-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

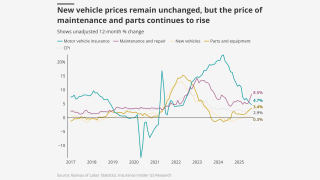

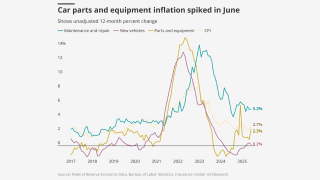

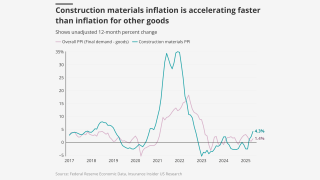

Inflation was down from the 3% recorded for the 12 months ending in September.

-

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

Sources said the Floridian insurer has been working with Deutsche Bank on the listing preparations.

-

The legal setback came as publication of a Fema reform report was postponed.

-

Trump’s shadow loomed over the beachside sessions.

-

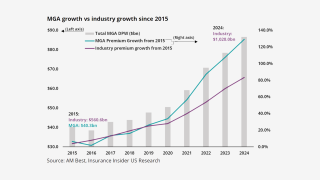

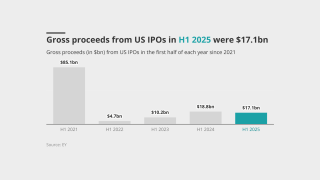

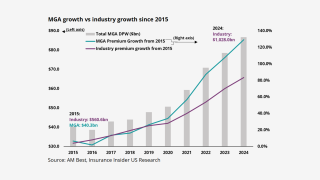

MGAs going public is now a viable option, but dominating a market comes first.

-

The Republican said his office has launched an investigation into the denials.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The carrier said it anticipates a better market due to recent reforms.

-

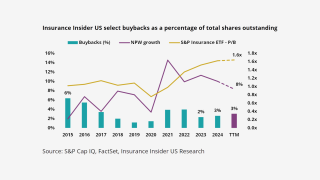

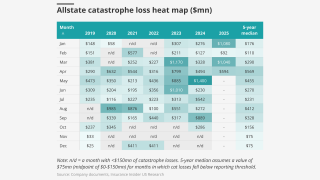

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

-

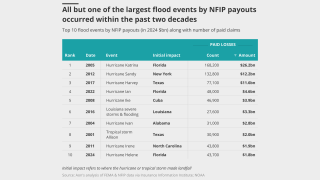

The peril has been historically difficult to model compared to others.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

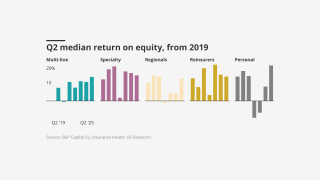

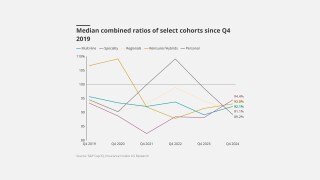

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

Senators asked for data on fraud but weren’t given any.

-

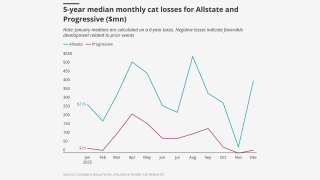

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

He will be replaced at a time when Fema is considering structural reforms.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

The deal to reopen the government also extended the NFIP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company is also prepared for potential M&A activity.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

