-

The facility has expanded to cover construction and renewable energy risks.

-

In a state prone to SCS, wind, floods and freezes, carriers are still fighting for market share.

-

In casualty, the executive is seeing an acceleration of flight to quality both from cedants and reinsurers.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

Inflation was down from the 3% recorded for the 12 months ending in September.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

The legal setback came as publication of a Fema reform report was postponed.

-

The company announced four internal promotions this week.

-

Trump’s shadow loomed over the beachside sessions.

-

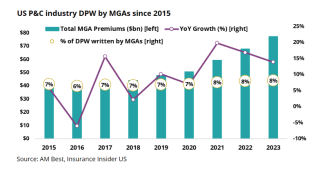

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

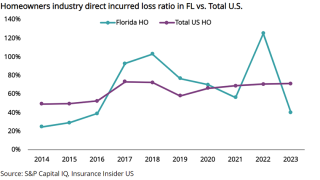

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Former chief growth officer Michael Anderson has taken on the CEO role.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The peril has been historically difficult to model compared to others.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The deal to reopen the government also extended the NFIP.

-

The MGA began offering US commercial E&S property products in December.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The credit can now be applied to mitigation against operational losses.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

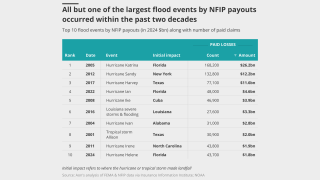

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

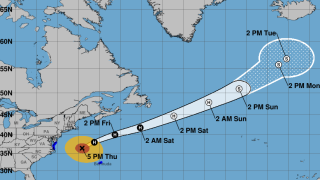

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The global insurer will need to convince investors on the quality of the book.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

APIP is one of the world’s largest property programs.

-

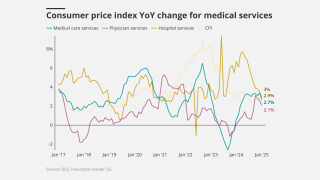

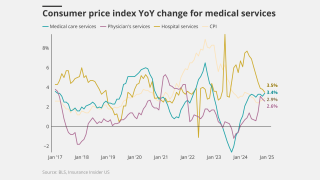

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

A quiet wind season is also expected to further soften the property market.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Brian Church has spent 20 years at Chubb.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

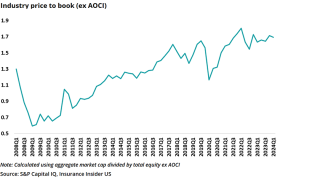

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

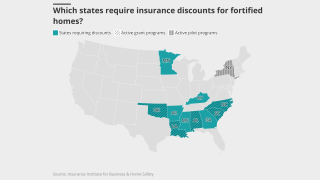

Sources said momentum around resiliency laws is growing at the state and local level.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The company is estimating its IPO price at $18-$20 per share.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

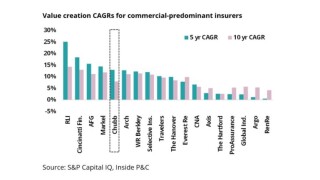

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive has been serving as COO since February.

-

The executive most recently served as head of North American treaty reinsurance.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The promotions will enhance underwriting capability across key segments.

-

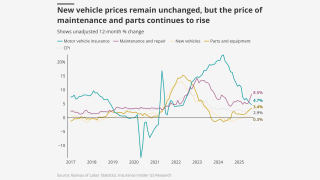

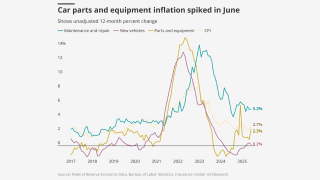

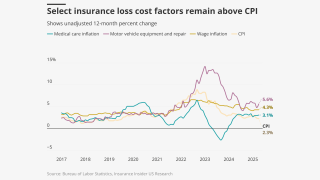

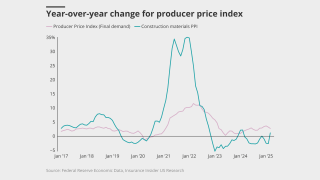

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Company alum David Murie will lead the new business unit.

-

The insurer said it expects to begin writing business by the end of the month.

-

July’s medical care increase was up from June’s o.6%.

