-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

The take-up rate will depend on the price discount and market segment.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

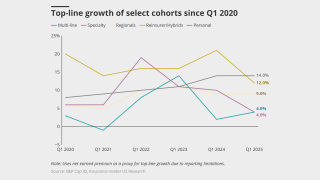

Median organic growth decelerated to 7.9% in Q1 from 9% in Q4 and 8.4% a year ago.

-

The industry is seen as “resilient” amid a volatile risk environment.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Broadstreet announced the most deals, followed by Hub and Gallagher.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

Growth and returns on equity fall, but most of the industry is still profitable.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.