-

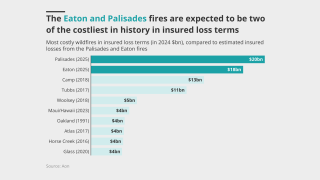

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

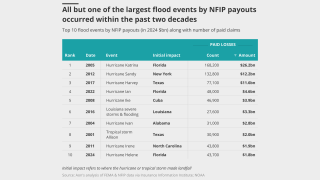

The legal setback came as publication of a Fema reform report was postponed.

-

The company announced four internal promotions this week.

-

Trump’s shadow loomed over the beachside sessions.

-

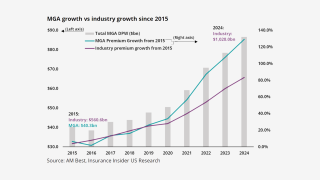

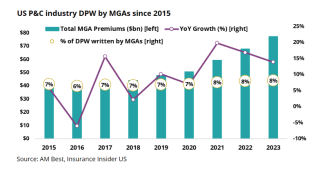

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Former chief growth officer Michael Anderson has taken on the CEO role.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The peril has been historically difficult to model compared to others.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The deal to reopen the government also extended the NFIP.

-

The MGA began offering US commercial E&S property products in December.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The credit can now be applied to mitigation against operational losses.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

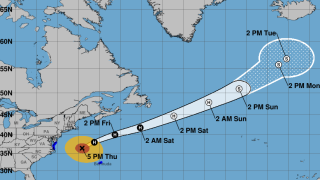

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The global insurer will need to convince investors on the quality of the book.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

APIP is one of the world’s largest property programs.

-

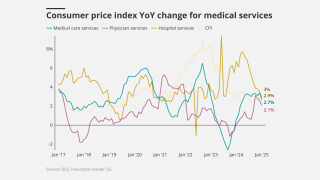

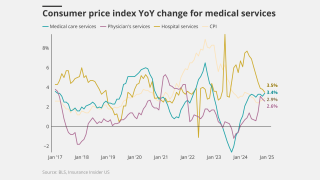

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

A quiet wind season is also expected to further soften the property market.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Brian Church has spent 20 years at Chubb.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

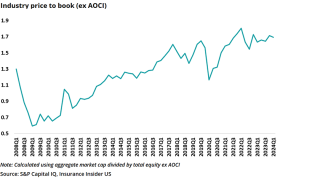

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

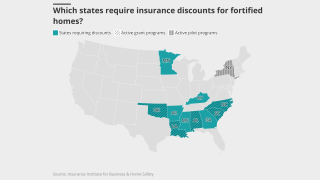

Sources said momentum around resiliency laws is growing at the state and local level.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The company is estimating its IPO price at $18-$20 per share.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive has been serving as COO since February.

-

The executive most recently served as head of North American treaty reinsurance.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The promotions will enhance underwriting capability across key segments.

-

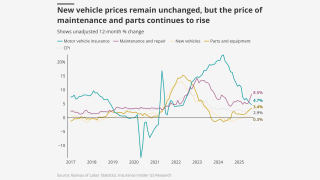

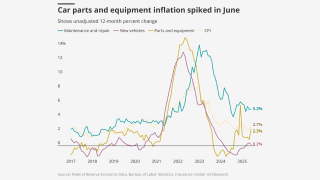

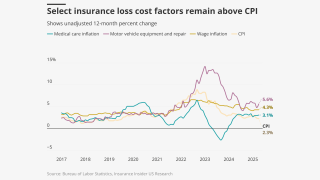

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Company alum David Murie will lead the new business unit.

-

The insurer said it expects to begin writing business by the end of the month.

-

July’s medical care increase was up from June’s o.6%.

-

The estimate covers property and vehicle claims.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

Both organisations still predict an above-average hurricane season.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

The executive has been with the brokerage since 2004.