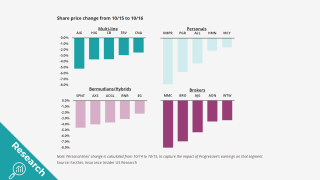

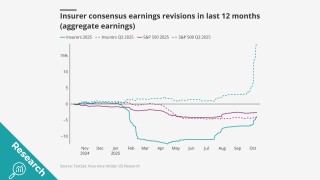

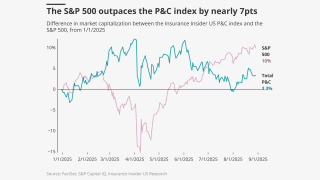

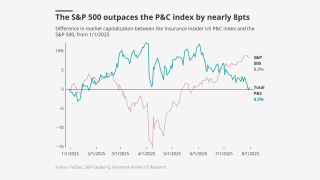

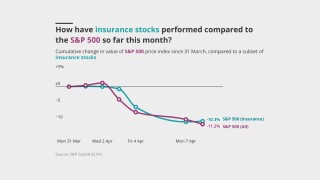

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

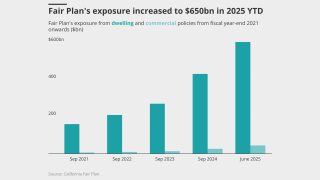

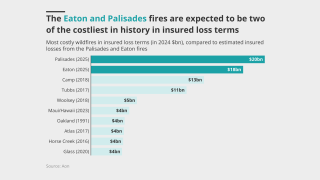

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

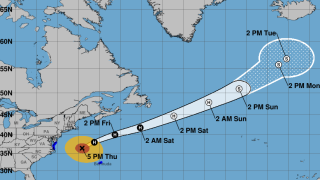

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

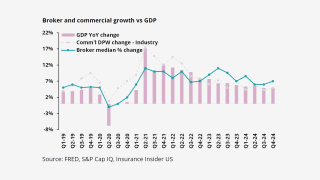

Opportunities for growth remain in small and medium commercial accounts.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

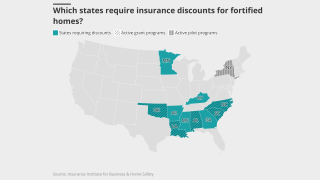

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

September’s medical care index increase follows a 0.2% drop in August.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

A quiet wind season is also expected to further soften the property market.

-

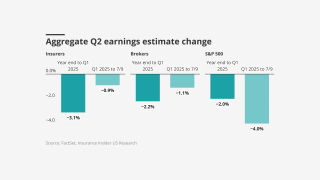

Early Q3 earnings reports point to worsening market conditions.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Dale Krupowicz was also named head of operations for the segment.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The governor has yet to sign a pending bill to create a public cat model.

-

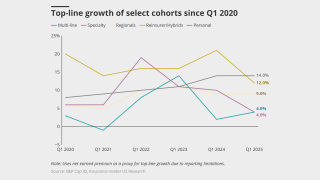

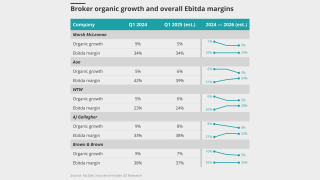

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

Superintendent Harris is stepping down this month after four years of service.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Sources said momentum around resiliency laws is growing at the state and local level.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The fundraising round brought in $50mn for the insurer.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

This is the first rate filing to use the recently approved Verisk model.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Profitability improves, even as growth stagnates.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

July’s medical care increase was up from June’s o.6%.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Its partnership channel grew three times in new writings year-over-year.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The company also purchased $15mn of SCS parametric coverage.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

CEO Roche said that “significant price increases” are still to come, however.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

Smaller accounts remain less affected by an influx of MGAs.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

At least 14 new companies have opened up shop in the state in recent years.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

The executive said the claims industry is going to “be transformed”.

-

Softer market conditions are likely to create a wave of consolidation favoring large brokers.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

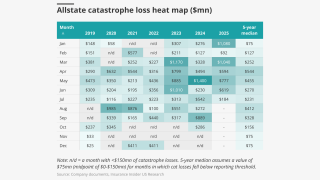

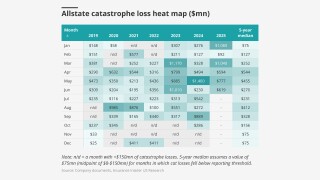

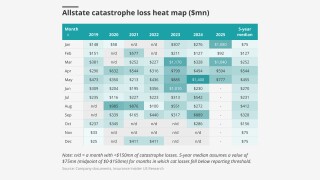

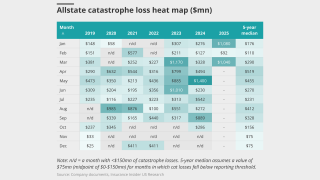

The research team presents the June cat heatmap.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The PE-backed MGA lined up Morgan Stanley, JP Morgan and Bank of America to advise.

-

Rising inflation could raise claims severity but also increase investment income.

-

The industry veteran has been in personal lines HNW for more than four decades.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

Rate gains are easing across many commercial and personal lines.

