-

In casualty, the executive is seeing an acceleration of flight to quality both from cedants and reinsurers.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

Ackman will need leaders like Ajit Jain behind him and make the right bets at the right price at the right time.

-

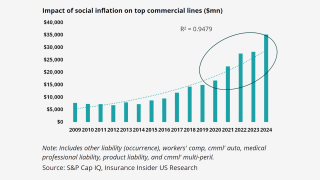

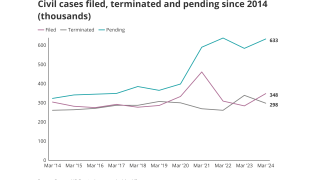

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Several of Henrietta Butcher’s former Tysers colleagues have also moved to Lockton Re.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

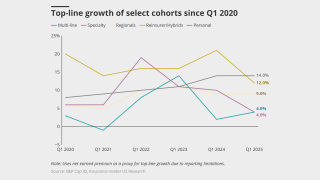

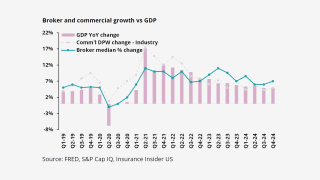

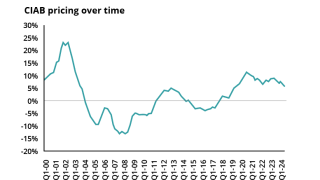

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

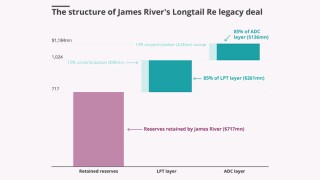

Fleming Re bought the James River Re legacy book in 2024.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The London-based MGA will begin underwriting its international book next month.

-

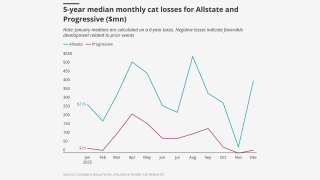

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

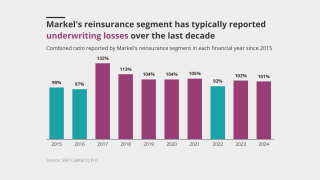

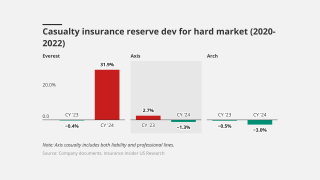

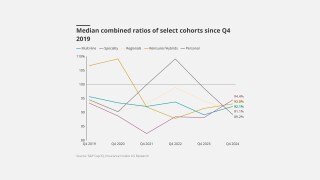

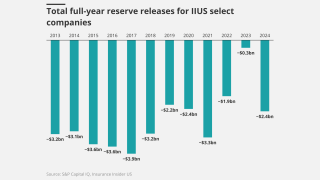

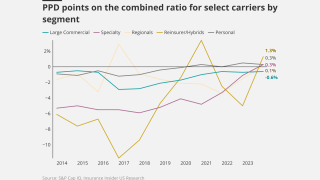

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

Habayeb will start next May following Kociancic's retirement.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Existing facilities and carrier partners will be transferring from K2.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The charity said that improved ecosystems could help protect from disasters.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

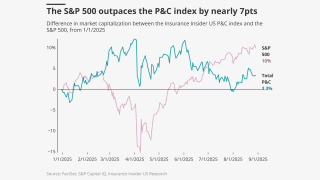

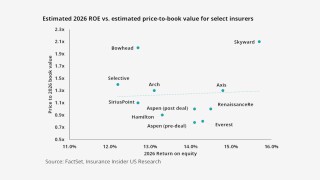

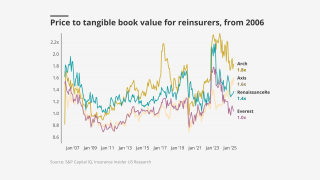

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

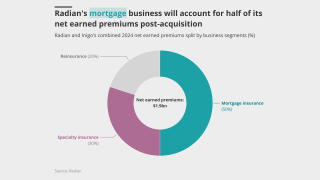

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

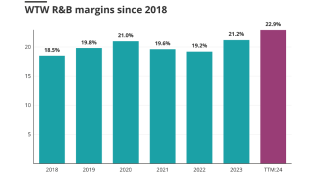

The broker grew earnings per share by 12.1% during the quarter.