-

The estimate covers property and vehicle claims.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

Both organisations still predict an above-average hurricane season.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

The executive has been with the brokerage since 2004.

-

The MGA will expand its US reach in apartments, condo associations and single-family rentals.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The company has also expanded its relationships with US and UK MGAs.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The novel product appears to have been pitched to multiple clients.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

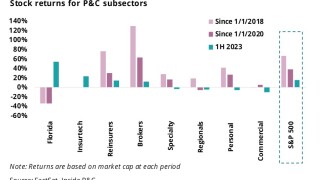

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The SME and middle market segments remain ‘pretty healthy’.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

Smaller accounts remain less affected by an influx of MGAs.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

The executive said the claims industry is going to “be transformed”.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Renewal rates fell, despite elevated catastrophe losses.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

Rising inflation could raise claims severity but also increase investment income.

-

The class can collectively challenge State Farm’s property claims calculations.

-

All lines except workers’ comp are up year over year, however.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Rate gains are easing across many commercial and personal lines.

-

US events accounted for more than 90% of global insured losses.

-

June’s increase was up from May’s 0.2%.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

His 30 years of experience includes stints at Tokio Marine and Swiss Re.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The floods have killed at least 81 people, with dozens more missing.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

But June was the busiest month of the year on the back of recent broker churn.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The soft market continued through H1 2025, especially on shared programs.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

Much was learned after the fires, but it could take years before that data influences models.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The ratings agency cited support from parent company MSI for the upgrade.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Few claims have been filed thus far, as damages have been highly localized.

-

The ongoing demonstrations could have law enforcement liability implications.

-

The medical care index numbers were below April’s 0.5% rise.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The legislature did pass Twia reforms, however.

-

"Smoke damage is real damage," Commissioner Lara said.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Modeling wildfires is particularly challenging compared to primary perils like hurricanes.

-

The medical CPI is up 3.1% for the last 12 months.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

California homeowners are also expected to move admitted business to E&S.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

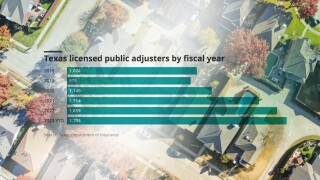

The Lone Star State has seen rapidly increasing rates in recent years.

-

The only major product line to see rate increases was casualty.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

After seven years of premium rate growth, rates are down 5% to 40% across the US.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

The Floridian company applied to be traded on the NYSE.

-

Rouse was promoted to co-global placement leader last October.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

The coverage will only be available in Illinois and Michigan at first.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The 12 insurers together have $418mn in policyholder surplus.

-

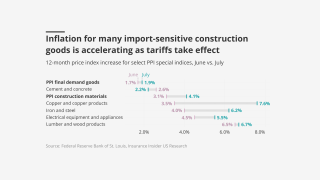

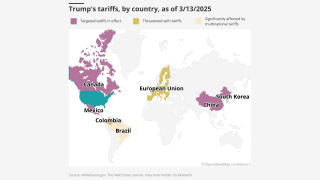

The tariffs could expose insurers to the risk of recession and shrinking income.

-

Korte had been serving as interim president of the unit since December.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The bill being considered would effectively eliminate personal injury protection.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Coverage will increase to $20mn per building.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

BHSI is dividing its retail general property unit into four regions.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

The agency collects gold standard data and conducts research. Without that, there’s more uncertainty.

-

A quick roundup of our best journalism for the week.

-

The move combines two units in the North America middle market division.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

The executive joined the Bancolombia-owned insurer as CEO in early 2020.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

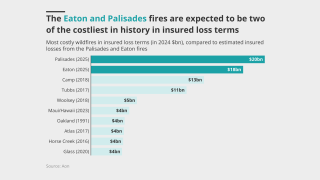

The London D&F market will shoulder most of the losses.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

Inflation, supply chains and tariffs also add to the challenges, he said.

-

The organization was hoping to grow its reinsurance cover.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

The state-backed carrier has $2.1bn of Alamo Re cat bond coverage.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

Sources noted that Dowling Hales is advising the MGA.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The news comes around three months after GTCR agreed to sell AssuredPartners to AJ Gallagher for nearly $13.5bn.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

January CPI/PPI heats up but won’t translate to higher loss costs.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

More than 33,000 claims had been filed as of 5 February.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The estimate covers property and vehicle claims.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

Insureds often just want cover in place at the lowest price possible, and insurers oblige under the skeptical eye of regulators.

