Liberty Mutual

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

Ford had purchased a builder’s risk policy from the insurer.

-

The years-long legal battle was brought on by a former employee alleging wrongful termination.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

When owners are not paying attention, discipline and governance are not top priorities.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The firm’s subsidiary in India paid $1.47mn in bribes to officials at state-owned banks and raised revenue of $9.2mn.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

Last month, Insurance Insider US revealed that former GTS Americas head Scott Pegram had left the company.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

Fallon will retire in January 2026 after 30 years at the company.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Scott Pegram had been at Liberty Mutual for over six years in various senior roles.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

The executive has been with the firm since 2011.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

Korte had been serving as interim president of the unit since December.

-

The new CEO hints at expansion into MGA markets.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

The carrier has seen increased legal system abuse in US small commercial and excess and umbrella.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Customers will keep their agent relationship and policies will not be impacted.

-

A quick roundup of our best journalism for the week.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The carrier has seen two other exits from its US tax team this year.

-

The appointment will be effective January 1.

-

The renewal book has auto, home, renters and condo policies, among others.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

Insurers are fighting to recoup claims they have paid out.

-

Sources said LSM head of third party in Miami Humberto Pozo will serve as interim head of distribution.

-

Sanchez will report to Carolina Carmona, LSM’s head of financial lines in south Florida.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Year to date, casualty rates, excluding shared economy, are up roughly 10%, the executive said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Julie Hasse is currently COO of Liberty Mutual Investments.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

The firm recently announced a restructure across its underwriting team.

-

Spelman joins Hiscox from Liberty Mutual.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

The BMC-IBM judgment was insured for about $700mn on a heavily co-insured tower of around $1bn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The product was made through a partnership with technology provider Safehub.

-

Chres Lee was previously M&A counsel for Liberty Global Transaction Solutions.

-

Based in Miami, the executive has worked at Liberty Mutual for nearly 13 years.

-

The company has no immediate plans to re-deploy proceeds from recent sales in Europe and LatAm.

-

The company provides reinsurance to insurers in LatAm and the Caribbean.

-

The carrier laid off approximately 850 staff late last year.

-

As part of Liberty Specialty Markets, John Krupczak will report to Manuel Moreno.

-

In his new role Bolaños will report to both Matthew Moore, Liberty Global Risk Solutions (GRS) president of underwriting, and to Phil Hobbs, LSM president and MD.

-

In this new role, she will manage cyber product and underwriting strategy across the globe, reporting to Matthew Hogg, global product leader, cyber.

-

It is understood that the cuts are based on a review of five-year loss ratios, and that agents above 70% will be impacted.

-

The underwriter will work in the retail property team at BHSI serving the central region.

-

As part of the US standard casualty team, she will develop and manage a portfolio of assumed casualty treaty reinsurance business.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Liberty GTS noted a fall in the proportion of R&W notifications where the potential loss exceeds the retention in the last 12 months as compared to the preceding 12 months.

-

The cuts amount to roughly 2% of the insurer’s US workforce.

-

The executive has 15 years of underwriting experience and most recently led Liberty Mutual’s North America specialty primary casualty business.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Aggregate pricing for GRS North America increased 12.1% with a rate hike of 9.6%, exceeding loss cost trends of 8.4%. Competition retaining quality accounts partially offset these increases.

-

The Inside P&C news team runs you through the earnings results for the day.

-

She succeeds Noel MacCarthy, who announced his retirement earlier this year.

-

It will also start non-renewing its current book in this line of business beginning in December.

-

The company also announced that Asia retail markets will join global risk solutions and that it was launching its enterprise transformation and solutions unit.

-

Johnson will assume the role July 3, taking over from Marc Orloff.

-

The sale includes Liberty Seguros operations in Ireland, Northern Ireland, Portugal and Spain.

-

Talanx said the transaction will make the company the third-largest P&C insurer in Latin America.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The quarterly performance was driven by the global retail market unit which reported $892mn in catastrophe losses during the quarter.

-

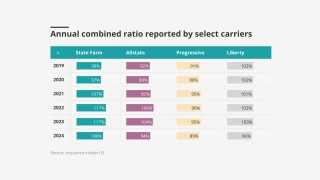

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

2022 statutory data is now available, and results show winners and losers

-

The US mutual cut back its 1.1 reinsurance program, according to sources.

-

The improvement was driven by higher earned premium and lower employee-related costs, as well as more favorable cat-loss development.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The unit will be led by GRS insurance solutions president Liz Geary, until the appointment of a global head of cyber, who will report to her.

-

In this newly created position, Korte will report to GRS NA CUO Brandon Fick.

-

In his new position, the executive will report to GRS North America specialty president Matt Dolan.

-

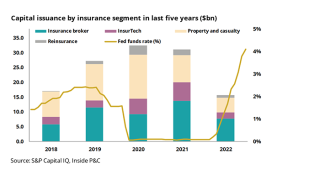

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Boston-headquartered mutual is understood to have recently pitched potential acquirers of the LatAm assets.

-

In her new role, Sutton will report to GRS COO Susanne Figueredo Cook and GRS North America president Kevin Smith.

-

The carrier is reportedly looking to sell its operations in Spain, Portugal and Ireland.

-

The appointment completes the CUO team at Liberty Mutual’s Global Risk Solutions office of underwriting.

-

The proportion of notifications reporting high severity ($10mn+) remains unchanged at 9%, according to the report.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The increases were driven by higher US non-cat losses, primarily due to personal auto, personal property and business lines, as well as higher current-year losses in global risk solutions.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

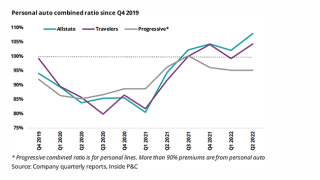

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

Both Chu and Leahy will report to GRS president of underwriting Matthew Moore.

-

The company acquired Ironshore from Fosun in a $2.9bn deal that closed in May 2017.

-

Kevin Smith was most recently president and COO of CNA's specialty business.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

Ottaviano was most recently chief risk officer with Aspen Insurance, while Rodriguez has been with Liberty Mutual for 13 years.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.