-

The MGA will expand its US reach in apartments, condo associations and single-family rentals.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The company has also expanded its relationships with US and UK MGAs.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The novel product appears to have been pitched to multiple clients.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The SME and middle market segments remain ‘pretty healthy’.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

Smaller accounts remain less affected by an influx of MGAs.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

The executive said the claims industry is going to “be transformed”.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Renewal rates fell, despite elevated catastrophe losses.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

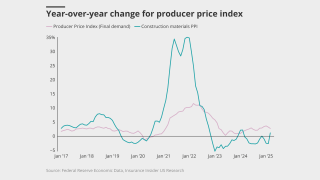

Rising inflation could raise claims severity but also increase investment income.

-

The class can collectively challenge State Farm’s property claims calculations.

-

All lines except workers’ comp are up year over year, however.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Rate gains are easing across many commercial and personal lines.

-

US events accounted for more than 90% of global insured losses.

-

June’s increase was up from May’s 0.2%.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

His 30 years of experience includes stints at Tokio Marine and Swiss Re.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The floods have killed at least 81 people, with dozens more missing.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

But June was the busiest month of the year on the back of recent broker churn.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The soft market continued through H1 2025, especially on shared programs.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

Much was learned after the fires, but it could take years before that data influences models.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The ratings agency cited support from parent company MSI for the upgrade.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Few claims have been filed thus far, as damages have been highly localized.

-

The ongoing demonstrations could have law enforcement liability implications.

-

The medical care index numbers were below April’s 0.5% rise.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The legislature did pass Twia reforms, however.

-

"Smoke damage is real damage," Commissioner Lara said.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Modeling wildfires is particularly challenging compared to primary perils like hurricanes.

-

The medical CPI is up 3.1% for the last 12 months.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

California homeowners are also expected to move admitted business to E&S.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

The only major product line to see rate increases was casualty.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

After seven years of premium rate growth, rates are down 5% to 40% across the US.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

The Floridian company applied to be traded on the NYSE.

-

Rouse was promoted to co-global placement leader last October.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

The coverage will only be available in Illinois and Michigan at first.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The 12 insurers together have $418mn in policyholder surplus.

-

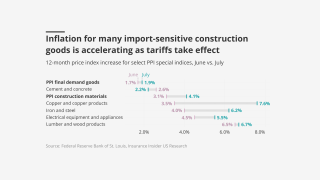

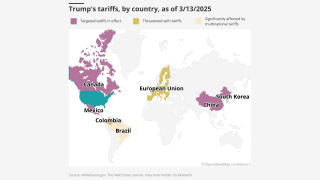

The tariffs could expose insurers to the risk of recession and shrinking income.

-

Korte had been serving as interim president of the unit since December.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The bill being considered would effectively eliminate personal injury protection.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Coverage will increase to $20mn per building.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

BHSI is dividing its retail general property unit into four regions.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

The agency collects gold standard data and conducts research. Without that, there’s more uncertainty.

-

A quick roundup of our best journalism for the week.

-

The move combines two units in the North America middle market division.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

The executive joined the Bancolombia-owned insurer as CEO in early 2020.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

The London D&F market will shoulder most of the losses.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

Inflation, supply chains and tariffs also add to the challenges, he said.

-

The organization was hoping to grow its reinsurance cover.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

The state-backed carrier has $2.1bn of Alamo Re cat bond coverage.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

Sources noted that Dowling Hales is advising the MGA.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The news comes around three months after GTCR agreed to sell AssuredPartners to AJ Gallagher for nearly $13.5bn.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

January CPI/PPI heats up but won’t translate to higher loss costs.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

More than 33,000 claims had been filed as of 5 February.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The estimate covers property and vehicle claims.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

Insureds often just want cover in place at the lowest price possible, and insurers oblige under the skeptical eye of regulators.

-

The carrier has not added new business in the state since 2007.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeler said.

-

The executives will report to Jenise Klein, CUO for North America.