-

The carrier has not added new business in the state since 2007.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeler said.

-

The executives will report to Jenise Klein, CUO for North America.

-

Loss-cost indicators are high for liability, low for property.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

Rate increases averaged 0.0% in December 2024, from 16.3% in December 2023.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Irwin joins the firm from Beazley, where she’d worked since 2019.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

This publication revealed in July 2023 that the utility company had chosen to try self-insurance for the first time.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Investigators are homing in on the likely causes of the incidents.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

More than 4,000 acres are burning as thousands evacuate.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

In property, Canada, Central and Eastern Europe and UAE renewals were impacted by losses.

-

The insurance industry countered that the committee ignored a “toxic mix” of risks driving up costs.

-

More competitive pricing is predicted for the commercial insurance market.

-

Both the US and UK had busy summers, but the talent momentum in the US did not continue into Q4.

-

Sources said Berkshire will move from the largest single capacity provider to a single-digit percentage line size.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The move was led by ex-Icat CEO Gregory Butler.

-

James Drinkwater is to serve as vice chair and executive chairman at Amwins Global Risks.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The carrier attributed the intensification of storms this season to climate change.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The executive joins RPS after almost 12 years at Markel.

-

The floods add to an already historic loss tally for Canada in 2024.

-

The executive will build out Hamilton Americas property team and a book targeting commercial E&S risks.

-

The carrier said activity across smaller and mid-sized natural catastrophe and risk events had been “elevated”.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

The firm will provide an update on November 22 to avoid holiday season.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Total insured losses are expected to range from $34bn to $54bn.

-

Westhoff will also spearhead the launch of QBE’s E&S property offering.

-

Underwriting remains disciplined as insurers target profitable growth.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

The three-year deal is expected to generate $200mn in GWP over the period.

-

Sources said that Milton may slow the pace of rate deceleration.

-

The company said $13bn-$22bn will come from wind damage.

-

Prior to the event, clients were expecting a “very competitive market environment”.

-

Most of the insured loss was attributable to wind.

-

He replaces Kevin Madden who will assume the role of chairman for North American real estate.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Milton stole the limelight from slightly stuck PE-backed brokers, acquisitive globals and the casualty conundrum.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Reinsurance capacity is largely stable but that doesn’t mean discussions will be a smooth ride.

-

The figure does not include NFIP losses.

-

Sources expect loss amplification in claims from Georgia, the Carolinas and Tennessee.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Andrew Rowland will oversee the portfolio, offering up to $7mn per risk.

-

Property rates had increased 25.5% one year ago, in Q2 2023.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The storm is expected to make landfall in the next several hours.

-

An estimated $450mn of losses from Hurricane Beryl will wipe out a surplus Twia had been building since 2017.

-

"Life-threatening" storm surge and hurricane-force winds are expected for the state, according to the NHC.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Some Canadian cedants have approached the market for top-up cover.

-

Rate increases on primary liability placements range from 10% to 20%.

-

Umbrella was the exception, ticking up slightly on the month.

-

The US carrier abandoned the project due to high price expectations.

-

Included is the full utilization of $25mn available under its cat aggregate treaty.

-

The report flagged “opportunistic underwriting” by many of the major markets.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

Premiums increased 5.6% across all major lines, down from last quarter.

-

The consortium backing the MGA is led by Axa XL Syndicate 2003.

-

It had planned to non-renew 47,000 DP-3 and 53,000 high-risk homeowners’ policies this year.

-

The rise is equal to 5%-10% of catastrophe capacity purchased, including cat bonds, depending on region.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

The Irish MGA will be able to underwrite commercial property risk up to EUR10mn.

-

Insurers' losses will likely be low and readily absorbed by their earnings.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

The flattish outcome comes after a larger year-on-year hike in January.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

This publication broke news of the loan in May.

-

The onus is on buyers to provide more granular and comprehensive data.

-

AmCoastal also cut its board down to five members, including two new appointments.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Commercial and residential carriers have different requirements.

