-

Commercial auto, workers’ comp and BOP were down from Q3, however.

-

The market expects a lower proportion of restoration by utilities than after 2018’s Camp Fire.

-

The company will also split operations into US and international divisions.

-

Last year was the ninth-largest loss year for the country on record.

-

The year featured the fewest multi-billion-dollar insured loss events since 2019.

-

The deal follows Alacrity’s sale last year to a group of its private lenders.

-

The move comes after the sale of Dual’s crisis management division.

-

The storm is expected to bring freezing rain and heavy snow across a wide swath of the US.

-

Over 30 years after the Northridge earthquake, quakes have fallen out of market discussions.

-

Increased vegetation could spell trouble in the future.

-

While buyers enjoy favorable market conditions, increased costs from tariffs could spell trouble in 2026.

-

The executive was previously head of casualty at the AIG subsidiary.

-

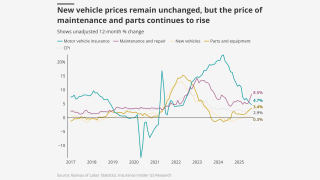

Casualty and auto loss costs continue to rise due to inflation as we head into 2026.

-

The MGA’s property team buildout was led by Clif Hope, former Lexington head of property.

-

Sources said they expected FM to keep around $2bn of the maximum line net.

-

Insurance has been an increasingly salient issue among politicians in the state.

-

The company’s policy count has been declining rapidly in recent months.

-

FM announced a new super-sized $5bn data center line as it grows book value $3bn-$4bn a year.

-

The multi-line program seeks to support investors, developers and operators involved in the AI boom.

-

The medical care index increased 3.5% over the past 12 months.

-

Wildfires and SCS led to $108bn of total insured losses globally, despite no major hurricane making US landfall.

-

The 25-year industry veteran will report directly to CEO Adrian Daws.

-

The property insurer has secured significant additional capacity for its FM Intellium unit.

-

The move is one of several promotions that shake up the property, cat modeling and client/broker relationship teams.

-

Oliphant was the president of the property division for Core Specialty for five years.

-

He will join the company on January 15 as SVP, global market and product relations.

-

The team will focus on distressed, hard-to-place accounts.

-

He was previously property practice leader for the Southeast.

-

Insurers have thrown fuel on the fire of the soft property market and brokers will struggle to eke out organic growth.

-

The bill would also mandate guaranteed replacement cost coverage.

-

The program complements the MGA’s middle-market offerings.

-

One avenue for capital freed up by a softer-than-expected renewal could be more M&A.

-

The move comes after a 200+ person mass team lift from Brown & Brown’s retail business in the US.

-

This is lower than some estimates, which had put insured losses at over $30bn.

-

The first round of 2026 renewals was largely favorable for buyers.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

Specialty was the busiest segment but still recorded a YoY drop of seven points.

-

The facility has expanded to cover construction and renewable energy risks.

-

In a state prone to SCS, wind, floods and freezes, carriers are still fighting for market share.

-

In casualty, the executive is seeing an acceleration of flight to quality both from cedants and reinsurers.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

Inflation was down from the 3% recorded for the 12 months ending in September.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

The legal setback came as publication of a Fema reform report was postponed.

-

The company announced four internal promotions this week.

-

Trump’s shadow loomed over the beachside sessions.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Former chief growth officer Michael Anderson has taken on the CEO role.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The peril has been historically difficult to model compared to others.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The deal to reopen the government also extended the NFIP.

-

The MGA began offering US commercial E&S property products in December.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The credit can now be applied to mitigation against operational losses.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The global insurer will need to convince investors on the quality of the book.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

APIP is one of the world’s largest property programs.

-

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

A quiet wind season is also expected to further soften the property market.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Brian Church has spent 20 years at Chubb.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

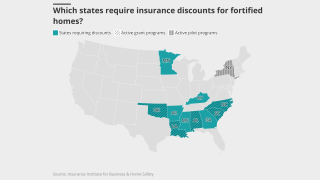

Sources said momentum around resiliency laws is growing at the state and local level.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The company is estimating its IPO price at $18-$20 per share.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive has been serving as COO since February.