-

The executive had been Stone Point’s representative on Higginbotham’s board.

-

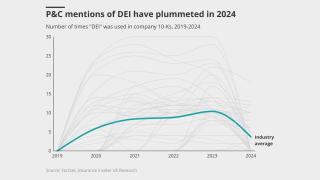

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

The US accounted for 92% of all global insured losses for the period.

-

June’s increase was up from May’s 0.2%.

-

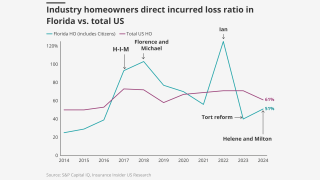

State legislation has led to major strides in rate adequacy.

-

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

Category 4 and 5 storms could become more common and hit further north.

-

While official return to office mandates have gathered steam, what they look like in practice can vary widely.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The floods have killed at least 81 people, with dozens more missing.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

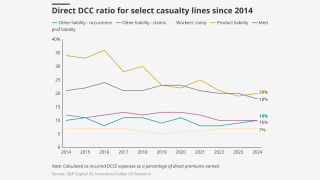

Litigation costs continue to weigh on long-tail lines, but effects of tort reform are visible.

-

The transition will be implemented starting October 15.

-

The company said the reduction was due to years of steady improvements.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The insurer intends to take on up to 81,040 policies this year.

-

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

Much was learned after the fires, but it could take years before that data influences models.

-

The research team presents the May cat heatmap.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

The regulatory body is also looking at AI rulemaking and catastrophe resiliency.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

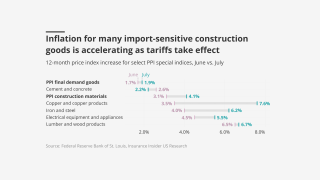

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

The insurer first noticed “unusual network activity” on June 7.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

Fallon will retire in January 2026 after 30 years at the company.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The pair joined MMA after the $7.75bn purchase of McGriff in November.

-

An active hurricane season threatens to weigh on hard-fought capital and underwriting margins.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Van Bakel said that AI can help triage thousands of disaster claims.

-

Lara approved an interim rate increase for the company just weeks ago.

-

GCP retains a controlling interest in the Californian retail brokerage.

-

Hippo will also provide capacity for existing and future MSI programs.

-

The medical care index numbers were below April’s 0.5% rise.

-

The regulator said further measures could still be passed in this session.

-

The executive has been with the firm for close to 15 years.

-

The Floridian is the third insurance company to go public in 2025.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

DUAEs are increasingly leveraging specialized expertise to address underserved risk.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Acrisure recently raised $2.1bn from investors in its latest step towards an IPO.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

The once niche product is generating interest in a growing number of industries and sectors.

-

One measure could give regulators greater leeway to deny rate requests.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

This publication reported earlier today that the S-1 filing was imminent.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

This publication reported earlier this year that the carrier is targeting a $250mn-$350mn raise.

-

A historic cat loss year remains a possibility as storm losses accumulate.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Wildfires resulted in heavy losses for insurers focused on HNW, personal lines and reinsurance.

-

The sale process was first reported by this publication three months ago.

-

"Smoke damage is real damage," Commissioner Lara said.

-

The assumption date for the combined 16,250 policies is August 19.

-

Tornadoes have killed at least 32 people in three states.

-

He will lead AIG’s business across Latin America and the Caribbean.

-

Two wind and hail events were responsible for 60% of the total.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

The medical CPI is up 3.1% for the last 12 months.

-

The Tampa-based insurer says it will use the capital for general corporate purposes.

-

Broadstreet announced the most deals, followed by Hub and Gallagher.

-

Growth and returns on equity fall, but most of the industry is still profitable.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The total cost for the program increased 1.8% from last year’s.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

The initial offering includes 6,875,000 shares of common stock.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The offering launched last week with a valuation between $103mn and $116.8mn.

-

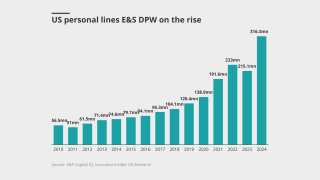

California homeowners are also expected to move admitted business to E&S.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

The platform will focus on acquiring MGAS across lines of coverage.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

Insurers haven’t announced concrete steps – yet.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Planning for the carrier was halted in January due to the CEO’s health issues.

