-

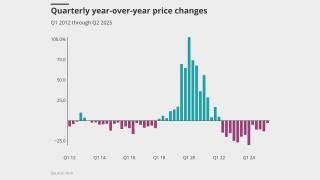

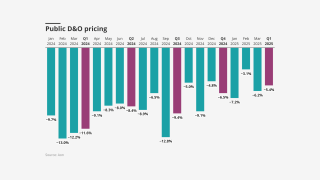

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

Next year will mark five consecutive years of insolvency increases.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

The company announced four key leadership appointments on Wednesday.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

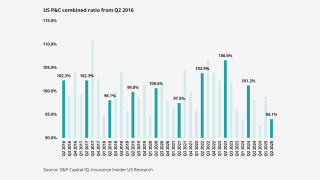

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

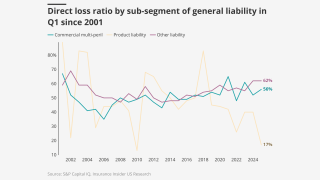

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

The executive said the floor on D&O pricing is in sight.

-

The move will impact around $50mn of gross written premiums in total.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The professional lines market remains ‘challenging’ overall, however.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

Pricing was “virtually flat” in the second quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The company also encouraged insurers and brokers to support the initiative.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

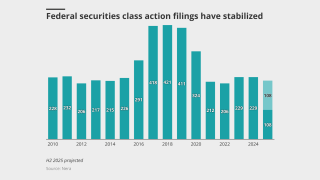

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The executive has experience as both an attorney and a broker.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Competition and ample capacity are pushing premiums lower.