Everest

-

Diaz joined the company in 1991, where he took on various leadership roles to promote the company’s expansion internationally.

-

Guy Carpenter’s US facultative leader steps down after just eight months.

-

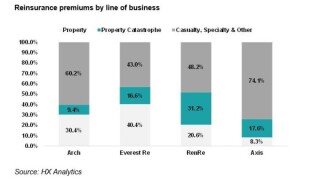

Everest Re recently outlined plans to lift gross premium by 10%-15% annually from 2021 to 2023.

-

Andrew McBride has also served as director of claims at QBE’s European operations and held various overseas roles managing claims at Aon and Axa.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

Modin will succeed David Whiting, who is retiring after a 45-year career in the reinsurance industry.

-

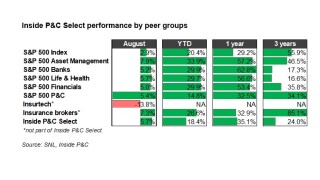

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

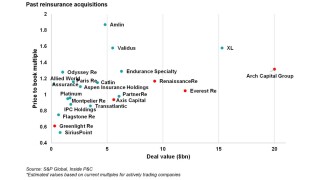

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

New Everest E&S casualty CUO Casey Hartley has over two decades of experience in the industry.

-

Good news may be temporary, no matter how good it is.

-

He suggested that the company might be willing to allow higher commissions.

-

The reinsurer grew its casualty pro rata reinsurance book by 64%, adding $218mn in GWP.

Related

-

Bermuda Q2: Diverging paths for the hybrid carriers

August 01, 2025 -

Everest promotes Beggs to CEO of reinsurance

July 24, 2025