-

Specialty was the busiest segment but still recorded a YoY drop of seven points.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

The executive co-led the US financial institutions business at BHSI.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

The hire advances Howden’s growth push in the US.

-

Next year will mark five consecutive years of insolvency increases.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

The move comes after the company posted 52% YoY top-line growth in Q3.

-

The company announced four key leadership appointments on Wednesday.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The broker will join Ron Borys’ financial lines team.

-

The global insurer will need to convince investors on the quality of the book.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The new chief executive has served on PI’s board since 2018, including as chair.

-

The broker will report to Howden US CEO Mike Parrish.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

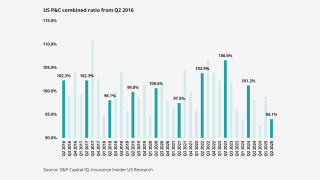

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

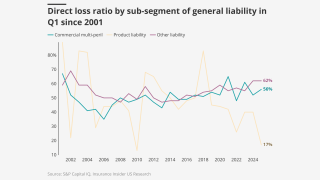

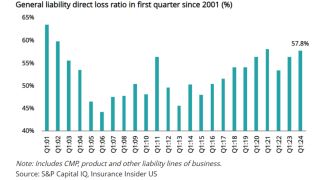

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Company alum David Murie will lead the new business unit.

-

Appointments include leadership in transportation, energy, marine and others.

-

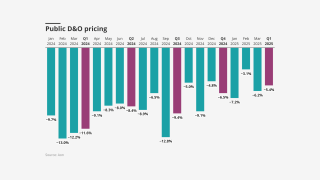

The executive said the floor on D&O pricing is in sight.

-

The move will impact around $50mn of gross written premiums in total.

-

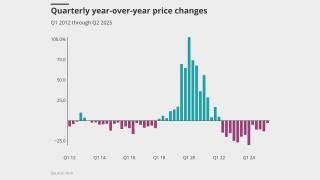

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The professional lines market remains ‘challenging’ overall, however.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

Pricing was “virtually flat” in the second quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The company also encouraged insurers and brokers to support the initiative.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

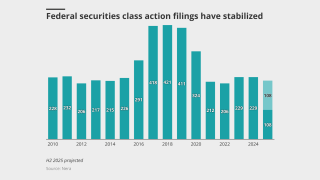

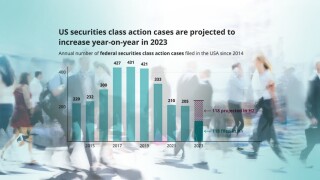

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The executive has experience as both an attorney and a broker.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Competition and ample capacity are pushing premiums lower.

-

Large account and E&S property have gotten competitive faster than expected.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The executive has previously held roles at CRC Group, Allianz and Nationwide.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The program is designed to address a changing risk environment.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The deal is expected to close in the second quarter.

-

The only major product line to see rate increases was casualty.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The role will unify the P&C and professional and executive risk practices.

-

The two internal hires have been with BHSI for around five years.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

The executive was most recently chief revenue officer at Aon.

-

Capital funding new litigation dropped 16% YoY, however.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The executive will continue as head of BHSI’s E&P lines business.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

ProAssurance brands will be transitioned to The Doctors Company in "all/most markets" over time.

-

Markel had announced the exit from the line of business in the US last year.

-

The market is up against emerging risks and a whole heap of uncertainty.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

D&O liability premiums have declined by double digits in seven of the last eight quarters.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

The broker said clients could expect to see double-digit rate decreases this year.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

The program will offer limits up to $5mn.

-

The move comes after Argo Pro announced it will exit professional lines.

-

The executives will report to Jenise Klein, CUO for North America.

-

Challenges in claims frequency and carrier competition are likely to remain.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Around $155m of the businesses in-force gross premium will be transferred to Core Specialty.

-

Federal court securities class actions hit a four-year high last year.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

IAP served as financial adviser to Atri in the transaction.

-

The pair will lead crisis management and financial lines, respectively.

-

Both the US and UK had busy summers, but the talent momentum in the US did not continue into Q4.

-

Batch coverage is also coming into focus as insurers look for ways to reduce exposure to large losses.

-

The expectation – and strong hope – is that deregulation will spur growth and bring benefits to the D&O line.

-

The business will trade via London, the US and Canada.

-

Underwriting remains disciplined as insurers target profitable growth.

-

The price for policies with the same limit and deductible decreased 6.0%.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

The carrier will only continue to offer lead capacity to some existing accounts.

-

Current rates at 2% to 2.5% translate to an 86% incurred loss ratio.

-

D&O direct written premiums fell 8% YoY as of June 30, and direct earned premiums declined 16%.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

The firm will specialize in professional liability insurance for SMEs.

-

Renewals with flat or increased premiums are on the rise, however.

-

Expansion of the middle-market book is an ongoing focus.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

However, the market is still struggling with excess capacity and low demand.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

Pearce brings 25 years of experience with a background in the A&E sector.

-

In 2023, the segment had its best direct loss ratio in nearly a decade at 50.8%.

-

The offering is an admitted product for SMBs and non-profits.

-

Loss picks for other liability are at a 23-year high, but that still may not be enough.

-

As the industry gathers in San Diego, these are the key discussion points.

-

Rooker joined the Texas brokerage in 1999, while Schramm joins from CNA.

