Homeowners' insurance

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

The legal setback came as publication of a Fema reform report was postponed.

-

Trump’s shadow loomed over the beachside sessions.

-

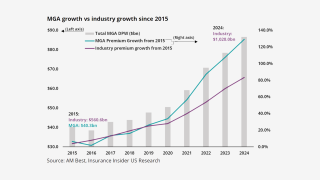

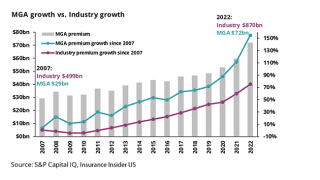

MGAs going public is now a viable option, but dominating a market comes first.

-

The Republican said his office has launched an investigation into the denials.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The carrier said it anticipates a better market due to recent reforms.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

Senators asked for data on fraud but weren’t given any.

-

The deal to reopen the government also extended the NFIP.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

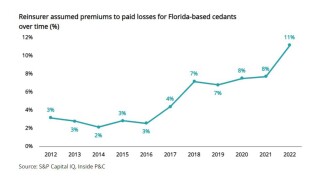

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

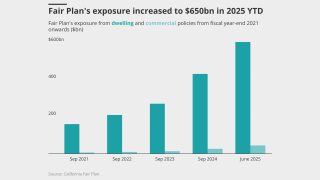

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

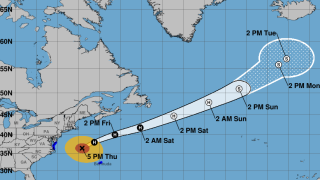

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

A former NOAA climatologist who left the agency is running the new operation.

-

A quiet wind season is also expected to further soften the property market.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The fundraising round brought in $50mn for the insurer.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

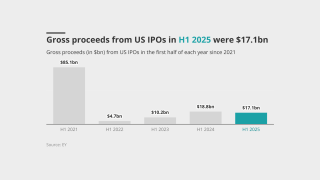

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

This is the first rate filing to use the recently approved Verisk model.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

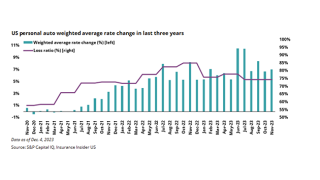

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

Smaller accounts remain less affected by an influx of MGAs.

-

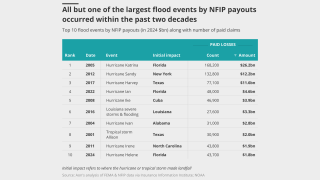

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

At least 14 new companies have opened up shop in the state in recent years.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Category 4 and 5 storms could become more common and hit further north.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The floods have killed at least 81 people, with dozens more missing.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The company said the reduction was due to years of steady improvements.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The insurer intends to take on up to 81,040 policies this year.

-

Much was learned after the fires, but it could take years before that data influences models.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Lara approved an interim rate increase for the company just weeks ago.

-

Hippo will also provide capacity for existing and future MSI programs.

-

The regulator said further measures could still be passed in this session.

-

The Floridian is the third insurance company to go public in 2025.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

One measure could give regulators greater leeway to deny rate requests.

-

This publication reported earlier today that the S-1 filing was imminent.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

This publication reported earlier this year that the carrier is targeting a $250mn-$350mn raise.

-

Wildfires resulted in heavy losses for insurers focused on HNW, personal lines and reinsurance.

-

The assumption date for the combined 16,250 policies is August 19.

-

Two wind and hail events were responsible for 60% of the total.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

The Tampa-based insurer says it will use the capital for general corporate purposes.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

The initial offering includes 6,875,000 shares of common stock.

-

The offering launched last week with a valuation between $103mn and $116.8mn.

-

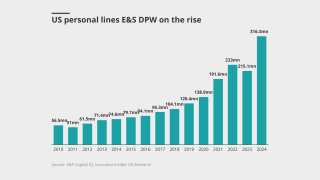

California homeowners are also expected to move admitted business to E&S.

-

But automotive repair costs are likely to increase faster than home repair.

