-

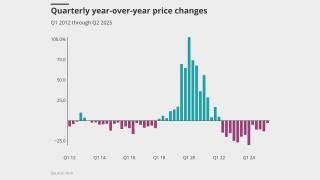

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

Next year will mark five consecutive years of insolvency increases.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

The company announced four key leadership appointments on Wednesday.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

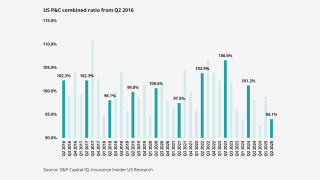

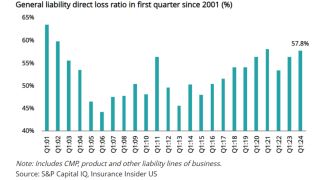

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

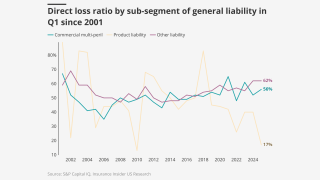

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

The executive said the floor on D&O pricing is in sight.

-

The move will impact around $50mn of gross written premiums in total.

-

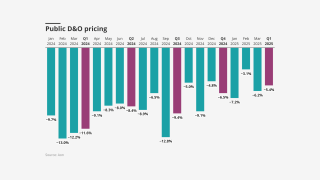

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The professional lines market remains ‘challenging’ overall, however.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

Pricing was “virtually flat” in the second quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The company also encouraged insurers and brokers to support the initiative.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

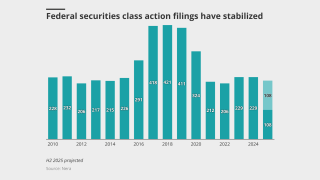

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The executive has experience as both an attorney and a broker.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Competition and ample capacity are pushing premiums lower.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The program is designed to address a changing risk environment.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The role will unify the P&C and professional and executive risk practices.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The executive will continue as head of BHSI’s E&P lines business.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

Markel had announced the exit from the line of business in the US last year.

-

The market is up against emerging risks and a whole heap of uncertainty.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

D&O liability premiums have declined by double digits in seven of the last eight quarters.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

Challenges in claims frequency and carrier competition are likely to remain.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Federal court securities class actions hit a four-year high last year.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

The expectation – and strong hope – is that deregulation will spur growth and bring benefits to the D&O line.

-

Underwriting remains disciplined as insurers target profitable growth.

-

The price for policies with the same limit and deductible decreased 6.0%.

-

D&O direct written premiums fell 8% YoY as of June 30, and direct earned premiums declined 16%.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

The firm will specialize in professional liability insurance for SMEs.

-

Renewals with flat or increased premiums are on the rise, however.

-

Expansion of the middle-market book is an ongoing focus.

-

However, the market is still struggling with excess capacity and low demand.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

Pearce brings 25 years of experience with a background in the A&E sector.

-

In 2023, the segment had its best direct loss ratio in nearly a decade at 50.8%.

-

The offering is an admitted product for SMBs and non-profits.

-

Loss picks for other liability are at a 23-year high, but that still may not be enough.

-

As the industry gathers in San Diego, these are the key discussion points.

-

Rooker joined the Texas brokerage in 1999, while Schramm joins from CNA.

-

Michael Smith is a former mortgage broker.

-

The policy offering expands third-party liability coverage and wage and hour liability.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

The hire comes after the company’s recent rebrand from Capitola Insurance.

-

The executive has been with Zurich since 2018.

-

The plaintiffs – three former claims adjusters – were each awarded $25mn in punitive damages.

-

The US regulator faces litigation from both sides of the climate issue.

-

A total of 30 carriers entered the US public company D&O space in 2023.

-

Chres Lee was previously M&A counsel for Liberty Global Transaction Solutions.

-

Given ample capacity and no sharp increase in demand, a market sea change is not expected, barring an unforeseen economic event.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

This continues a consecutive quarterly gain of over 6%.

-

Executives at D&O Plus said the pain from deploying those limits is being felt.

-

The ratings agency said growing competition has led to lower pricing.

-

The broker has been adding to its capabilities in the region.

-

The pace of price decreases has eased since Q2 last year.