-

Loss-cost indicators are high for liability, low for property.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

Rate increases averaged 0.0% in December 2024, from 16.3% in December 2023.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Irwin joins the firm from Beazley, where she’d worked since 2019.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

This publication revealed in July 2023 that the utility company had chosen to try self-insurance for the first time.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Investigators are homing in on the likely causes of the incidents.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

More than 4,000 acres are burning as thousands evacuate.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

In property, Canada, Central and Eastern Europe and UAE renewals were impacted by losses.

-

The insurance industry countered that the committee ignored a “toxic mix” of risks driving up costs.

-

More competitive pricing is predicted for the commercial insurance market.

-

Both the US and UK had busy summers, but the talent momentum in the US did not continue into Q4.

-

Sources said Berkshire will move from the largest single capacity provider to a single-digit percentage line size.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The move was led by ex-Icat CEO Gregory Butler.

-

James Drinkwater is to serve as vice chair and executive chairman at Amwins Global Risks.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The carrier attributed the intensification of storms this season to climate change.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The executive joins RPS after almost 12 years at Markel.

-

The floods add to an already historic loss tally for Canada in 2024.

-

The executive will build out Hamilton Americas property team and a book targeting commercial E&S risks.

-

The carrier said activity across smaller and mid-sized natural catastrophe and risk events had been “elevated”.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

The firm will provide an update on November 22 to avoid holiday season.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Total insured losses are expected to range from $34bn to $54bn.

-

Westhoff will also spearhead the launch of QBE’s E&S property offering.

-

Underwriting remains disciplined as insurers target profitable growth.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

The three-year deal is expected to generate $200mn in GWP over the period.

-

Sources said that Milton may slow the pace of rate deceleration.

-

The company said $13bn-$22bn will come from wind damage.

-

Prior to the event, clients were expecting a “very competitive market environment”.

-

Most of the insured loss was attributable to wind.

-

He replaces Kevin Madden who will assume the role of chairman for North American real estate.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Milton stole the limelight from slightly stuck PE-backed brokers, acquisitive globals and the casualty conundrum.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Reinsurance capacity is largely stable but that doesn’t mean discussions will be a smooth ride.

-

The figure does not include NFIP losses.

-

Sources expect loss amplification in claims from Georgia, the Carolinas and Tennessee.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Andrew Rowland will oversee the portfolio, offering up to $7mn per risk.

-

Property rates had increased 25.5% one year ago, in Q2 2023.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The storm is expected to make landfall in the next several hours.

-

An estimated $450mn of losses from Hurricane Beryl will wipe out a surplus Twia had been building since 2017.

-

"Life-threatening" storm surge and hurricane-force winds are expected for the state, according to the NHC.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Some Canadian cedants have approached the market for top-up cover.

-

Rate increases on primary liability placements range from 10% to 20%.

-

Umbrella was the exception, ticking up slightly on the month.

-

The US carrier abandoned the project due to high price expectations.

-

Included is the full utilization of $25mn available under its cat aggregate treaty.

-

The report flagged “opportunistic underwriting” by many of the major markets.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

Premiums increased 5.6% across all major lines, down from last quarter.

-

The consortium backing the MGA is led by Axa XL Syndicate 2003.

-

It had planned to non-renew 47,000 DP-3 and 53,000 high-risk homeowners’ policies this year.

-

The rise is equal to 5%-10% of catastrophe capacity purchased, including cat bonds, depending on region.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

The Irish MGA will be able to underwrite commercial property risk up to EUR10mn.

-

Insurers' losses will likely be low and readily absorbed by their earnings.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

The flattish outcome comes after a larger year-on-year hike in January.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

This publication broke news of the loan in May.

-

The onus is on buyers to provide more granular and comprehensive data.

-

AmCoastal also cut its board down to five members, including two new appointments.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Commercial and residential carriers have different requirements.

-

His experience includes HPR engineering, facultative reinsurance and E&S underwriting.

-

The Florida portion of the program provides $1bn in protection.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

He will oversee management of the P&C loss adjusting business.

-

The Howden-owned MGA lost ~$250mn in cat capacity in September.

-

The broad themes remained the same as those dominating in April.

-

Additional capacity for upper layer coverage is driving rate reductions, the broker says.

-

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.