Fidelis Insurance

-

The proceeds will be used by the Bermudian to take advantage of rate hardening in key markets.

-

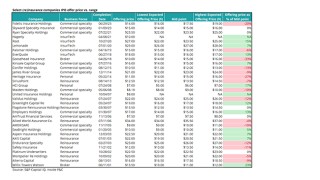

After pricing below the expected range at its IPO, the Fidelis stock price slipped on the first day of trading - here's how other (re)insurance IPOs have gone since 2000.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

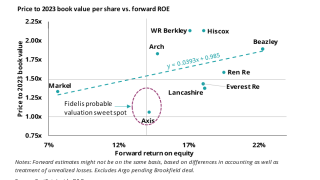

Fidelis shares closed down from the $14 per share price set for the IPO, or a 0.8x multiple of its $17.19 book value per share at end of Q1 2023.

-

The carrier stands to raise $210mn from the offering.

-

The increase takes the carrier’s total reserves for the conflict to $145.6mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has set its IPO price at between $16 and $19 per common share, and will trade on the New York Stock Exchange under the ticker FIHL.

-

The carrier also recorded a large one-off benefit from the separation of its balance sheet and MGU segments.

-

The Fidelis IPO has no clear precedent, but there is an appetite for investment in the specialty space, as seen earlier this year with the Skyward public listing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

Related

-

Ategrity IPO: Not all E&S is created equal

May 22, 2025 -

The Fidelis Partnership takes Arch’s Wells as COO

April 10, 2025