Fairfax Financial

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

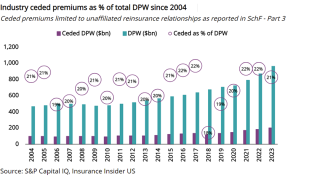

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The activist investor has accused Fairfax of “pulling levers” to produce “paper profits”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The short seller has accused the company of manipulating asset values.

-

The company will hold its Q4 earnings call on Friday February 16.

-

The deal was announced in April, whereby the firm agreed to purchase a further 46% stake to take its shareholding to 90%.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The COO noted that despite being able to get rate in excess of inflation, particularly social inflation, the carrier is watching casualty lines “very closely”.

-

The upgrade reflects improvements in C&F’s financials and those of parent company Fairfax.

Related

-

Fairfax appoints Sherk as CFO, Allen transitions to CBO

March 07, 2025 -

Fairfax has ‘no plans of walking away’ from cat after LA wildfires: COO

February 14, 2025