-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

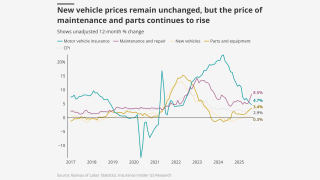

Inflation was down from the 3% recorded for the 12 months ending in September.

-

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

Sources said the Floridian insurer has been working with Deutsche Bank on the listing preparations.

-

The legal setback came as publication of a Fema reform report was postponed.

-

Trump’s shadow loomed over the beachside sessions.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The Republican said his office has launched an investigation into the denials.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

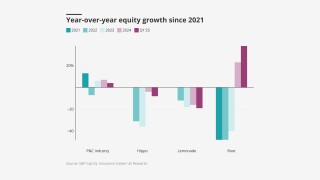

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The carrier said it anticipates a better market due to recent reforms.

-

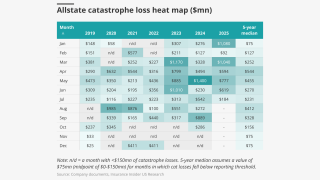

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

-

The peril has been historically difficult to model compared to others.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

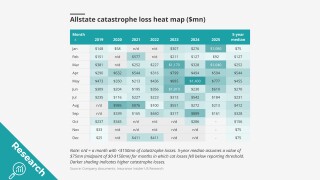

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

Senators asked for data on fraud but weren’t given any.

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

He will be replaced at a time when Fema is considering structural reforms.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

The deal to reopen the government also extended the NFIP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company is also prepared for potential M&A activity.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

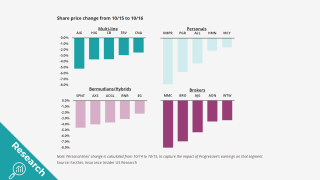

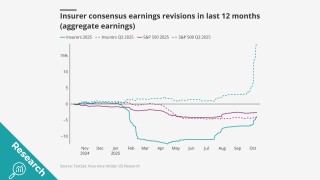

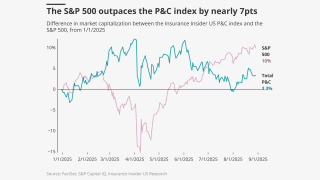

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

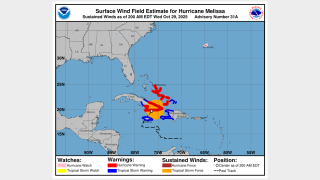

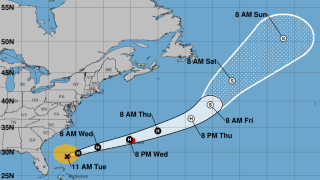

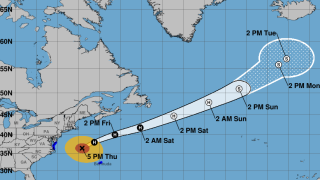

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Opportunities for growth remain in small and medium commercial accounts.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

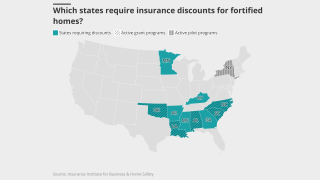

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

September’s medical care index increase follows a 0.2% drop in August.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

A quiet wind season is also expected to further soften the property market.

-

Early Q3 earnings reports point to worsening market conditions.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Dale Krupowicz was also named head of operations for the segment.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

Superintendent Harris is stepping down this month after four years of service.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Sources said momentum around resiliency laws is growing at the state and local level.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The fundraising round brought in $50mn for the insurer.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The program is aimed at affluent homes valued between $1mn and $6mn.