-

A district court judge had dismissed the case in September, with prejudice.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

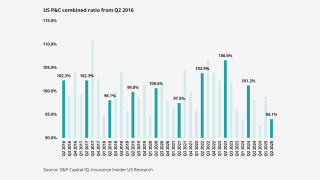

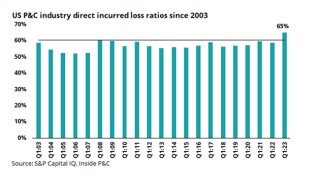

A favorable nine months for the industry does not solve its underlying problems.

-

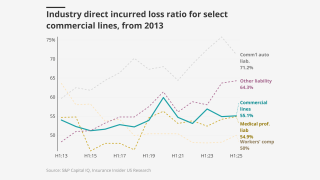

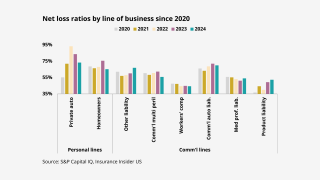

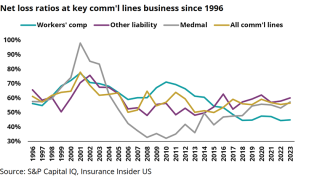

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

The company has now posted rate increases for 37 consecutive quarters.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

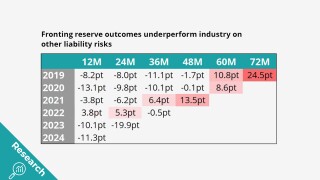

Fronting doesn’t look any better when it’s broken down by segment.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

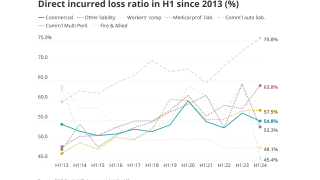

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

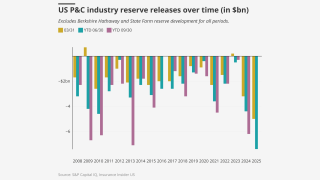

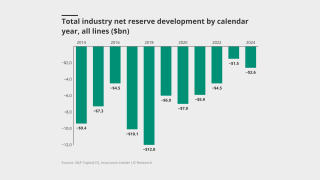

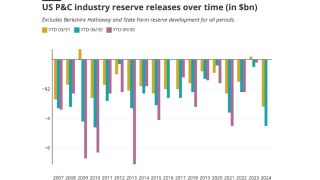

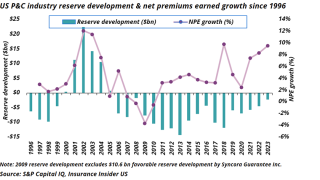

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

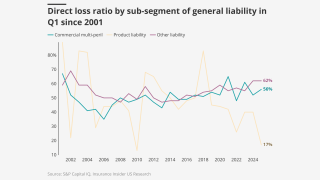

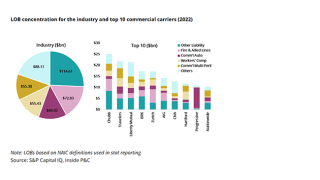

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The rules would require paid rest breaks, among other measures.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Sources said that the program manager is being advised by Dowling Hales.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

Macroeconomic volatility could also create top-line headwinds.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The executive will also oversee premium audit and customer service.

-

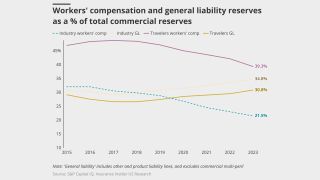

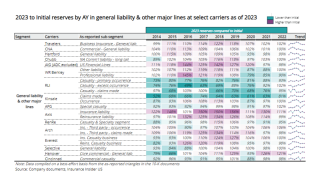

What past trends can tell us about the future of commercial reserving.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

The InsurTech was also removed from under review, negative.

-

Newly released annual stat filings on reserve data show some troubling trends.

-

The industry continues to take reserve addition medicine in smaller doses than recommended.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

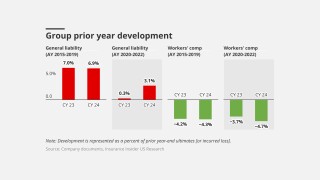

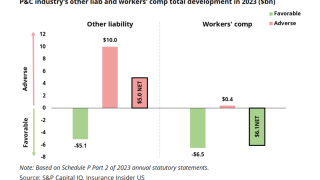

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Profitability over growth continues to be the company’s “mantra”.

