Claims trends

-

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

Many nuclear verdicts become much less radioactive on appeal.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The executive said the claims industry is going to “be transformed”.

-

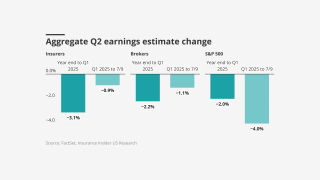

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.