-

His experience includes HPR engineering, facultative reinsurance and E&S underwriting.

-

The Florida portion of the program provides $1bn in protection.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

He will oversee management of the P&C loss adjusting business.

-

The Howden-owned MGA lost ~$250mn in cat capacity in September.

-

The broad themes remained the same as those dominating in April.

-

Additional capacity for upper layer coverage is driving rate reductions, the broker says.

-

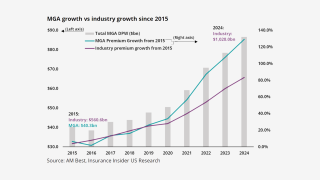

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The outlook calls for an 85% chance of an above-normal season.

-

He will report to Cynthia Beveridge, global chief broking officer for commercial risk.

-

Ten companies have filed a 0% increase and at least eight companies have filed a rate decrease to take effect in 2024.

-

Average premiums rose 5.8% across all major lines, roughly flat from 5.7% in Q4.

-

The CEO said he is “optimistic” about the future of the commercial space.

-

Farmers cited “positive changes” in the state's commercial insurance market.

-

The executive succeeds Rick Miller, who passed away last month at age 62.

-

Casualty is less of a concern, despite reserving issues.

-

Habitational, lessors’ risk and BOP accounts are among the most challenged.

-

As the industry gathers in San Diego, these are the key discussion points.

-

The company says its insurance policies “include significant property and inventory coverage”.

-

Approximately 1.2 million units are vacant throughout the state.

-

Overall economic losses hit $45bn in the first quarter of 2024.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

The US large property team will support middle-market and corporate clients.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

Freeman has spent 11 years in property leadership roles with BHSI.

-

Duncan Milne and Cabot Lyman are both leaving Aon for McGill.

-

The ratings agency cited erosion in the company’s surplus position, among other developments.

-

CoreLogic’s report for April 2024 saw rising costs across four common loss scenarios.

-

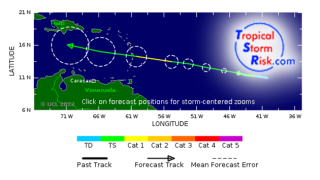

Tropical Storm Risk (TSR) has updated its forecast for North Atlantic hurricane activity, predicting a "hyper-active season" in 2024, with activity being around 70% above the 1991-2020 climate norm.

-

Compared to March, more sources shared accounts of rate declines and oversubscription.

-

Westchester’s Kyle Garrett was named VP, executive underwriter for property.

-

The oversubscription may signal additional capacity waiting on the sidelines.

-

Ten states joined in the original suit.

-

The announcement confirms earlier reports from this publication.

-

Rate increases are expected to continue, but at a slower pace.

-

Joe Morrello joined the firm in 2022 after serving as E&S property head at Beazley.

-

The value of the bridge is estimated at $1.2bn.

-

After the 2007-17 decade of “bad underwriting” carriers are recovering from “past sins”.

-

Loss ratios and surplus improve for the group, but don’t guarantee this is a turning point.

-

Sizeable investment returns masked 10-year high underwriting losses.

-

The Truist-owned cat MGA had reduced its line size to $50mn last year.

-

London underwriters are getting aggressive in the US.

-

The company provides reinsurance to insurers in LatAm and the Caribbean.

-

Commercial property was at 10.30%, down from 10.67% in December.

-

The index’s 2023 peak was Q2, when rates increased 19%.

-

Severe convective storms are the biggest overall driver of adverse results.

-

Competition, particularly from MGAs, is expected to accelerate in 2024.

-

The average 2023 premium renewal rate change for commercial property was significantly higher than 2022 across all months.

-

The practice will provide clients with tailored risk management and insurance packages to address challenges in the commercial insurance property market.

-

“We're certainly much more optimistic than we've been at any point probably over the last five years,” he told this publication in an exclusive interview.

-

A “return to minimal valuation increases can be expected soon”, the broker wrote in its 2024 P&C market outlook report.

-

While there’s no evidence that SCS activity is climbing beyond normal bands of variability from a frequency perspective, emerging data signifies that severity could be ticking up.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

January 1, 2024 was a “spotty” renewal, with the most over-subscribed deals being those bought by the major global cedants with good track records, whereas others did not attract as much attention.

