-

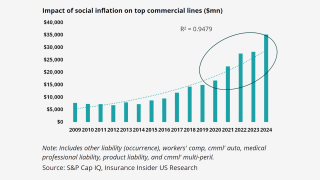

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Several of Henrietta Butcher’s former Tysers colleagues have also moved to Lockton Re.

-

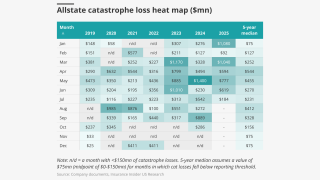

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

Fleming Re bought the James River Re legacy book in 2024.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

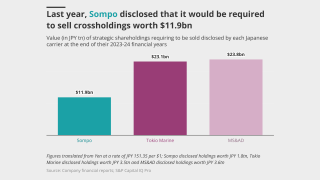

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The London-based MGA will begin underwriting its international book next month.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

Habayeb will start next May following Kociancic's retirement.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

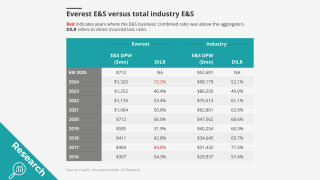

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Existing facilities and carrier partners will be transferring from K2.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The charity said that improved ecosystems could help protect from disasters.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

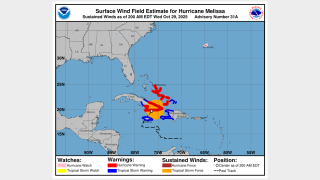

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

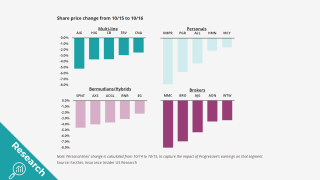

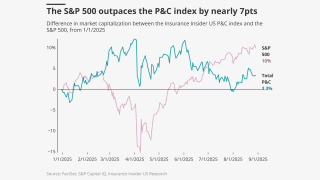

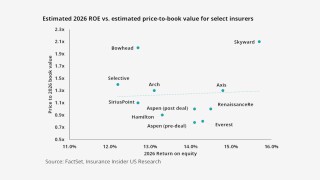

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

This publication revealed the move earlier this year.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

The reinsurer also hired Martin Bages as Latin America and Caribbean head.

-

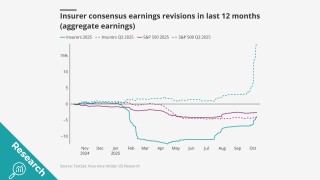

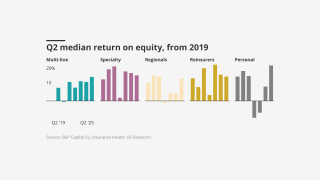

Early Q3 earnings reports point to worsening market conditions.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The move marks Acrisure Re’s first investment in Latin America.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

The executive has worked for Aon for almost two decades.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

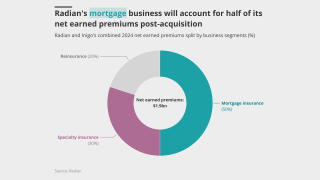

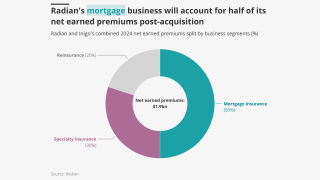

The low degree of overlap between the combining portfolios benefits both parties.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The business said it was experiencing strong momentum on the Island.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The carrier’s US and Europe claims teams will report to Dominic Clayden.

-

The platform aims to “bend the loss curve”.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

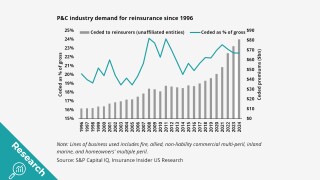

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The executive most recently served as head of North American treaty reinsurance.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The deal was announced last month.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

Profitability improves, even as growth stagnates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier reported an increase of 82% in pre-tax income.

-

The forecast has increased since the early July update due to several additional factors.