-

Valor Equity led the raise, which included Lightspeed and General Catalyst.

-

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

-

Attorneys and doctors targeted by the case claim Uber has no standing to bring a Rico suit.

-

He served as SVP of transportation at ISC since mid-2024.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

The trucking carrier has been building out its executive team this year.

-

The change was made on December 2 and was effective immediately.

-

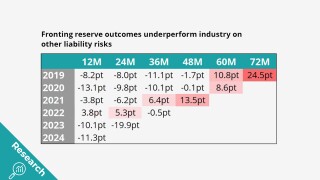

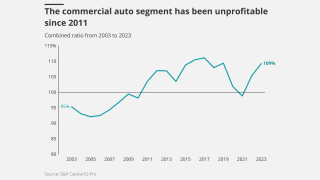

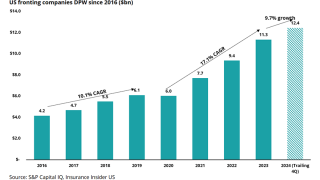

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

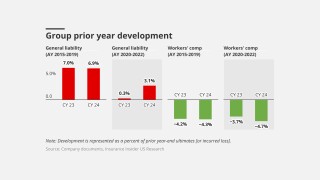

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

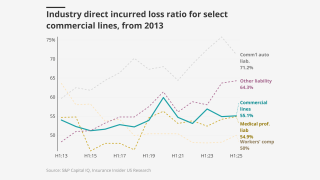

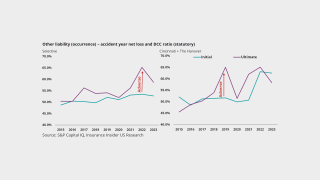

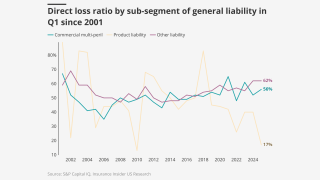

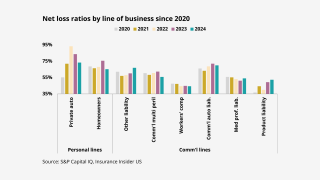

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

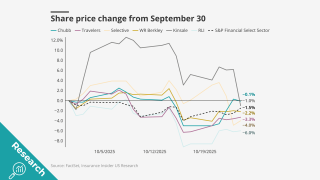

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

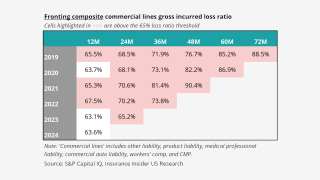

Fronting doesn’t look any better when it’s broken down by segment.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