-

Reinsurers are looking to grow in top-layer cat risk, resulting in “variable” outcomes on sign-downs.

-

Some reinsurers could be heading into 2024 with spare capacity, the reinsurance leader said.

-

The broker said over-placement on some deals was a positive sign for brokers, though reinsurance capacity is still very tight in some areas.

-

Travelers is set to expand its core cat treaty by between $1bn and $1.5bn, in a further sign of increased demand for cat reinsurance coverage at 1 January, this publication can reveal.

-

Carriers aren’t calling off their retreat from the market until tangible, actionable regulations emerge from commissioner Lara’s camp, sources told this publication.

-

The syndicate exited the class in 2021 at a time when the Lloyd’s market was in the thick of its performance drive and Decile 10 exercise.

-

For some time now, property has been doing the heavy lifting around growth and rate rises in E&S.

-

Next year will see North Atlantic hurricane activity about 30% above the 1991-2020 30-year norm, according to Tropical Storm Risk.

-

The commercial lines market is generally rational and disciplined, the CEO told analysts at the Goldman Sachs 2023 US Financial Services Conference.

-

Cat-exposed accounts will still face higher rates and more restrictive terms, however, as carriers continue to manage their aggregate, according to Amwins’s “State of the Market 2024” report.

-

Nancy Woode and Erinn Pearson most recently worked at McGill and Partners and will be based in Aon’s Atlanta office.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Issues over reinsurance pricing and capacity continued to plague commercial property.

-

The ratings agency said premium rate increases for specialty lines would be most pronounced in political risk, terrorism and political violence lines because of heightened geopolitical tensions.

-

RPS said higher excess layers in the E&S property sector are still seeing increases north of 50% while primary and lower buffer layers are seeing average increases of 10%-15%.

-

Everest is targeting a combined ratio of 89%-91% for 2024-2026, compared to the 91%-93% target range from its previous investor day event in 2021.

-

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

Around 85% of companies mistakenly believe that their property insurance covers some, all or most types of flooding.

-

Cedants and brokers are navigating the complexities of varying risk appetites signaled by reinsurers, who are willing to provide more capacity for cat treaty but only at certain layers as they maintain discipline.

-

The company also plans to ramp up its media spend in 2024 after having significantly slashed advertising budgets earlier this year.

-

Up-to-date building codes could reduce the amount insurers pay in the Caribbean by 18%, according to the risk modeller.

-

The broker’s “State of the Market: Real Estate” report says little change is expected in the property insurance marketplace for the rest of the year, but talk of more moderate rate increases in 2024 is “gaining momentum” specific to loss-free, properly valued and attractive accounts.

-

In 2022, Texas ranked third in incurred losses behind Florida and California, clocking in at $53bn, according to data from the Insurance Council of Texas.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Q2 marked the 23rd consecutive quarter of year-over-year property rate increases, with rates rising 21% on average and further increases expected for the rest of the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Administered by FEMA, the NFIP holds 4.7 million policies in force and provides $1.28tn in coverage across 56 US states and jurisdictions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Lara's plan, backed Thursday by an executive order from California Governor Gavin Newsom, repackages elements of a proposed bill that collapsed earlier this month.

-

Rating agency cites elevated underwriting results from convective storms, cat events in core states of operation.

-

Insureds that have taken higher retentions or less limit due to increased cost could be exposed this year if there is a major cat event, according to Swiss Re’s Kyle Burnett.

-

Competing forces of loss cost inflation and mixed rate action yield uneven trajectories for the largest commercial lines.

-

European and Bermudian reinsurers are expected to be the most favorably affected by the current environment.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Some 15 months on from the property reinsurance exit, he said the firm continued to reserve the right to reshape the portfolio.

-

The pressure on catastrophe terms and conditions seen at the January 2023 renewals will likely not be repeated as renewals get more orderly in 2024.

-

Some reinsurers are developing products and solutions for cedants’ newly retained risk under those higher attachment points, executives noted.

-

It is more dependent on property, and its longevity is uncertain.

-

Floridians will bear the brunt of Idalia's losses as a retention event, but reinsurers will reap the benefits of pricing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Karen Clark & Company said the majority of insured losses will incur from US wind and storm surge damage, apart from just under $5mn which was attributed to winds across the Caribbean.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

The estimate includes privately insured damage to residential, commercial and industrial property, as well as automobiles. Boats, offshore properties and NFIP losses were excluded.

