-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker is looking to solve the severe capacity crunch for its clients as rising demand meets falling supply.

-

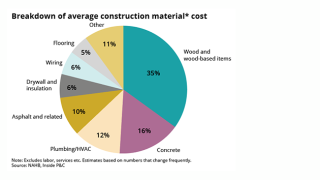

As the loss numbers for Hurricane Ian begin to come into focus, three topics to watch are impact from demand surge, litigation trends, and rate activity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Other firms such as Lexington, QBE and Zurich ranked among the top 20 underwriters in the six counties with highest exposure to Ian.

-

RMS pushed the guidance for the Carolinas component of the Ian loss $120mn higher at the mean level up to $1.94bn, as it updated figures on Saturday in private figures to clients.

-

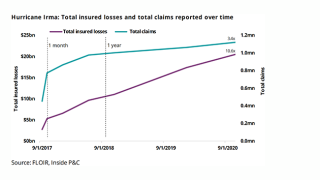

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The storm, currently 285 miles south of Charleston, is expected to make landfall as a hurricane on Friday.

-

Florida homeowners insurers, cat reinsurers and the ILS market could all face crises as a result of the loss.