-

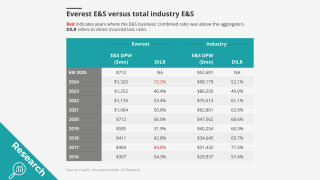

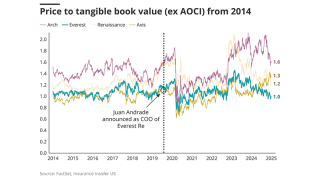

A re-focus on reinsurance nearly brings Everest back where it started.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

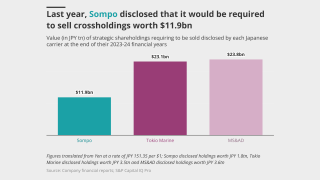

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

This publication revealed the move earlier this year.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

The reinsurer also hired Martin Bages as Latin America and Caribbean head.

-

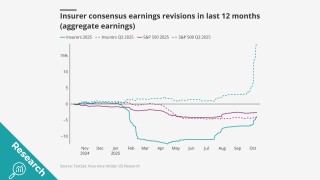

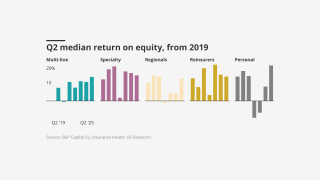

Early Q3 earnings reports point to worsening market conditions.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The move marks Acrisure Re’s first investment in Latin America.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

The executive has worked for Aon for almost two decades.

-

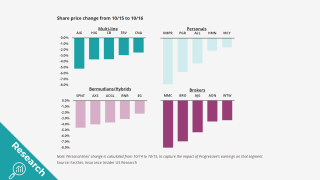

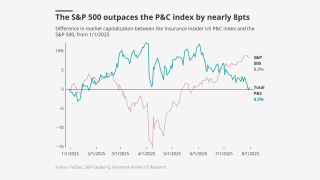

Industry stocks were firmly behind the S&P 500 in Q3.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The business said it was experiencing strong momentum on the Island.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The carrier’s US and Europe claims teams will report to Dominic Clayden.

-

The platform aims to “bend the loss curve”.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The executive most recently served as head of North American treaty reinsurance.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The deal was announced last month.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

Profitability improves, even as growth stagnates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier reported an increase of 82% in pre-tax income.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

The CEO said business remains adequately priced in most classes.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The carrier said market dynamics were shifting due to increased capacity.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The executive left Lockton Re in June after almost six years.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Jill Beggs was most recently COO for reinsurance.

-

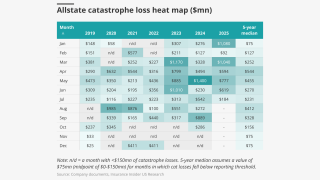

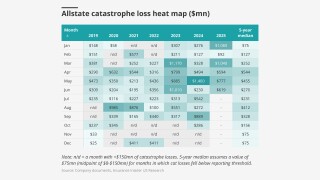

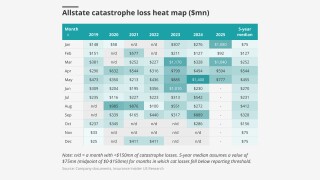

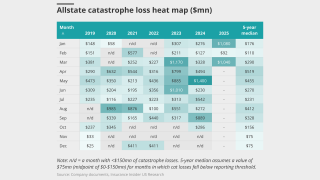

The research team presents the June cat heatmap.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

-

The appointments will be effective as of August 1.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The reinsurer said US president Donald Trump’s policy was already impacting investment.

-

The weather-modelling agency is predicting a below-normal season.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

The executive succeeds Tim Barber, who left the firm as of July 1.