-

The bill was introduced shortly after a similar bill failed in Mississippi.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

NCCI’s WCWMI posted 2.3% growth last year, below 2023’s 2.9%.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

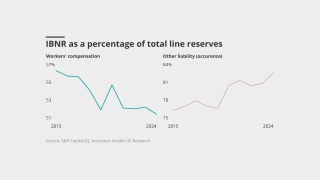

Trends leading into 2025 may indicate workers’ comp releases have peaked.

-

Executives have said that the carrier’s conservative reinsurance program made losses sustainable.

-

The law takes effect January 1.

-

A jury found the retailer defamed a former driver with false claims of workers’ compensation fraud.

-

Through Q2 2024, the index is up 10% since 2020.

-

Executives said the company continues to shrink its book of business in markets with poor underwriting conditions.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Despite pricing declines, state funds recorded their third year of DWP growth.

-

Increasing loss picks in difficult lines suggest top writers are accepting shifting loss trends.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

Umbrella was the exception, ticking up slightly on the month.

-

The highest releases in nearly 15 years challenge conventional wisdom on reserving.

-

States are grappling with first responder claims litigation as some move to expand presumptions to more worker types.

-

The complaints are the first effort to crack down on existing suspicions.

-

The report also noted that 35% of injuries occurred during an employee’s first year.

-

The executive said the company remains optimistic about small commercial, where NWP grew 8.5% in Q2.

-

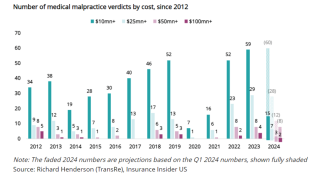

Reserve analysis shows that OL reserving may be insufficient for recent AYs.

-

Rising medical inflation, less favorable frequency trends and difficulty in getting rate are challenging the line.

-

The first RICO complaint targeted medical providers and training centers.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

Reserve releases in workers' comp may have been premature despite industry confidence.

-

Hansen joined the California-based workers’ compensation provider in 2006.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

The firm’s underwriting performance is hard to piece together from the limited available data.

-

Mental health problems account for 52% of all workplace injury cases.

-

The segment’s accident year 2023 combined ratio moved up 1 point to 98% in 2023.

-

The all-items CPI has increased 3.4% over the last 12 months.

-

The carrier’s comments on claims severity should serve as a warning for the industry

-

Yesterday, the carrier reported its Q1 CoR improved 2.3 points to 111.6%, reflecting a better CAY loss ratio.

-

The business consists of the workers’ compensation book and auto casualty bill review solutions.

-

Michael Smith is a former mortgage broker.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

Workers’ comp releases continue to mask deteriorating reserves in 2023.

-

Specialty reinsurance MGU Waypoint has formed a strategic partnership with workers compensation carrier CompSource Mutual.

-

Trends in IBNR might suggest over-optimism in carriers’ reserving outlook.

-

AM Best then withdrew its ratings at the company’s request.

-

Other liability adverse development is being offset by workers' compensation releases.

-

Commercial lines difficulties continue to weigh down industry results.

-

The agency cited the InsurTech’s material underwriting losses in 2023.

-

Some carriers may be pressing too hard on reserve releases from recent years.

-

Workers' comp saw an ongoing significant increase in losses.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

David Arick will design and implement Sedgwick’s risk management solutions.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Last year, this publication revealed that TPA SCM and Rimkus launched sales processes.

-

Severe convective storms are the biggest overall driver of adverse results.

-

The average 2023 premium renewal rate change for commercial property was significantly higher than 2022 across all months.

-

S. Akbar Khan is a 20-year insurance industry veteran, most recently serving as a senior officer at a leading national US insurer.

-

Christopher Laws is eligible to receive severance benefits under the severance plan for executive vice presidents.

-

The company distributes insurance through leading national commercial broker partners and currently focuses on manufacturing, agriculture and the construction industry.

-

The new platform includes over 400 workers’ compensation classes, including contractors, healthcare, hospitality, manufacturing and transportation.

-

Q2 marked the 23rd consecutive quarter of year-over-year property rate increases, with rates rising 21% on average and further increases expected for the rest of the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction includes the full operations, including underwriting, loss control and claims, along with transfer of the employees supporting the business.

-

Competing forces of loss cost inflation and mixed rate action yield uneven trajectories for the largest commercial lines.

-

According to NCCI, sector-wide accident year ratios for 2022 clocked in at 98%, while calendar year ratios came in at 83%.

-

The improvement in 2022 was attributed to a favorable loss development of $6.5bn on older accident years and anticipated “probable” reserve releases in 2023.

-

The transactions were written into Darag Bermuda and offer full legal finality for the US workers’ compensation book of the latter and the US workers’ comp and automotive liability books of the former.

-

Recently released statutory data shows the US P&C industry loss ratio touching the 65% mark, the highest level in two decades.