-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Several of Henrietta Butcher’s former Tysers colleagues have also moved to Lockton Re.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

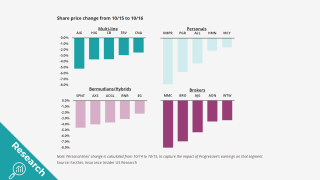

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

Fleming Re bought the James River Re legacy book in 2024.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The London-based MGA will begin underwriting its international book next month.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

Habayeb will start next May following Kociancic's retirement.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Existing facilities and carrier partners will be transferring from K2.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The charity said that improved ecosystems could help protect from disasters.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

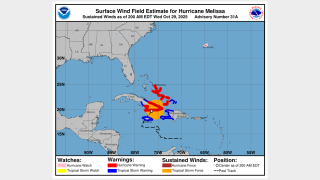

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

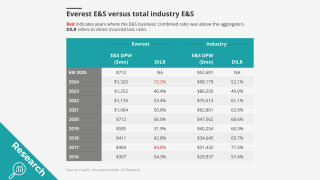

A re-focus on reinsurance nearly brings Everest back where it started.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

This publication revealed the move earlier this year.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

The reinsurer also hired Martin Bages as Latin America and Caribbean head.

-

Early Q3 earnings reports point to worsening market conditions.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.