-

The take-private deal was announced in July 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

Separately, Caribbean market head Janine Seifert is leaving the reinsurer for BMS Re.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The company said the reduction was due to years of steady improvements.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

The program’s total limit this year is down $594mn to $1.36bn.

-

The broker noted a “significant variation” in renewal outcomes.

-

The measure could have landed insurers with extra tax on US business.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

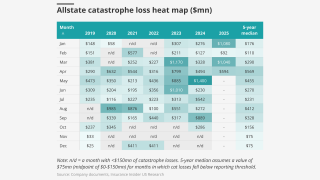

The research team presents the May cat heatmap.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

The appointments are pending regulatory approval.

-

In March, this publication revealed that Pinnacle was considering a sale.

-

The company has also promoted Alex Baker and Tim Duffin.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

The number has expanded by around 40% from an earlier update, sources said.

-

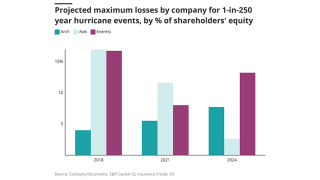

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive was previously president of insurance programs.

-

The $2.59bn renewal is up 45% from last year.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

The executive will also continue as MD overseeing Caribbean fac.

-

A historic cat loss year remains a possibility as storm losses accumulate.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Spicer will transition to a global specialty executive chairman role.

-

She will continue to work with the executive team on key projects and initiatives.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The executive will take the global role alongside his existing US responsibilities.

-

The bond will provide named storm and quake coverage in the US.

-

The executive has been with the firm since 2011.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

The CEO said Ascot would deploy capital where it sees opportunities.

-

New CEO Eckert said Conduit had taken “decisive action” after the LA wildfires.

-

Neil Eckert has been chair since the carrier was founded.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

Growth and returns on equity fall, but most of the industry is still profitable.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The firm expects to replace the volume with Innovations-channel business.

-

Hamilton also expects rising demand and stable supply for June 1 renewals.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

Jack Kuhn, President of Westfield Specialty, discusses the shifting market cycles and changing landscape at RISKWORLD 2025.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

The executive was previously a top US casualty broker.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The remediation process is on track for completion in the fourth quarter.

-

The reinsurer also promoted Ethan Allen to chief program officer.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The company also hired Beazley’s Tracy Holm as general counsel.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

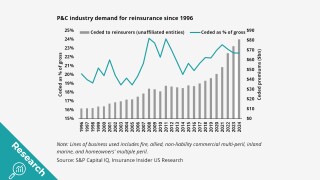

Growing economic and population exposures are driving potentially larger insured losses.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

The only major product line to see rate increases was casualty.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Severe weather in March drove monthly and Q1 losses to historic highs.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

The CUO’s turnover closely follows that of the CEO.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Insured losses were the second highest on record for the first quarter.

-

Fully placed, this would equate to $275mn on the per-occurrence tower and $675mn on agg.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

Alex Amezquita will fill Cahill’s previous position as CFO.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

The package comprises a $100mn cat bond and a $70mn sidecar.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

The prediction comes after a highly active hurricane season in 2024.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

The carrier has received 12,300 claims as of 28 March.

-

Jeanmarie Giordano joined the company last September.

-

The shares will be purchased via the open market or private third-party transactions.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

Sources said that Insurance Advisory Partners is advising the fac MGA on the strategic process.

-

The rating allows IQUW to access $1bn in group capital.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

Industry sources estimate the market to be around $3bn.

-

Price Forbes operations in Miami, Chile and Peru will report to Mulic.

-

The segment’s underwriting results halved to $532mn in 2024 from $1.07bn in the prior year.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Based in London, the executive joined BMS nine years ago after a stint as MD at AJ Gallagher.

-

The company is seeking to expand in the reinsurance and retrocession markets.

-

The carrier was seeking to expand its March 1-renewing program.

-

He also joined Everest’s board last week as an independent director.