-

For insurers, the Golden State is one of the last places they want to face disputes or lawsuits with consumers.

-

More than half of the top 20 global reinsurers maintained or reduced their natural catastrophe exposures during the January 2023 renewals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The nod follows that of Mainsail Insurance Company, owned by Hippo subsidiary Spinnaker, in August and HCI-owned Tailrow Insurance Company in April.

-

The agency put insured property values in the burn footprint at $2.5bn to $4bn, which marks an uptick compared to Moody’s estimate from last week, when the agency pegged insured losses at around $1bn.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The development in reconstruction costs and contingent BI claims may put the ultimate sum beyond current estimates.

-

The carrier was originally in the market for extra capacity at January 1 before pulling plans.

-

Nearly two years since the start of the program to lift NFIP rates, (re)insurers remain hesitant to fully commit to flood.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The carrier said a greater number than usual of North Atlantic storms are possible despite El Niño conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The risk of US wildfire in 2023 is expected to be lower than in recent years, except in the Pacific Northwest, namely Oregon, Washington and Montana, according to analytics firm ZestyAI.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The first quarter of 2023 has already gone down as the costliest on record for the peril in the US.

-

Capacity is still short of demand, even in the non-admitted market where carriers are not subject to regulatory approval for prices.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

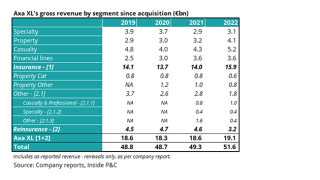

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The utility previously bought a $1bn policy from the (re)insurance market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

The broker’s latest report finds stability but continued price discipline in most lines and regions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The reciprocal’s purpose is to deliver additional US property catastrophe capacity to existing and new policyholders of Victor's subsidiary, International Catastrophe Insurance Managers LLC.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The hard reinsurance market and elevated cat losses continued to drive rate increases.

-

New homeowners' policies in wildfire-prone areas will have to flow to the non-admitted market or the state’s last resort, the California Fair Plan.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive first joined Vantage in 2021 after stints at Hamilton and Allied World.

-

The intermediary’s latest study shows double-digit rate increases in commercial property and auto lines.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Hot and dry weather in the summer and fall is also a conditional factor.

-

H1 2023 renewal rates for wind and fire-exposed properties in Florida, Louisiana and Texas increased more than 300% in some cases, exceeding the broker’s January forecast.

-

In the non-admitted property market, more policies are including language that discourages clients from hiring adjusters.

-

Some cedants paid more than 40% increases depending on Florida concentration and Hurricane Ian losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Even clean accounts in the admitted space are seeing rate increases of 15% year on year, while loss-hit accounts in Florida were slapped with a 100% rate increase for June 1.

-

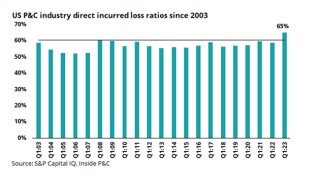

Recently released statutory data shows the US P&C industry loss ratio touching the 65% mark, the highest level in two decades.

-

The US National Oceanic and Atmospheric Administration (NOAA) has forecast “near normal" hurricane activity in the Atlantic this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

The average increase in commercial property premiums was 20.4% during the quarter due to inflation, natural catastrophes and persisting supply chain issues.

-

Reinsurers are starting to see increased demand from personal lines, where valuations are being updated to match inflation.

-

In connection with the transaction, Amwins and Flexpoint will each appoint a representative to the SageSure board of managers.

-

Strong results reflect tailwinds in the E&S space, but social inflation will be a trend to watch.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Client fatigue has transitioned to frustration as buyers face a hard commercial property market and inconsistency of coverage.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

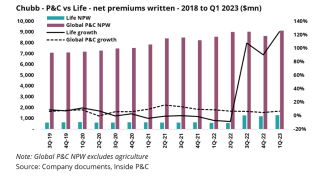

Chubb earnings reveal strategic expansion in Asia and pricing outpacing exposure.