-

The initial offering will include 6,875,000 shares of common stock.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

Imported goods account for 30%-50%+ of materials used for HNW homes, versus 15%-25% in standard houses.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Howard and Moore were among a group to receive letters over links to prior insurance insolvencies.

-

The suit seeks to block insurers from passing through assessment costs.

-

The insurer achieved an 86.4% acceptance rate of the policies selected.

-

The release followed the filing of an updated Plan of Operation.

-

The suit alleges a “deliberate scheme” to deny smoke damage claims.

-

The counties make up for the majority of the state’s high net worth market, sources said.

-

The package comprises a $100mn cat bond and a $70mn sidecar.

-

The 12 insurers together have $418mn in policyholder surplus.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The bill being considered would effectively eliminate personal injury protection.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

The MGA recently secured capacity to write HNW homes in California.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

Shift to growth includes all geographies in which the company does business.

-

Four cat modelers have also submitted their tech for regulatory review.

-

The commissioner said in a legal bulletin that smoke claims can’t be “summarily denied”.

-

As of February 14, the company received 405 claims.

-

The carrier is only going to write new business on E&S paper, sources said.

-

Customers will keep their agent relationship and policies will not be impacted.

-

Under the new guidelines, the carrier is requiring more distance from the brush.

-

This is the second acquisition Amwins has announced this year.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

State Farm General has asked California regulators for an emergency rate increase.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

The policies represent approximately $35mn of in-force premium.

-

Slide lined up Morgan Stanley, Barclays and JP Morgan as lead bookrunners.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The insurer is seeking a 22% interim raise, but the request is currently on hold.

-

Commissioner Lara calls the 10 bills a ‘comprehensive legislative package.’

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

Insureds often just want cover in place at the lowest price possible, and insurers oblige under the skeptical eye of regulators.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

Democrats pushed back during the hearing, urging rules to encourage mitigation.

-

The carrier has been reducing its presence in the state since 2007.

-

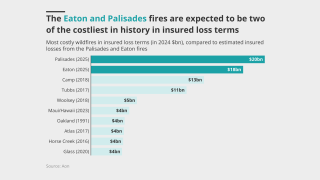

The company says the recent wildfires will be the costliest in its history.

-

The new Floridian carrier plans to write homeowners’ insurance in Q1.

-

Commissioner Lara said 31,000 claims have been filed for disaster-related needs.

-

The company received over 10,100 home and auto claims as of January 27.

-

The bill would put new restrictions on bad faith claims, close loopholes.

-

The homeowners’ carrier has secured Floir approval.

-

The laws mandating payments were enacted after devastating fires in 2018.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The fire started Wednesday morning and is currently 0% contained.

-

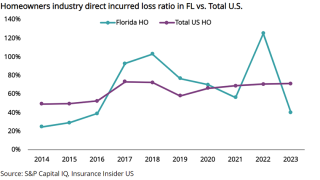

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The homeowners’ MGA CEO said the wildfires could spur a re-evaluation of models.

-

A state-mandated, one-year moratorium on non-renewals is also in place.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

Six fires now cover more than 27,000 acres across Southern California.

-

The fast-moving blazes have prompted evacuations across the city.

-

CA insurers can now use forward-looking cat models in ratemaking.

-

A separate Senate report found climate change is also increasing non-renewals.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

The Federal Insurance Office has data collected from over 300 insurers.

-

The regulations are part of a state effort to expand wildfire coverage.

-

Malibu, which has 10,000 residents, posted on social media on Wednesday that the fire was 7% contained.

-

The fire started Monday night, with high winds predicted for Tuesday morning.

-

The insurer will conduct an audit to ensure “transparency and accountability.”

-

TDI is urging legislators to incentivize more resilient housing construction.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The executive will focus on securing reinsurance capacity for new programs.

-

The California fire was 91% contained as of Friday.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The company said Helene claims have surpassed those of Hurricane Ian.

-

The renewal book has auto, home, renters and condo policies, among others.

-

A total of $2.1bn in Fema money has been approved for the state.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

The NFIP can take on more debt, but climate-fueled disasters aren’t going anywhere.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The policies assumed represent $200mn of in-force premium.

-

The firm still expects to deliver positive net income for Q3 2024.