-

The percentage of cases that could lead to higher losses increased in 2023.

-

This publication recently noted that ongoing rate declines and questions about past accident years are leading to calls for D&O price discipline.

-

Frequency and severity are both ratcheting up at a time when there are already questions about rate adequacy.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

Issues over reinsurance pricing and capacity continued to plague commercial property.

-

Distinguished will initially offer a true follow-form excess product covering D&O, employment practices and fiduciary liability for public, private and non-profit risks.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive said that NA financial lines rates and pricing in aggregate were down 4.8% and 3.8%, respectively, in Q3 as Chubb is trending financial lines loss costs at 4.7%.

-

Ongoing rate declines have been seen in recent renewals though the pace of decreases, particularly for established public companies, has slowed.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Q2 marked the 23rd consecutive quarter of year-over-year property rate increases, with rates rising 21% on average and further increases expected for the rest of the year.

-

Nearly half of the over 300 small business owners and CEOs surveyed say the US economy has improved.

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

Cyber is another market Axis is watching closely, given new MGA entrants as well as the recent rise of ransomware activity, with the carrier expecting more “undulation” as a result.

-

It is more dependent on property, and its longevity is uncertain.

-

Earlier this month, Inside P&C revealed that the underwriter hired ex-Ascot EVP Becker and a team of four executives to spearhead the Aquiline-backed MGA’s entry into D&O.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Rate declines have not been as pronounced in private D&O, though competition is increasing.

-

Sources said SVP Crystal Greene along with VPs Carol Smith and Devon Lay and assistant underwriter Maggie Holland are joining Distinguished’s new D&O unit.

-

Average renewal premiums decreased 20% to 30% over the previous year’s price, with some public companies posting premium falls of 50% to 60% in the past 18 months.

-

Some 81.5% of policies renewed with the same limit and deductible, marking a return to historic levels after bottoming out in Q3 2020. Among those policies, the average price decrease was 13.8%, while the average price increase was 30.2%.

-

The underwriter has previously worked at AIG, Chubb and Markel.

-

The hard reinsurance market and elevated cat losses continued to drive rate increases.

-

The broker said clients could save money, increase limits and buy extra coverage.

-

The primary layer of $10mn was written by Chubb. The policies cover the period from August 1 2022 through August 1 2023.

-

He will be based in Connecticut and report to Alex Blanco, Vantage's chief executive, insurance.

-

Speaking about the recently spun-out HNW MGA, Zaffino said AIG expects to bring on additional capital providers to the subsidiary through H2 2023.

-

The scale of reductions is increasing as the class of business experiences its fourth consecutive quarter of rate falls.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

An uptick in financial markets activity could increase demand, but there is also significant risk which currently isn’t priced into the market.

-

D&O (Inside P&C Daily lead story): There is hope that public D&O rates could stabilize in the second half of the year following a tough end to 2022 and an ongoing slump in Q1. Significant discounts granted in 2022 are unlikely to be repeated, and there are ongoing concerns around both economic and social inflation, sources said. In the meantime, rates remain pressured from ample capacity and muted demand as established providers and incumbents drawn to the hard market of past years compete for relatively stagnant demand. The collapse of SVB, while a shock, wasn’t the inflection point for D&O that some might have expected.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

High capacity and an ongoing faith in the financial system have mitigated against instant action from insurers.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

The US continues to experience catastrophic flash flooding and heavy rainfall events that are impacting “inland” areas across the country, as well as coastal areas.

-

D&O underwriters, as well as financial institution insurers supporting startups and venture capitalists, could have faced “financial distress” without government intervention.

-

Costs of defending and settling lawsuits are likely to fall on the bank’s D&O insurers.

-

Experts at the Plus D&O symposium took a deep dive into the issues and uncertainties affecting the D&O market as rates soften.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The market has quickly moved away from dramatic hardening in 2020 and 2021 following an influx of capacity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

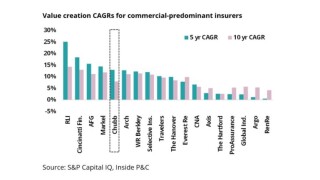

Chubb’s balanced view of the market as a whole, and pricing and loss cost trends in particular, puts it ahead of the curve on value creation, despite a difficult economic backdrop.