-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

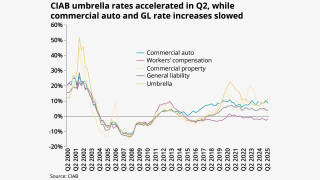

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The Delaware high court’s reasoning could find application in other cases.

-

The executive was previously Navigators’ head of excess casualty.

-

Appointments include leadership in transportation, energy, marine and others.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

The professional lines market remains ‘challenging’ overall, however.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The company also encouraged insurers and brokers to support the initiative.

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The rules would require paid rest breaks, among other measures.

-

The unit will operate via VerTerra Insurance, the company’s E&S insurer.

-

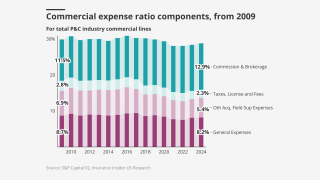

Expense ratios started to move higher in 2024 as the cycle reverses, with this trend likely to persist.

-

The executive brings nearly 30 years of liability experience to the role.

-

The former Hub executive has over 30 years of experience in transportation.

-

The executive said he left the company in September.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

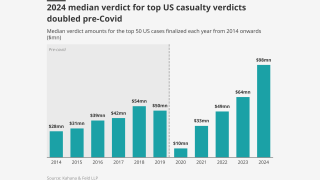

Rates and limits have done the heavy lifting to date – but there are other options.

-

The team is led by ex-Liberty Mutual executive David Perez who was hired for the launch in October.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The MGA market now makes up 10% of the overall P&C market.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

The program will provide excess casualty coverage across a broad range of industries.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

The partnership will launch a new umbrella excess insurance product.

-

The company is seeking to promote growth in its US excess casualty book.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

He will oversee the launch of Tokio Marine’s new excess casualty line.

-

Reinsurance capacity is largely stable but that doesn’t mean discussions will be a smooth ride.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

Reinsurers will likely push for double-digit US premium rate increases.