Chubb

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

This publication exclusively reported the executive’s plans last month.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

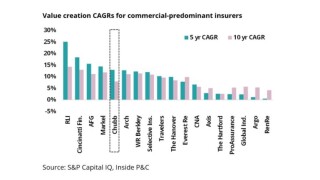

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Pre-tax cat losses were down 63% from the prior year quarter to $285mn.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Brian Church has spent 20 years at Chubb.

-

Lupica moved to the role last year as part of a staggered handover of responsibilities to Juan Luis Ortega.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

The Delaware high court’s reasoning could find application in other cases.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Teresa Black will succeed him as division president of North American surety.

-

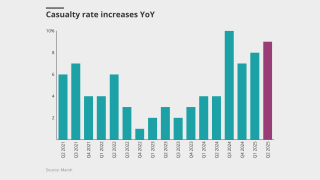

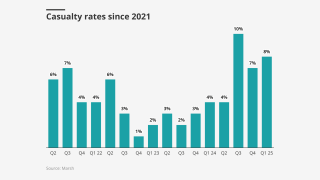

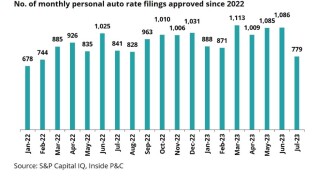

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The carrier's Q2 reserve releases rose to $249mn from $192mn on favorable NA personal development.

-

The company also encouraged insurers and brokers to support the initiative.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The transition will be implemented starting October 15.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The panel aimed to highlight “synergies” between insurance and litigation finance.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Philip Enan joins following 11 years at Chubb.

-

The two parties seek to delay a judge’s summary judgment order.

-

The executive had served as chief investment officer since 2000.

-

The program will succeed the previous buyback launched in 2023.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

The take-up rate will depend on the price discount and market segment.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

Of the $170mn cat losses outside LA wildfires, US cat activity accounted for 74% and international cats 26%.

-

Reserve releases at Chubb rose to $255mn from $207mn a year ago.

-

The executive has spent over 20 years at Chubb.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Joe Cala will leave the carrier after nearly 13 years on the product recall team.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

CEO Greenberg cited ‘competing priorities’ in his annual letter to shareholders.

-

The move combines two units in the North America middle market division.

-

Last year, the firm consolidated financial and excess liability lines under the leadership of Richard Porter.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

Under the new guidelines, the carrier is requiring more distance from the brush.

-

Former PRS president Ana Robic was promoted to regional president.

-

Ana Robic will succeed Furby as EMEA regional president.

-

The executive succeeds Lou Capparelli, who becomes global casualty chairman.

-

Andy Houston will be based in London, reporting to Mark Roberts, division president UKISA.

-

Changes in cat activity and social inflation have impacted carriers focused on the mid- and small commercial market.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

Chubb’s Q4 cat losses more than doubled to $607mn, driven by Hurricane Milton.

-

The carrier named Jason Neu, financial lines EVP for its E&S subsidiary Westchester, to succeed Stapleton.

-

The E&S lines division adds property, casualty and financial lines.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

The storm caused major damage to one of the drinks company’s warehouses in Tennessee.

-

The carrier had $300mn of favorable development in Q3, mostly led by short-tail lines and ex-workers' comp.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The appointments will enhance Chubb’s Latin American leadership structure.

-

Greenberg said London behavior in cat market “is almost aberrant relative to everybody else”.

-

The CEO noted, however, that the UK retail market remains a big business growing well.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier booked $250mn of pre-tax losses for Hurricane Helene.

-

He succeeds Laura Vest, who is retiring after 20 years with the company.

-

Mark Gregory will retire next March, while Sara Mitchell will initially join as a strategic adviser.

-

The executive has 20 years of experience in environmental risk and sustainability.

-

The carrier writes all of its E&S business in the state through Arch Specialty Insurance Company.

-

The executive joined Chubb in 2013 as assistant VP and regional manager.

-

The conglomerate now owns around 27 million Chubb shares valued at roughly $6.9bn, compared to nearly 26 million in Q1.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

-

The carrier recognized a goodwill of $256mn and intangible assets of $39mn from the transaction.

-

A quick roundup of today’s need-to-know news, including Chubb’s Q2 earnings call.