-

Mark Cloutier set out Aspen’s plans for top-line 2023 growth in the range of 10%, and a continued strategy of pursuing rate rather than exposure growth in property cat.

-

On March 31, the National Weather Service counted 618 storm reports and 104 tornado reports, both records for the year to date.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The forecast included two intense hurricanes, six hurricanes and 12 tropical storms.

-

Reinsurers achieved an average ROE for 2022 of 5.2% – far below the cost of capital – in what Aon described as a “poor year for reinsurance sector earnings”.

-

Prior to 2019, the Fair Plan’s commercial limits had not been adjusted in over two decades.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The US continues to experience catastrophic flash flooding and heavy rainfall events that are impacting “inland” areas across the country, as well as coastal areas.

-

The facility will support quota share capacity with Anchor Re on behalf of SageSure carrier partners.

-

Carriers will address exposure to catastrophe losses, higher reinsurance costs, macroeconomic factors and inflation.

-

Across Mississippi, Alabama and Tennessee, around 34,000 customers remained without electricity as of Monday morning.

-

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

Business is surging into the E&S market, with rates up in the triple digits in some instances, as carriers combat claims volatility.

-

2022 statutory data is now available, and results show winners and losers

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Intermediaries have highlighted the ‘evolution’ in reinsurance buying as hard market conditions are expected to continue.

-

Carrier and broker sources canvassed by this publication indicate that whatever they imagined pre-January 1 reinsurance renewals, the community is experiencing an even harder market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Respondents attributed this increase to inflation’s effect on property valuations and the cost of goods, as well as to the natural catastrophe losses.

-

Topics discussed included Caribbean cat risk, protests in Peru, crisis in Argentina and the World Cup.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Global P&C insurers must reassert their relevance by reducing cat-related protection gaps rather than retreat from nat cat risk, McKinsey said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Chubb’s balanced view of the market as a whole, and pricing and loss cost trends in particular, puts it ahead of the curve on value creation, despite a difficult economic backdrop.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This was the highest single-year increase for the US index since 2006.

-

Sources said that the company initially claimed to have secured support from London underwriters Canopius, Tokio Marine Kiln and Liberty Syndicate.

-

Louisiana governor John Bel Edwards, state insurance commissioner Jim Donelon, and legislative leadership are in discussions about a potential special session.

-

The association has also set its 1-in-100 PML at $4.45bn for the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Private flood insurance accounted for about 40% of total flood insurance premium in California, higher than Florida’s 15%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The ending of an exclusivity arrangement also allows Berkshire Hathaway to offer reinsurance to Australian rivals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Through the reciprocal exchange, the homeowners InsurTech plans to enter new markets in the first half of 2023, including catastrophe-prone states.

-

The Californian insurer secured approximately $50mn of additional excess reinsurance limit for residential and commercial earthquake insurance markets.

-

The intermediary recorded “one of the hardest reinsurance markets in living memory” as primary rate increases slowed.

-

Cedants are grappling with rising rates while coverage narrows.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

TigerRisk Capital Markets & Advisory acted as exclusive structuring and placement agent for the reinsurance sidecar.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Severely distressed, cat-exposed E&S property accounts could even face 100% price increases, while retentions move significantly upwards.

-

On Tuesday, the bill passed in the State Senate 27-13, and today's passage in the House represented an 84-33 party line split.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The storm in Florida will drive primary loss costs up for property carriers even more, due to higher treaty attachment levels, the company’s report read.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

While Canopius has been in the US for 10 years, the insurer has been building “a multi-platform approach” in which underwriters can write business on several different types of paper.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The forecast included three intense hurricanes, six hurricanes and 13 tropical storms.

-

The California Earthquake Authority expects difficulty sourcing capacity well into 2023.

-

With weaker economic growth and competitive pressures hindering insurers' efforts to push through offsetting price increases, the ratings agency expects the sector's underwriting profitability to weaken.

-

The reinsurer said the appointment comes as it looks to grow in the property treaty arena.

-

Third-quarter statutory data reveals premium growth, worsening loss ratio because of increased loss cost trends and Hurricane Ian.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Secondary perils – which have traditionally been high-frequency, low-severity events – accounted for 70% of all insured losses in 2022.

-

Sources said Miami-based Everest fac VP Sean Berry is set to move to London as head of international property.