Kemper

-

The affirmations reflect Kemper’s recent rate increases in California and its exit of the preferred home and auto insurance market to redeploy capital to the carrier’s core segments.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The segment will now be a non-core part of the business and will no longer be reflected in future reporting, Lacher told analysts on the carrier’s Q2 earnings call on Monday.

-

The Inside P&C news team runs you through the earnings results for the day.

-

All policies will be non-renewed or canceled in accordance with state regulations, according to an announcement released ahead of the company’s Q2 earnings call on Monday.

-

The company also expects to record an after-tax goodwill impairment charge of approximately $45.5mn following a strategic review of its personal insurance business.

-

However, the carrier reiterated its prior guidance of a return to underwriting profitability In H2 2023 with a 2024 financial target of achieving 10%+ in full year RoE.

-

The auto insurer’s results were adversely impacted by prior-year claim reserve additions and catastrophes.

-

CEO Joe Lacher projected that the company will be profitable in the first half of the year and produce an underwriting profit in the second half.

-

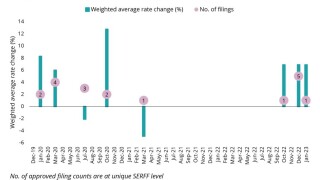

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

The insurer estimated a 109% combined ratio for Kemper Auto in Q4, which included $7mn of adverse legal cost development for the first three quarters of last year.

-

The sell-off was one of the carrier’s “strategic initiatives” to focus on core capabilities as the company navigates a challenging environment for personal line businesses.

Related

-

Kemper names Camden CFO

February 12, 2024 -

Q4 earnings roundup February 1: The Hartford, Kemper

February 01, 2024 -

Ex Kemper CFO McKinney to take home $1.975mn in severance

January 26, 2024 -

Kemper anticipates Q4 adjusted net operating income of $45mn-$55mn

January 24, 2024 -

Kemper’s Groundhog Day Revisited

November 07, 2023