Kemper

-

The pandemic’s reopening caused rapid increases in auto frequency and global disruptions in supply chains, leading to “disappointing” results, Kemper’s CFO said.

-

Kemper’s specialty P&C loss ratio spikes, driven by legal developments and increased severity in personal injury protection coverage in Florida.

-

The carrier also anticipates that Florida personal injury protection claims will exceed its historical expectations.

-

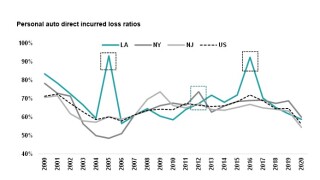

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

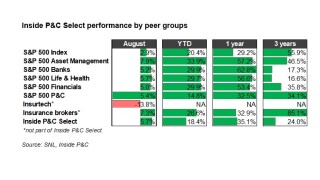

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The Chicago-based specialty company saw its combined ratio to spike to 116.1%.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

Personal auto carriers lowered rates in response to 2020’s loss cost trends, but chasing market share now could be a mistake.

-

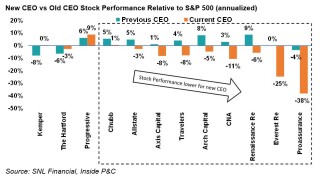

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

Joe Lacher will take over as non-executive chairman of Kemper, adding to his existing roles of president and CEO.

-

Kemper Insurance reported a 46% year-on-year dip in operating profits for the first quarter of 2021, as natural catastrophe claims weighed on the company’s results.

-

While the direct channel has strengthened over the past year, Root has not grown auto PIF since Q1:20.

Related

-

Kemper names Camden CFO

February 12, 2024 -

Q4 earnings roundup February 1: The Hartford, Kemper

February 01, 2024 -

Ex Kemper CFO McKinney to take home $1.975mn in severance

January 26, 2024 -

Kemper anticipates Q4 adjusted net operating income of $45mn-$55mn

January 24, 2024 -

Kemper’s Groundhog Day Revisited

November 07, 2023