Farmers Insurance

-

The carrier said it anticipates a better market due to recent reforms.

-

Insurers haven’t announced concrete steps – yet.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

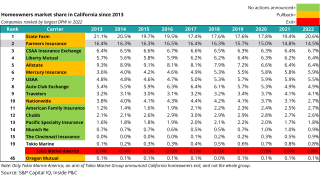

The nationwide carrier ranked sixth for multi-peril California homeowners' insurance in 2023.

-

Wildfire risk destabilized the state’s market, spurring regulator attention.

-

The suit also charges the agents with unjust enrichment and contract breach.

-

Those affected have been invited to interview for open positions with Farmers.

-

Farmers cited “positive changes” in the state's commercial insurance market.

-

-

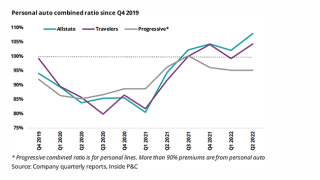

Ahead of third quarter earnings, many personal lines insurers are pulling several levers to right-size their operations, including conducting layoffs and reducing exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The rate cuts will affect both new and renewal business across most products, with the biggest reductions affecting new business.

-

These measures are intended to create a more efficient organization, and they follow a thorough evaluation and reduction of operational expenses across Farmers, the announcement noted.

-

The review reflects Moody's concerns around Farmers' underwriting results in its core personal lines and its capital adequacy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The non-renewals would have impacted Georgia homeowners with roofs over 15 years old, said Insurance Commissioner John King, calling it a “blatant violation of Georgia law”.

-

Farmers Insurance becomes the latest major national carrier to pump the brakes in California, limiting new business to only 7,000 policies per month, signaling further problems in the state’s homeowners’ market.

-

The news comes just over a month after two other large carriers, State Farm and Allstate, announced that they’d no longer accept new business in the state.

-

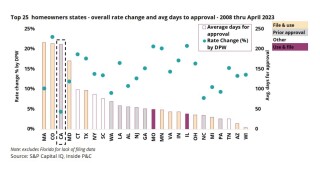

Continuing rises in loss frequency and severity plus a difficult regulatory framework make the situation in California highly challenging for carriers.

-

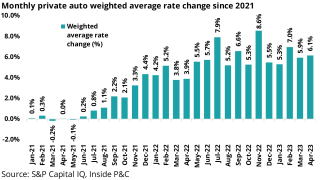

Personal lines rates ticked up in April compared to the prior month as insurers try to stay ahead of rising loss costs.

-

High-impact rate filings in California have driven increases nationwide.

-

In tandem, the ratings agency affirmed its "A" issuer credit and financial strength ratings on Farmers and its core operating subsidiaries.

-

He will also join the board of directors on January 1, while predecessor Jeff Dailey will remain as board chairman.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.