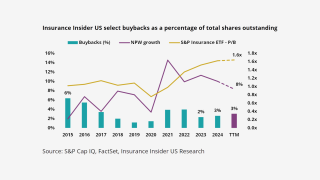

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

The executive will report to US construction practice leader Jim Dunn.

-

The move follows a recent string of initiatives for Howden in Latin America.

-

The platform will capture and standardise data from all submissions, the broker said.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

PwC reported that deal volume decreased to 209 deals from 297, but values climbed to $30bn from $20bn.

-

Howden has been expanding its South American presence through M&A.

-

Coverage has broadened while limits have increased, the broker said.

-

The pair joined MMA after the $7.75bn purchase of McGriff in November.

-

The executive was formerly head of cyber solutions, North America.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The 30-year insurance veteran will be charged with taking on recruitment and M&A.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

GCP retains a controlling interest in the Californian retail brokerage.

-

Hippo will also provide capacity for existing and future MSI programs.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The former Hub executive has over 30 years of experience in transportation.

-

Howden recently expanded in South America with the takeover of Contacto and Innova Re.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The appointment follows B&B’s acquisition of Accession.

-

The deal multiple is understood to be around 15x adjusted Ebitda.

-

The executive has been with the firm for close to 15 years.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

The Michigan-based firm will join Ryan Specialty’s binding authority division.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

The panel aimed to highlight “synergies” between insurance and litigation finance.

-

The deal values the company, formerly PCF, at roughly $5.7bn.

-

The PE firm’s Aaron Cohen said full integration of broking assets is crucial.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The broker has been building out its Bermuda reinsurance presence.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until September 1.

-

Insurance outperformance slows as markets recover from tariff shock.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Up to nine million acres of US land are considered likely to burn.

-

The Floridian brokerage expects to bring its leverage levels below 4x later this year.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

Acrisure recently raised $2.1bn from investors in its latest step towards an IPO.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Acrisure followed the recaps of Hub International and Broadstreet Partners.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive will also continue as MD overseeing Caribbean fac.

-

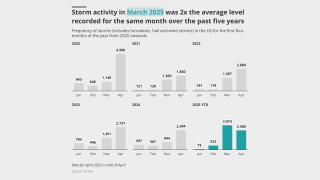

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Spicer will transition to a global specialty executive chairman role.

-

The broker called on carriers to expand coverage into new specialisms.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

The executive will take the global role alongside his existing US responsibilities.

-

Additional investors include Fidelity, Apollo Funds and Gallatin Point.

-

As with 2024, pricing pressure has been most acute on top layers.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

Third-party litigation financing remains the thorn in the sides of casualty insurers.

-

Competition and ample capacity are pushing premiums lower.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Large account and E&S property have gotten competitive faster than expected.

-

They cover environment, political violence, equipment and cannabis.

-

Growth in construction projects is increasing the need for coverage.

-

Insurance Insider US revealed last week that Hub had secured a ~16.5x Ebitda valuation in its “private IPO”.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

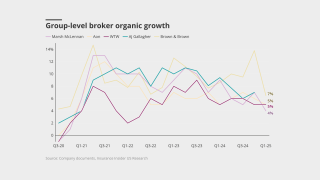

Median organic growth decelerated to 7.9% in Q1 from 9% in Q4 and 8.4% a year ago.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Broadstreet announced the most deals, followed by Hub and Gallagher.

-

He was appointed executive chairman for international in 2021.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The deal will place the highest ever private valuation on a broking firm.

-

The preferred shares will mandatorily convert to common equity on an IPO.

-

Alliant is celebrating its 100th anniversary this year, and is the ‘furthest thing from a serial acquirer,’ Greg Zimmer, CEO, Alliant, said at RISKWORLD 2025.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

Flexpoint Ford has also positioned itself as a potential minority backer.

-

The executive was previously a top US casualty broker.

-

In an economic downturn, the kneejerk reaction is to treat insurance and risk management as a cost.

-

MGA platforms, however, are seeing higher multiples than those in retail.

-

The executive had previously been at Aon for over 15 years.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Insurers haven’t announced concrete steps – yet.

-

The company completed the acquisition yesterday.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

It acquired wholesaler ARC Excess & Surplus, confirming an earlier report from this publication.

-

It will be tough to pull off prior goals despite management assurances.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Last summer Insurance Insider US flagged 3 advantages that minority deals provide.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

The executive will oversee Howden Re’s treaty and fac business in Miami as well as the firm’s specialty insurance unit.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The executive was most recently at Oliver Wyman after joining from AIG last year.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Q1 rates in most lines were consistent with prior quarters but slightly down on 2024.

-

The broker said the burgeoning class of business was still finding its stride.

-

Secondary perils are no longer so secondary, but the losses are already priced in for commercial property.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sources said JP Morgan and RBC are advising the brokerage.

-

The deal is expected to close in the second quarter.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

Macroeconomic volatility could also create top-line headwinds.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Sources said the firm retained Ardea to run the process.

-

The program will offer liability coverage up to $5mn per occurrence.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

In an interview, Blue spoke about integration, organic growth, M&A and current market uncertainty.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

Most Recent

-

Looking to stay up to date with the latest insurance broker news? As a trusted source in the industry, Insurance Insider US delivers in-depth coverage of the latest broker news, market movements, and key insights that matter most to your business. Our team brings you the exclusive, data-driven reporting and analysis you need to fuel your business. Subscribe today to get the latest broker news delivered directly to your inbox.