-

Aviation reserve strengthening added 10.1 points to the combined ratio.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

Dickerson has spent over three years at the reinsurance broker.

-

These events can also no longer be considered secondary perils, executives said.

-

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

Competition for specialty reinsurance talent remains high.

-

The ratings agency noted “significant” underwriting improvement in 2023-24.

-

The London D&F market will shoulder most of the losses.

-

Underwriting profits for casualty-exposed insurers show signs of struggle as loss costs worsen.

-

The organization was hoping to grow its reinsurance cover.

-

Katie McGrath is appointed CorSo CUO amid a restructure of the unit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The state-backed carrier has $2.1bn of Alamo Re cat bond coverage.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

The carrier will look to expand business outside North America.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker has over 30 years’ experience and will be based in Dallas.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Rate falls across the property class and uncertainty around the US administration dominated conversations.

-

Casualty reserve concerns continue to mount as releases remain elevated.

-

The second half of the year was significantly more active for the legacy market.

-

The role at PCS included acting as primary touchpoint for ILS.

-

The spillover impact from the LA wildfires will play a major role in how much reinsurance capacity will be available.

-

The start-up has achieved an A- credit rating from AM Best.

-

But cat bonds are experiencing negative secondary market price movement.

-

The restructuring arrangement is designed to protect creditors.

-

The agency said it does not expect a “material impact” from the charge.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

The carrier’s year-end kitchen sink action is a make-or-break moment for a troubled franchise.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The figure does not include specie or auto losses.

-

The nationwide carrier ranked sixth for multi-peril California homeowners' insurance in 2023.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeler said.

-

Disclosures show the insurer has roughly 4,300 homeowners’ policies in effect in fire-impacted zip codes.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

Year-end reserving, Milton and wildfires will dominate Q4 earnings discussions.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Investigators are homing in on the likely causes of the incidents.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The Corporation’s CEO will run Aon Reinsurance Solutions.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

Many cedants secured aggregate and subsequent coverage at 1 January.

-

In the US, pricing fell by 6.2% at the major renewal.

-

Abundant capacity was driven by reinsurers’ retained earnings after two profitable years.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

Attachment points are unlikely to return to pre-correction levels any time soon.

-

An 11th-hour softening has driven discounts into double-digit territory on some deals.

-

The firm has commenced writing collateralized retro and reinsurance, but its rated launch is still pending.

-

The broker said demand grew more slowly than reinsurer appetite.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

The carrier has used Lloyd’s London Bridge 2 structure for the launch.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

AIG launched an IPO of Corebridge Financial in September 2022.

-

A quick roundup of our best journalism for the week.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Major reserve releases help drive strong Q3 and year-to-date results, but the industry looks over-optimistic.

-

Castel founder Mark Birrell will take the role of executive chairman.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

The loss figure has increased 200% from the initial number provided in October.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The industry posted a good quarter, but reserving and loss cost concerns hardly abated.

-

The agency’s outlook for global reinsurance remains at Positive.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

Ceding commissions remain elevated but primary rates are improving reinsurer margins.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Arch stands out among hybrids, but Axis and Everest grind it out.

-

The carrier’s Q3 net income will be around $100mn, far below consensus.

-

The carrier increased specialty premium by 39% by the nine-month mark.

-

The carrier said activity across smaller and mid-sized natural catastrophe and risk events had been “elevated”.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

The firm will provide an update on November 22 to avoid holiday season.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

Republican tariffs and higher Democratic corporate taxes would hurt the sector.

-

It is understood the executive will join the carrier later this year.

-

RiverStone is assuming $1.2bn of a $1.6bn legacy deal.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

Coverages include missed bid reimbursement, contingent bodily and property damage, and drone use violations.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

It is understood that Bezerra will remain based in Miami for his new position.

-

This could change if Milton losses turn “ugly”.

-

The broker’s acquisition amid shifting tides is likely the beginning of a larger M&A uptick in the space.

-

Axa XL Re has hired former Swiss Re executive Greg Schiffer as its North America CEO, effective from 11 November.

