Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest News from Insurance Insider US

Competitor news

What Your Competitors are Reading

Competitor news

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

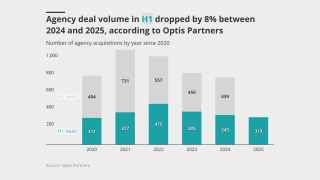

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Other parties that looked at the business include CPPIB, Permira and Carlyle, sources said.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

Onex is making the investment alongside PSP, Ardian and others.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

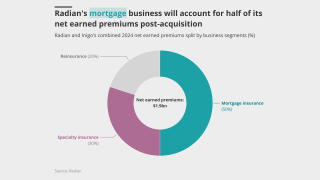

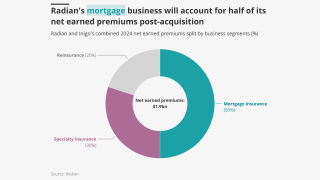

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Sources said the agency first considered a debt raise but recently pivoted to a sale process.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

As part of the transaction, PE firm Atlas Merchant has agreed to sell its interest in MarshBerry.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

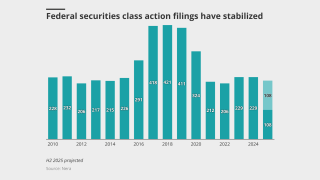

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The insurer has been under review with positive implications since March.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

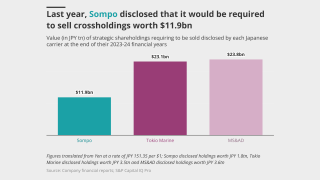

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

The likes of Genstar, Leonard Green and Bain also looked at the program manager.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

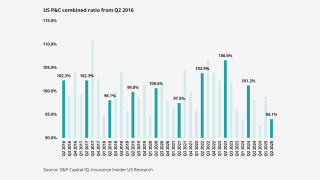

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

Sources said Atlas’ owner is selling the retail agencies but will retain the Hawaii carrier Island Insurance.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The deal was announced last month.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

The Brazilian carrier grew earned premiums to over $100mn in 2024.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

Insurance Insider US takes a closer look at tuck-in activity as valuations continue to hold steady.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Company alum David Murie will lead the new business unit.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

Appointments include leadership in transportation, energy, marine and others.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive said the floor on D&O pricing is in sight.

-

The move will impact around $50mn of gross written premiums in total.

-

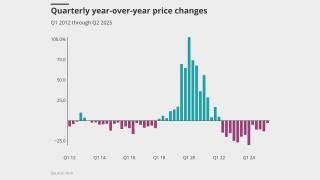

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

The professional lines market remains ‘challenging’ overall, however.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

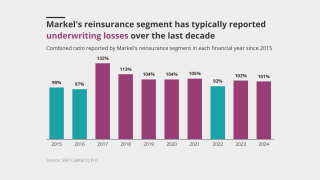

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

AmeriLife and OneDigital are in the market while Relation is preparing for a liquidity event.

-

Nationwide will delegate management of the policies to Ryan Specialty.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In partnership with M&A ServicesJoin Insurance Insider, in partnership with M&A Services, for a free webinar 10:30 EDT/15:30 BST on Sept. 24

-

In Partnership With MarkelJoin Insurance Insider for a free webinar, in partnership with Markel, 10:30 EST/ 15:30 GMT, Nov 5

-

In Partnership With VeriskJoin Insurance Insider, in partnership with Verisk, for a free webinar at 10:30 EDT/15:30 BST on 29 September

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.