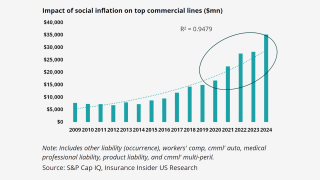

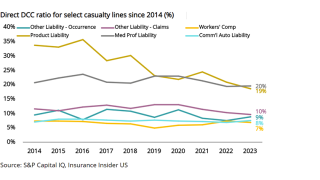

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

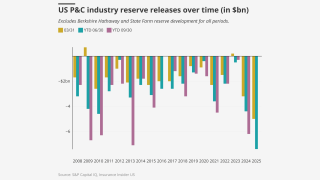

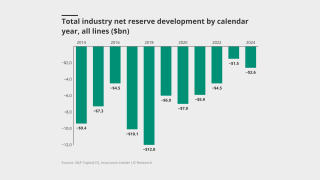

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

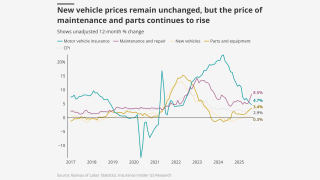

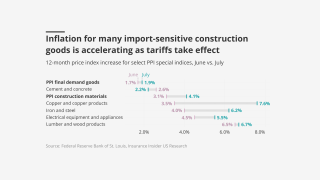

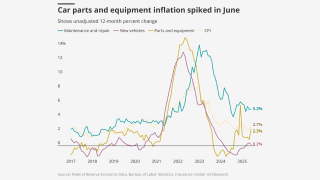

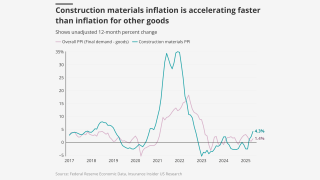

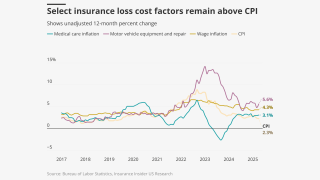

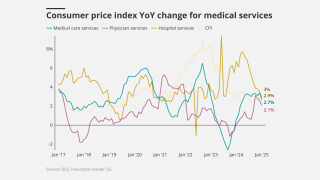

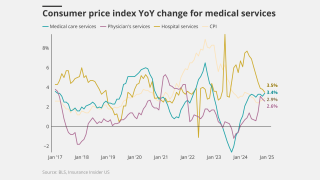

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

Appointments include leadership in transportation, energy, marine and others.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The company also purchased $15mn of SCS parametric coverage.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

Morgan Stanley first invested in Cover Whale in May 2024 with structured debt.

-

The executive said the claims industry is going to “be transformed”.

-

Rising inflation could raise claims severity but also increase investment income.

-

All lines except workers’ comp are up year over year, however.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

Premium rose across the top 15 P&C risks in 2024.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

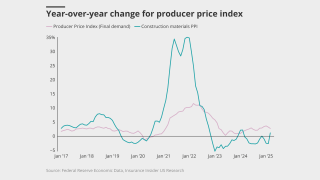

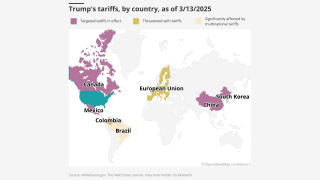

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Rates need to be fair but also should not be “destructive of competition”.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The former Hub executive has over 30 years of experience in transportation.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

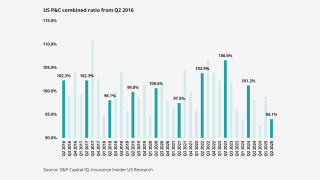

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

The executive will also oversee premium audit and customer service.

-

Data, technology and telematics could turn the struggling sector profitable.

-

Korte had been serving as interim president of the unit since December.

-

The costs of accident/casualty-related claims continue to rise.

-

The InsurTech was also removed from under review, negative.

-

Surplus lines are still strong, but not the standout they used to be.

-

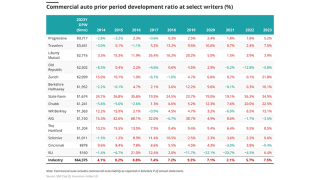

Newly released annual stat filings on reserve data show some troubling trends.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

The industry continues to take reserve addition medicine in smaller doses than recommended.

-

The funding round valued the company at around $850mn.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

January CPI/PPI heats up but won’t translate to higher loss costs.

-

Carriers that started earlier in correcting their books and catching up with loss trend may be reaping rewards.

-

The company’s combined ratio rose 6.5 points from 2023.

-

The executive joins after 20 years with Lexington.

-

Loss-cost indicators are high for liability, low for property.

-

The suit seeks compensatory and punitive damages from 180 defendants.

-

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

A quick roundup of our best journalism for the week.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

Sources said that the underwriter has been working with Houlihan Lokey to find a potential backer.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Worrisome trends in the line may be warning signs of worse to come.

-

It’s time regulators take decisive action regarding the company and regulation, sources say.

-

The storm is projected to make landfall in the next 24 hours in the highly populated Tampa Bay region.

-

Milton stole the limelight from slightly stuck PE-backed brokers, acquisitive globals and the casualty conundrum.

-

Sources expect loss amplification in claims from Georgia, the Carolinas and Tennessee.

-

In Q2, median property price increases decelerated to 2.3%.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

No-fault state regulation and alleged fraud continue to plague the fraught market.

-

Hereford and Maya have written $141mn and $15mn in DWP for H1 2024, respectively.

-

ATIC insures about 60% of the NY livery market.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

The company writes roughly $300mn with Ebitda of roughly $30mn.

-

The mean nuclear verdict for 2013-2022 was $89mn, versus $76mn in 2010-2019.

-

The InsurTech had been pursuing strategic investment options, including a minority stake sale.

-

The all-items CPI has increased 3.4% over the last 12 months.

-

Former NTUM president Justin Joyce will lead the ANTU binding unit.

-

It is understood that the company needs to secure cash within less than 30 days.

-

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

A litany of underwriting and quoting constraints has made it much harder to write business.