-

NA casualty pricing was up 11.7%, with rates increasing 9.9% and exposure up 1.6%.

-

Overseas GI cat losses rose to $157mn from $26mn while NA commercial cats were $252mn vs $231mn.

-

A roundup of today’s need-to-know news, including leadership changes at Chubb.

-

Diego Sosa will head up northern Latin America while Mario Romanelli will lead southern LatAm, excluding Brazil.

-

Two new promotions follow on the heels of appointments announced Tuesday.

-

He was also appointed to vice president of Chubb Group.

-

It is understood that the executive will report to Scott Meyer, now COO for NA Insurance.

-

-

The executives being promoted are all long-term Chubb veterans.

-

Marcos Gunn and Federico Spagnoli have been promoted as a result.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

With the appointment, current division president David Furby will step down from the role.

-

This is Chubb’s second MGA deal in the past few months.

-

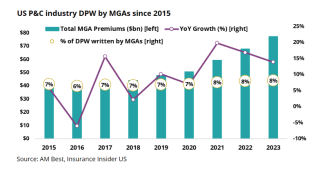

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The CEO said he is “optimistic” about the future of the commercial space.

-

The $6.7bn Chubb investment is an outlier in the Berkshire portfolio.

-

The conglomerate exited its $620mn position in Markel, which it has held since 2022.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

The CEO said companies are still taking charges on years 2013 to 2019.

-

In April, this publication revealed that the carrier is the lead market on the property placement for the bridge.

-

There is a high likelihood the property claim will be subrogated.

-

The CEO said Q1 was “one of the best quarters” for casualty pricing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive has been with the firm for 30 years.

-

The value of the bridge is estimated at $1.2bn.

-

This publication revealed Chubb was planning to re-enter the London TL market.

-

Choosing to shrink a money-losing business when necessary is “a strength”.

-

On average, revenue was up 12.4% for the year, but expansion plans are slowing.

-

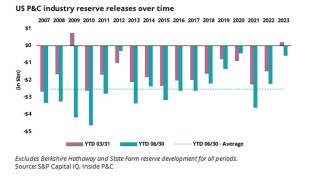

Commercial carrier earnings continue to show mixed prior-year development.

-

Chubb elevates Gillston to EVP, head of NA industry practices

-

High frequency and severity have been more acute in exposure with wheels.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer recorded lower cat losses and higher favorable development.

-

Prior to his new role, which Matt Prevost began this month, the exec spent nearly 10 years as Chubb’s SVP, cyber and product line manager.

-

The newly created role will see Frederico Spagnoli oversee Chubb’s consumer lines in 51 countries.

-

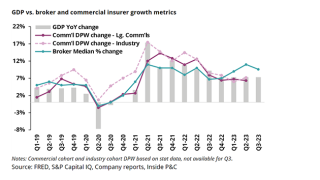

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Michelle Bryer had been serving as senior vice president of claims operations at Combined, a Chubb subsidiary.

-

Clearer wordings for cyber cat risk would also help foster the development of the more capital-efficient event XoL reinsurance market in cyber, Kessler said.

-

At a point when cyber rates are falling and capacity is plentiful in high excess layers, the mutual plans have the wider cyber market somewhat perplexed.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Chubb NA property soared 23% in Q3 with rates up 16.6% and exposure change of 5.5%, as casualty pricing rose 11%, with rates up 8.7% and exposure up 2%.

-

The executive said that NA financial lines rates and pricing in aggregate were down 4.8% and 3.8%, respectively, in Q3 as Chubb is trending financial lines loss costs at 4.7%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier grew NWP in Q3 by 8.4% to roughly $11.7bn, as NA commercial P&C lines rose 8.7% to over $5.1bn and personal lines increased 9.6% year-on-year to over $1.5bn.

-

The executive said he was “shocked and heartbroken” in a message circulated to Chubb staff.

-

According to a Chubb survey, 59% of respondents said inflation has impacted their ability to replace covered assets under existing coverage; 76% said they are considering increasing coverage amounts to compensate for inflation.

-

The consortium is supported by 11 other Lloyd’s businesses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

Sources have said the layer will provide the carrier with protection for the Northeast US only and attaches at a remote level.