-

In an interview with this publication, Lara said "everything’s on the table" for future reforms.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

Hurricane Helene was blamed for $92mn of those losses.

-

A bill in Congress would expand a similar pilot tried earlier in New York City.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

Florida concentrated property insurers are expected to face capital struggles.

-

American Integrity will take the largest chunk, out of six insurers total.

-

The storm is projected to make landfall in the next 24 hours in the highly populated Tampa Bay region.

-

Moody’s also predicts losses to the NFIP at potentially more than $2bn.

-

The government flood insurance program now carries $21bn in debt.

-

October 17 has been set as the deadline for written comment.

-

The figure does not include NFIP losses.

-

The residual insurer’s pricing is far from rate adequacy, and it is undercutting the commercial market.

-

Sources expect loss amplification in claims from Georgia, the Carolinas and Tennessee.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

Insurers are fighting to recoup claims they have paid out.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

State regulators have been monitoring climate risk for over a decade.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Moody’s also predicts losses to the NFIP at less than $200mn.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Eight Floridians will take on personal residential multi-peril and wind-only policies.

-

Moody’s also predicts losses to the NFIP at less than $300mn.

-

It had planned to non-renew 47,000 DP-3 and 53,000 high-risk homeowners’ policies this year.

-

The proposed class says the plan does not cover smoke damage.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

This is Emerald’s second facility, after its earthquake deal with Arrowhead.

-

There was a 12% increase in flood sums insured to C$7.3tn.

-

An “above average” hurricane season could spell disaster, but forecasts are not gospel.

-

Commercial and residential carriers have different requirements.

-

The Florida portion of the program provides $1bn in protection.

-

Floir has sent more than 20 letters to Florida executives for potential violation of Statute 624.4073.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

An EF-4 tornado devastated Greenfield Iowa, adding to the expected multi-billion-dollar toll.

-

The decrease takes effect August 20, 2024, and impacts new and renewal business.

-

The program includes all perils coverage and third-event protection.

-

The CEO is one of more than 20 executives who received letters from Floir citing Statute 624.4073.

-

US SCS insured losses YTD already stood at around $12bn prior to these events.

-

Approximately 1.2 million units are vacant throughout the state.

-

Flash floods moved into Texas overnight and into the lower Mississippi Valley Monday.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

Commercial lines will remain bifurcated, with strong growth in property and weak growth in liability.

-

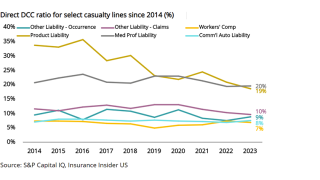

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

A litany of underwriting and quoting constraints has made it much harder to write business.

-

Tim Cerio also credited litigation reforms for the current market recovery.

-

He will manage the region’s sales and service teams.

-

CoreLogic’s report for April 2024 saw rising costs across four common loss scenarios.

-

The company has retained Tony Ursano’s IAP for the raise.

-

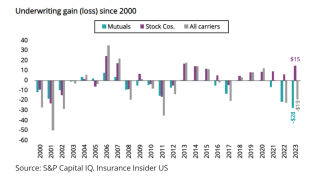

Mutuals struggle to react and adapt to a worsening loss environment.

-

The carrier stopped accepting new HO business in the state last May.

-

This year, the association’s funding will come to $4.05bn with a $2.45bn retention.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

Sure is the first Demotech-rated insurer to offer surplus lines homeowners.

-

Headwinds weigh on carrier results, but premiums and surplus remain mostly stable.

-

Loss ratios and surplus improve for the group, but don’t guarantee this is a turning point.

-

A January freeze saw temps drop to close to -50°F.

-

The CPI all items index was at 3.2%, from 3.1% in January.

-

Commercial lines difficulties continue to weigh down industry results.

-

Sizeable investment returns masked 10-year high underwriting losses.

-

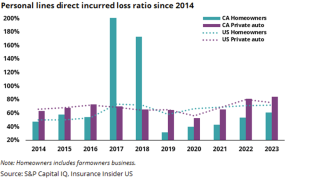

Personal lines rate filings are rising, even as some inflation drivers slow.

-

Slide, American Integrity, and Security First were approved.