-

The company said $13bn-$22bn will come from wind damage.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

An estimated $6bn to $9bn will be ceded to the FHCF, and $6bn to $10bn to traditional reinsurance markets.

-

Florida insurers averted a crisis, but reinsurers will still see damages.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

Daniel Boisvert will join the company’s Connecticut office.

-

US liability was a hot topic at the European conference.

-

Legal trends, the primary pricing micro-cycle and other factors all play into an opaque outlook.

-

Future deal flow in the US could come from more adequately reserved liability lines.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The take-private is expected to close by mid-2025.

-

Civil case, nuclear verdict and claims count data show worrying trends.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

-

Acquirers are increasingly discerning around deals, according to a report.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

The liquidation will let the company sell its Accredited arm to Onex via an alternative transfer structure.

-

The Canadian PE house is delaying close and seeking to renegotiate aspects of the deal.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

The vehicle will give the legacy carrier a US platform.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

Increasingly, deals are being brought to market but not transacted on.

-

The market is shifting towards capital relief, with fewer, larger deals.

-

The company reiterated its commitment to consummating the Accredited sale.

-

Its PE owners have been exploring strategic options since May last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

The transaction would have been one of the largest the market has seen for years.

-

The executive joined the legacy carrier as CIO in 2020.

-

As part of the transaction, Carrick will assume the company’s staff and operations.

-

Just over half of votes cast were in favour of the $465mn sale to Onex.

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

The regulator has also paused the redemption of the company’s $20mn Tier 2 floating-rate subordinated notes.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The consideration is expected to be around $140mn plus a $25mn dividend.

-

-

The R&Q share price has plummeted since the sale of the ~$1.8bn-premium fronting arm was announced 10 days ago.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

R&Q said it expects ongoing operating losses after the sale as it works on transitioning its legacy business to a fee-based model, with plans to explore further transactions to de-risk and reduce volatility.

-

R&Q CEO William Spiegel will transfer to the Accredited program management business.

-

The executive brings more than 25 years of global reinsurance broking experience to the new company.

-

Although the total deal values for 2022 and 2023 were almost identical, PwC noted that one-third fewer deals were announced in the more recent half-year period.

-

Catalina put its Irish subsidiary up for sale in May as it looks to streamline operations.

-

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

Under an advisory agreement, Enact will provide underwriting expertise, market intelligence and portfolio analysis.

-

The transactions were written into Darag Bermuda and offer full legal finality for the US workers’ compensation book of the latter and the US workers’ comp and automotive liability books of the former.

-

The legacy carrier reported significant unrealised investment losses.

-

Accredited and R&Q Legacy will now operate under two separate holding companies within the group.

-

The carrier had estimated a write-off in the range of $25mn-$35mn.

-

The legacy carrier’s wholly owned subsidiary will reinsure 80% of RACQ’s motor vehicle compulsory third-party insurance liabilities of accident years 2021 and prior.

-

Gallagher Re is looking to increase its presence in the North American large-account space, where it is underweight compared with rivals.

-

The loss portfolio transfer deal was completed in March of this year, covering £200mn of UK motor insurance claims.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The deal includes a diversified book of international and NA financial lines, European and NA reinsurance portfolios, and several US discontinued programs.

-

The company believes the program management and legacy businesses would work better as standalone operations.

-

The appointment comes as the legacy and investment banking divisions join under common management.

-

Last week, SiriusPoint and Compre signed an LPT deal covering $1.3bn of reserves.

-

In tandem, the company elevated David Ni as chief strategy officer, Paul Brockman as chief operating officer and Matthew Kirk as chief financial officer.

-

Following the completion of this transaction, Enhanzed Re became a wholly owned subsidiary of the legacy carrier.

-

2022 represented a period of bumper legacy deal-making for the legacy carrier.

-

After taking a $90mn capital charge relating to the former Ace run-off asbestos book in 2021, the group is looking to liquidate the entity.

-

The Chicago-based InsurTech placed its debut cat bond in April 2022 in a private deal.