Fairfax Financial

-

Fairfax completed the sale of a $900mn stake in Odyssey Group to CPPIB and Omers earlier this month.

-

A total of 2 million shares will be bought back by Fairfax at a price of $500 per share, the top end of the forecast range.

-

The arrangement allows Brit to reduce exposure to US casualty claims inflation.

-

Fairfax has entered into an agreement with the Canada Pension Plan Investment Board (CPPIB) and the Ontario Municipal Employees Retirement System (Omers), where each of them will acquire a 4.995% stake in Odyssey Group for an aggregate cash consideration of $900mn.

-

Hurricane Ida hit Fairfax’s Brit operations, but the Odyssey business took a higher proportion of Fairfax’s overall losses.

-

The conglomerate posted $604.6mn in Hurricane Ida and European floods losses.

-

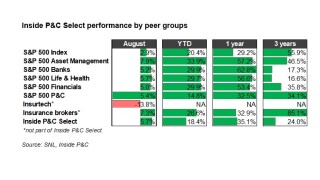

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

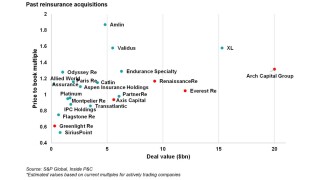

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

The ransomware surge is likely to lead to changes in the product, a shake-up in market share and challenges for MGAs.

-

CEO Prem Watsa said the company expects to acquire the remaining 6% of the company and delist it from the Singapore Stock Exchange.

-

Net diluted earnings per share jumped to $43.25 in Q2 2021, up from $15.26 last year.

-

HudsonPro will be led by senior VP Trevor Howard.