-

Increased cat losses in property offset auto improvements.

-

The carrier has filed to withdraw from nine states total.

-

The non-renewals will continue through June 15, 2025.

-

Insured loss estimates are not yet available.

-

Twia’s actuarial and underwriting committee made the recommendation last week.

-

The downgrades reflect Gallatin Point’s recent acquisition of a majority stake in TRUE.

-

A hearing with the Florida Office of Insurance is scheduled for February 21.

-

CSAA writes over 70% of its business in the Golden State.

-

The changes will be up for discussion at a March 26 public hearing.

-

The company is aiming for a 2024 Florida rollout, offering HO-3 and DP-3 policies.

-

The reciprocal will write homeowners’ insurance primarily in Florida.

-

The home insurance start-up claims the fundraise was made at a $1bn-plus valuation.

-

The carrier expects to re-emerge after operating as going-concern Anchor.

-

The parties also signed a release of claims arising from the Vesttoo fraud.

-

Over $1bn in claims had been paid as of November 30, 2023.

-

Rates are generally cheaper than the admitted market.

-

Lamb’s previous position was controller with Kin Insurance.

-

The insurer said it will continue to renew existing homeowners’ business.

-

The company announced it is undertaking several strategic steps designed to increase operational and capital flexibility and to better position it for future growth opportunities.

-

A Branch spokesperson cited persistent inflation as a “significant challenge for home and auto insurance companies” and the reason for the staff reductions.

-

Participating insurers would be required to provide all-perils property insurance for residential and commercial policyholders.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

Blandford noted that there is more willingness to deploy capacity compared to last year, a function of orderly January 1 renewals bringing in more capital and the absence of a major hurricane or wildfire in 2023.

-

If the Floridian goes through with a listing, it will be a true test of whether the public markets believe that the state’s fragmented insurance market is fixed, or on its way to being so.

-

Sources said the fast-growing homeowners' Floridian is finalizing the process to retain investment banks with the aim for an equity event to take place in the first half of the year.

-

Sources said that TMA ran a profitable book in California that included personal auto and homeowners’ policies.

-

The agency said TRUE’s ratings will remain under review until there is additional clarity surrounding a new business plan.

-

Booten has been COO at Citizens since May 2020, and at the public insurer in various positions since 2002.

-

Under the new agreements, Kingstone will cede 27% of its personal lines insurance written, down from 30% in 2023, and will receive a higher ceding commission rate than in 2023.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

Carriers aren’t calling off their retreat from the market until tangible, actionable regulations emerge from commissioner Lara’s camp, sources told this publication.

-

The reforms are working for claims filed after December 2022, but attorneys are still litigating claims filed prior to the legislation.

-

At a Tuesday hearing, California's assembly committee on insurance quizzed insurance commissioner Ricardo Lara on the finer points of his sustainable insurance plan.

-

The 2024 budget increases net operating expenses to $40.2mn, up from $35.2mn in the 2023 budget.

-

It is understood that the cuts are based on a review of five-year loss ratios, and that agents above 70% will be impacted.

-

The ratings agency also downgraded carrier’s Long-Term Issuer Credit Ratings (Long-Term ICR).

-

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

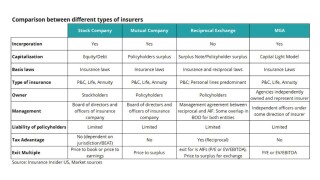

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

The state is already experiencing affordability challenges, and regulators are concerned that an availability crisis is brewing.

-

The ratings agency cites ongoing deterioration in results for personal auto and homeowners’ lines, along with rising loss costs, driven by inflationary pressures.

-

The Senate Budget Committee, chaired by Democratic Senator Sheldon Whitehouse, is seeking information on plans to address increased underwriting losses from extreme weather events.

-

Cedeño Camacho will expand his insurance carrier holdings to North America.

-

Carriers have sought to restore profitability through a mix of rate hikes, policy restrictions and localized non-renewals and moratoriums on new business.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Commissioner Lara’s 2019 mandate, ordering FAIR to offer a more comprehensive insurance package beyond its historical “fire-only” coverage, has now survived a second court challenge.