-

The new suite of coverages is designed to meet the unique needs of healthcare organizations.

-

Michael Smith is a former mortgage broker.

-

The policy offering expands third-party liability coverage and wage and hour liability.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

The hire comes after the company’s recent rebrand from Capitola Insurance.

-

The executive has been with Zurich since 2018.

-

The plaintiffs – three former claims adjusters – were each awarded $25mn in punitive damages.

-

Pauline Morley will report to John Van Decker, head of global financial lines.

-

The US regulator faces litigation from both sides of the climate issue.

-

A total of 30 carriers entered the US public company D&O space in 2023.

-

Chres Lee was previously M&A counsel for Liberty Global Transaction Solutions.

-

Given ample capacity and no sharp increase in demand, a market sea change is not expected, barring an unforeseen economic event.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

This continues a consecutive quarterly gain of over 6%.

-

The MGA will be offering $10mn limits for $300mn-$10bn companies.

-

Executives at D&O Plus said the pain from deploying those limits is being felt.

-

The ratings agency said growing competition has led to lower pricing.

-

The broker has been adding to its capabilities in the region.

-

The pace of price decreases has eased since Q2 last year.

-

The percentage of cases that could lead to higher losses increased in 2023.

-

This publication recently noted that ongoing rate declines and questions about past accident years are leading to calls for D&O price discipline.

-

Frequency and severity are both ratcheting up at a time when there are already questions about rate adequacy.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

Issues over reinsurance pricing and capacity continued to plague commercial property.

-

Distinguished will initially offer a true follow-form excess product covering D&O, employment practices and fiduciary liability for public, private and non-profit risks.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive said that NA financial lines rates and pricing in aggregate were down 4.8% and 3.8%, respectively, in Q3 as Chubb is trending financial lines loss costs at 4.7%.

-

Ongoing rate declines have been seen in recent renewals though the pace of decreases, particularly for established public companies, has slowed.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Q2 marked the 23rd consecutive quarter of year-over-year property rate increases, with rates rising 21% on average and further increases expected for the rest of the year.

-

Nearly half of the over 300 small business owners and CEOs surveyed say the US economy has improved.

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

Cyber is another market Axis is watching closely, given new MGA entrants as well as the recent rise of ransomware activity, with the carrier expecting more “undulation” as a result.

-

It is more dependent on property, and its longevity is uncertain.

-

Earlier this month, Inside P&C revealed that the underwriter hired ex-Ascot EVP Becker and a team of four executives to spearhead the Aquiline-backed MGA’s entry into D&O.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Rate declines have not been as pronounced in private D&O, though competition is increasing.

-

Sources said SVP Crystal Greene along with VPs Carol Smith and Devon Lay and assistant underwriter Maggie Holland are joining Distinguished’s new D&O unit.

-

Average renewal premiums decreased 20% to 30% over the previous year’s price, with some public companies posting premium falls of 50% to 60% in the past 18 months.

-

Some 81.5% of policies renewed with the same limit and deductible, marking a return to historic levels after bottoming out in Q3 2020. Among those policies, the average price decrease was 13.8%, while the average price increase was 30.2%.

-

The underwriter has previously worked at AIG, Chubb and Markel.

-

The hard reinsurance market and elevated cat losses continued to drive rate increases.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

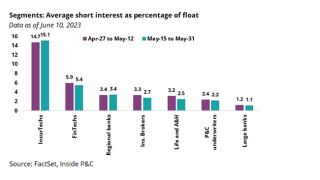

InsurTechs are still the most heavily shorted among P&C names, though they likely have been beneficiaries of a short squeeze for most of 2023.

-

The broker said clients could save money, increase limits and buy extra coverage.

-

The primary layer of $10mn was written by Chubb. The policies cover the period from August 1 2022 through August 1 2023.

-

He will be based in Connecticut and report to Alex Blanco, Vantage's chief executive, insurance.

-

Speaking about the recently spun-out HNW MGA, Zaffino said AIG expects to bring on additional capital providers to the subsidiary through H2 2023.

-

The scale of reductions is increasing as the class of business experiences its fourth consecutive quarter of rate falls.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

An uptick in financial markets activity could increase demand, but there is also significant risk which currently isn’t priced into the market.

-

D&O (Inside P&C Daily lead story): There is hope that public D&O rates could stabilize in the second half of the year following a tough end to 2022 and an ongoing slump in Q1. Significant discounts granted in 2022 are unlikely to be repeated, and there are ongoing concerns around both economic and social inflation, sources said. In the meantime, rates remain pressured from ample capacity and muted demand as established providers and incumbents drawn to the hard market of past years compete for relatively stagnant demand. The collapse of SVB, while a shock, wasn’t the inflection point for D&O that some might have expected.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

High capacity and an ongoing faith in the financial system have mitigated against instant action from insurers.

-

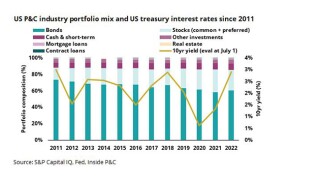

A subtle, decade-long shift toward equity investments halts as rising interest rates push carriers back to short-duration bonds.

-

While there were sparks of cheerfulness among attendees, a careful reading of the room showed that rationalism is superseding optimism.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.