-

The impact could also raise home-building costs by $10,000 per unit.

-

The company is also pursuing “deconcentration” to lower SCS exposure.

-

But automotive repair costs are likely to increase faster than home repair.

-

The LA fires and spring storms drove CinFin's CoR up 19.7 points to 113.3%.

-

The LA wildfires, however, will be the firm’s largest event to date.

-

The executive was most recently at Oliver Wyman after joining from AIG last year.

-

The initial offering will include 6,875,000 shares of common stock.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

MGA growth is still strong but has passed its 2022 peak.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The Hartford’s Q1 CoR increased 4.1 points to 96.9% driven by cat losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

Severe weather in March drove monthly and Q1 losses to historic highs.

-

The executive will define strategic priorities and guide global growth.

-

The carrier forecasts stable profits, but tariffs are creating “high uncertainty”.

-

Imported goods account for 30%-50%+ of materials used for HNW homes, versus 15%-25% in standard houses.

-

The sale price represents Elephant’s approximate net asset value.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The BRIC program helped fund local resiliency programs, which can reduce loss costs.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Howard and Moore were among a group to receive letters over links to prior insurance insolvencies.

-

In operation since 1991, Pearl represents Ocean Harbor and Equity insurance companies.

-

The suit seeks to block insurers from passing through assessment costs.

-

The insurer achieved an 86.4% acceptance rate of the policies selected.

-

The release followed the filing of an updated Plan of Operation.

-

The Floridian company applied to be traded on the NYSE.

-

Economic unease will join cat losses, renewals, and organic growth as Q1’s key topics.

-

The suit alleges a “deliberate scheme” to deny smoke damage claims.

-

The broker adds a new EVP and new president to its benefits practice.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

The counties make up for the majority of the state’s high net worth market, sources said.

-

The medical CPI is up 3% for the last 12 months.

-

The announcement spurred a quick spike in stock market valuations.

-

The coverage will only be available in Illinois and Michigan at first.

-

The book of business comprises both personal and commercial lines.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

The package comprises a $100mn cat bond and a $70mn sidecar.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

The 12 insurers together have $418mn in policyholder surplus.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

The executive will continue to lead personal lines and core commercial.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

In February, the company announced it received regulatory approval for the deal.

-

The bill being considered would effectively eliminate personal injury protection.

-

The carrier has received 12,300 claims as of 28 March.

-

Both bills are now on Governor Kemp’s desk awaiting signatures.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The decision is the first of its kind under the new Trump administration.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The bill also creates a governing board comprising insurance and consumer reps.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

The commissioner is eyeing transparency in billing, comparative fault and non-economic damages changes.

-

Surplus lines are still strong, but not the standout they used to be.

-

Mangrove can take out up to 81,040 polices while Slide’s limit is 15,000.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

A quick roundup of our best journalism for the week.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

The MGA recently secured capacity to write HNW homes in California.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

Shift to growth includes all geographies in which the company does business.

-

Admitted insurer withdrawals and rising demand are pushing more entrants into E&S.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Four cat modelers have also submitted their tech for regulatory review.

-

Wows will offer coverage tailored to high-value properties, written on non-admitted paper.

-

The commissioner said in a legal bulletin that smoke claims can’t be “summarily denied”.

-

Insurers and distributors must adapt or risk irrelevance.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

As of February 14, the company received 405 claims.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is only going to write new business on E&S paper, sources said.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

Customers will keep their agent relationship and policies will not be impacted.

-

Underwriting profits for casualty-exposed insurers show signs of struggle as loss costs worsen.

-

Under the new guidelines, the carrier is requiring more distance from the brush.

-

The carrier has also received 11,750 fire-related claims so far this year.

-

This is the second acquisition Amwins has announced this year.

-

The company is seeking an emergency rate increase after the devastating Los Angeles wildfires.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Former PRS president Ana Robic was promoted to regional president.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

State Farm General has asked California regulators for an emergency rate increase.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The policies represent approximately $35mn of in-force premium.

-

Slide lined up Morgan Stanley, Barclays and JP Morgan as lead bookrunners.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The carrier said 72% of those losses occurred in personal property.

-

The investment firm’s holdings were down to $59mn at the end of Q4.