-

The office also said it has approved the assumption of 650,399 policies from Florida Citizens so far this year, a more than 800% increase from the previous year.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The government funding bill signed by Biden on November 16 contains provisions extending National Flood Insurance Program to February 2, 2024.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

The E&S personal lines insurer also named Malcolm Tsung as commercial lines product management VP and Scott Crozier for a similar role in the personal lines division.

-

Insurers have paid out $673.3mn in claims through September 30 for residential losses related to the August fires.

-

Susan Arnold, co-vice chair of NAIC’s P&C Insurance Committee, also urged passage of legislation exempting mitigation grants from taxation.

-

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

Following reforms enacted by the state, the insurer will seek to provide new insurance coverage options to property insurance policyholders.

-

The cuts amount to roughly 2% of the insurer’s US workforce.

-

Ahead of third quarter earnings, many personal lines insurers are pulling several levers to right-size their operations, including conducting layoffs and reducing exposure.

-

White Mountains’ final stake could range between 62%-81% of Bamboo, and the Bermudian’s investment in connection with the deal could be around $246mn-$323mn.

-

Inside P&C’s news team brings you all the top news from the week.

-

Data shows Texas developments parallel some of the trends in other troubled states, but it is heading in from a stronger position.

-

From 2020 to 2023, P&C replacement costs increased by 45% on average, whereas inflation for the overall US economy increased 15% within that same period, though the forecast expects that to change.

-

In 2022, Texas ranked third in incurred losses behind Florida and California, clocking in at $53bn, according to data from the Insurance Council of Texas.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Farmers’ agents in Florida will be offered an appointment with Slide. Renewals issued by Slide will begin for February 2024 effective dates.

-

In a presentation before Florida lawmakers, Cerio noted recent success in Citizens’ efforts to move policyholders to private insurers and reduce risk exposure.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The changes will take place “over the next few years” and will also include migrating all personal lines business into a single operating model and platform.

-

HCI subsidiary TypTap Insurance Company has received approval from Floir to assume up to 25,000 policies from Florida’s state-owned insurance company.

-

Worsening results in key states and belated rate action weigh against a shifting business model, making the path to profitability unclear.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Losses from the Maui wildfire include a modest amount of reinsurance recoveries from the Per Risk reinsurance program, while losses from Hurricane Idalia were fully retained.

-

This is the second downgrade faced by State Farm and its subsidiaries from AM Best in the last month.

-

The first non-renewals are scheduled for May 2024 in what is expected to be an 18-month process.

-

The business reductions will affect policies up for renewal from December 2023 to July 2024.

-

The national program will insure homes with a replacement value up to $10mn, and deductibles will range from $10,000 to $1mn. Properties in cat-exposed locations will be eligible for coverage.

-

K2 will make an equity investment in Titan Flood and be given a seat on the MGA’s board.

-

As of last week, Florida Citizens had sent out depopulation notices to more than 300,000 policyholders for October, though nearly one-third of those notices were delayed.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Lara's plan, backed Thursday by an executive order from California Governor Gavin Newsom, repackages elements of a proposed bill that collapsed earlier this month.

-

Rating agency cites elevated underwriting results from convective storms, cat events in core states of operation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Following the 2017 Tubbs Fire and the 2018 Camp and Woolsey fires, insurers cumulatively paid out more than twice as much in claims and expenses as they collected in premiums for both years.

-

The agency cited net underwriting losses, inflationary and supply chain pressures, and elevated reinsurance costs as factors leading carriers to pull back in cat-exposed US states.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The shareholders are among the company’s top 10 largest and hold nearly 2.5% of outstanding shares.

-

Investors include IA Capital Group, Blue Bear Capital, Gallatin Point Capital, and Avanta Ventures, among others

-

The additional funding brings Kin’s series D total to $142mn, and its overall equity funding total to $265mn.

-

Lawmakers were discussing legislation that would have facilitated insurance commissioner Ricardo Lara’s ability to implement more insurer-friendly regulations, but talks stalled with just one week left in the 2023 legislative session

-

-

Floridians will bear the brunt of Idalia's losses as a retention event, but reinsurers will reap the benefits of pricing.