-

The carrier was originally in the market for extra capacity at January 1 before pulling plans.

-

Executives have pointed out that it is becoming increasingly difficult to talk about broader trends as micro-cycles are developing for each line.

-

Chubb’s Victoria Learned-Fenty stepped down as insurer member following the resignations of agent members Joshua Morey and Ben Rathbun.

-

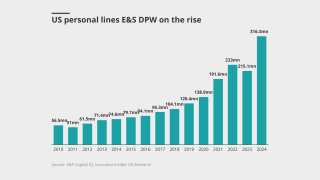

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

At the same time, insurers are assessing the level needed to address loss cost trends.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Chubb NA property rates climbed 22% in the second quarter, driven by higher cat losses, inflation and reinsurance costs.

-

The insurer reported that the NA personal lines reserve release recorded in Q2 was primarily related to its auto portfolio.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The firm posted a total of $400mn in P&C pre-tax cat losses, up from $291mn, while reserve releases were $200mn, down from $247mn.

-

Chubb has appointed Ryan France to an EVP role as technology industry practices leader.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The first signs of limit expansion, growing appetite in the admitted market, and retail brokers' impatience with wholesalers are all evident.

-

O’Donnell will focus on strategic and tactical operations within global reinsurance alongside his continuing responsibility for Chubb Tempest Re USA.

-

Krump retired from Chubb in January of this year, while Masojada retired from Hiscox in 2021.

-

The company’s existing share repurchase authorization will remain effective through June 30.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

The executive will be responsible for the growth and profitability of the carrier’s casualty lines in 51 countries and territories outside North America.

-

The executive will have responsibility for lines including property, casualty, professional lines, energy and marine.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In early January, the company completed the transactions to increase its position in Huatai to 64.2% from 47.3%.

-

During the first quarter, Chubb paid $200mn and another $300mn last month, according to the company’s Q1 10-Q filed with the SEC.

-

This environment includes a “turbo-charged” hard market for property reinsurance, with higher pricing, reduced terms of coverage and capacity defining features.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Chubb earnings reveal strategic expansion in Asia and pricing outpacing exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pricing in NA commercial P&C increased 11.2%, including changes in rate and exposure of 6.4% and 4.5% respectively, while loss cost trends rose 6.7%.

-

D&O (Inside P&C Daily lead story): There is hope that public D&O rates could stabilize in the second half of the year following a tough end to 2022 and an ongoing slump in Q1. Significant discounts granted in 2022 are unlikely to be repeated, and there are ongoing concerns around both economic and social inflation, sources said. In the meantime, rates remain pressured from ample capacity and muted demand as established providers and incumbents drawn to the hard market of past years compete for relatively stagnant demand. The collapse of SVB, while a shock, wasn’t the inflection point for D&O that some might have expected.

-

Pre-tax and after-tax catastrophe losses were $458mn and $382mn, respectively, compared to $333mn and $290mn in the prior year period.

-

The executive will relocate from London to New York and report to Chubb NA field operations COO Rob Poliseno.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Ringsted will remain a core member of the Risk Underwriting Committee and was assigned a new role as chief digital business officer.

-

In a filing, the carrier said its investment strategy does not include contingent convertible bonds.

-

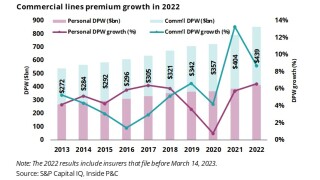

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

2022 statutory data is now available, and results show winners and losers

-

Steven Hill will report to Michael Mollica, division president of North America financial lines.

-

The payment followed a $200mn disbursement that Chubb made in Q3. The insurer expects to cover the remaining $500mn of the liability in 2023.

-

Maria Guercio, Melanie Markwick-Day and Jared Concannon join the unit as executives.

-

The AIG 200 project has officially ended, with the goals met ahead of schedule and under-budget, but there is still work to do to close the gap with competitors.

-

The move fits the broader strategy around dampening volatility, but sourcing capacity in the US domestic market will be tough.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Chubb’s balanced view of the market as a whole, and pricing and loss cost trends in particular, puts it ahead of the curve on value creation, despite a difficult economic backdrop.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO also told analysts there is currently no M&A on the table for Chubb.