-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Trump’s shadow loomed over the beachside sessions.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The CEO said that new funding will be used to expand its underwriting capabilities.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

The MGA said payments to affected customers began shortly after the event.

-

The executive was previously the cyber practice lead for Ryan Financial.

-

The city said it was self-insured at the time of the attack.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The tech error, now resolved, halted traffic to sites like X and ChatGPT.

-

The executive joined the company from Zurich last year.

-

The executive most recently served as the company’s chief broking officer.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

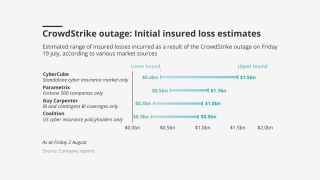

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

Growth concerns were top of mind at this year’s conference.

-

Insurers continue to compete on price, especially in the SME sector.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Global pricing is now 22% below the mid-2022 peak.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

Average incident costs for SMEs were up nearly 30%.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

It is understood that CyberCube has been considering a sale of the business.

-

Growth in the SME sector could help stabilize the market, however.

-

The company was hit with a data breach on July 16.

-

The executive joins from Coalition and brings more than 30 years of experience.

-

The program is set to begin binding this month.

-

The executive joins from At-Bay and brings more than 25 years of experience.

-

The group has hit multiple industries since March, including a raft of insurance companies.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The executive formerly held roles at At-Bay, AIG and Hiscox.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The executive has been with the company for roughly one year.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The executive said the claims industry is going to “be transformed”.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

But June was the busiest month of the year on the back of recent broker churn.

-

The cyber business will continue to operate as a standalone entity.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

The outages began around 07:00 ET on Tuesday.

-

The insurer’s system has now been out of commission for over two weeks.

-

The decrease in premiums aligns with price cuts across the market.

-

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

The insurer first noticed “unusual network activity” on June 7.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly head of cyber solutions, North America.

-

The carrier has scaled up its international insurance offering in recent years.

-

The company first experienced system disruptions on June 7.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The executive has experience across both insurance and banking.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The broker said the burgeoning class of business was still finding its stride.

-

The deal is expected to close in the second quarter.

-

The only major product line to see rate increases was casualty.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

The company is expanding availability of its large enterprise offerings.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

K2 Cyber is entering an increasingly crowded cyber market.

-

While significant, the fires are expected to be an earnings rather than a capital event for the industry, John Huff, CEO of the Association of Bermuda Insurers & Reinsurers, said.

-

Tactics underwriters employ to manage cyber risk are maturing, as well.

-

The investment supports Coalition’s goals for its active insurance offerings.

-

Other digital distribution platforms, including ProWriters and SportsInsurance, are also exploring a sale.

-

A quick roundup of our best journalism for the week.

-

Insureds, however, are often reinvesting savings into purchasing increased limit.

-

The MGA’s US clients will now have access to London market capacity.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

This year's modelled outputs have increased across all return periods.

-

CEO Tom Kang said Converge will now be able to deploy a total of $10mn in limit in certain segments.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

Jason Hart, head of proactive cyber, was also promoted to managing director.

-

The carrier also grew TL written premiums by 11% in Q4 and 24% for the full year.

-

The December 28 breach involved millions of sensitive individual records.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

Regilio will lead a sales team to “expand market share and forge strategic partnerships”.

-

The cyber MGA also named Sarah Thompson global head of sales strategy and Jack Jenner to managing director.

-

Challenges in claims frequency and carrier competition are likely to remain.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

The biggest riser in this year’s Allianz Risk Barometer was climate change.

-

Groeber joined CFC as EVP in 2020 before becoming US CEO in 2023.

-

The move comes after Burke’s five years as EVP of cyber and technology.

-

Old Republic Cyber will focus on providing specialized cyber and technology-related coverage.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

After recording triple digit growth in 2020-2022, the US cyber market grew just 1.6% in 2023.

-

Maria Long joins the cyber insurer from Munich Re as the company's deputy CUO.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

The firm laid off senior leaders this month, weeks after it began pursuing a sale, this publication can reveal.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Businesses exceeding $50mn in revenue are 2.5 times more likely to face cyber incidents, the report found.

-

The construction industry remains a top target for attackers and was the most impacted sector in Q3.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

D&O and D&F are also facing increased competition, but property remains price adequate.

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

The Hartford will assume a quota share of Coalition’s UK cyber program.

-

Sinclair had $50mn in coverage through five separate cyber policies.

-

The airline says the crash resulted in over $500mn in losses.

-

Coverages include missed bid reimbursement, contingent bodily and property damage, and drone use violations.

-

Underwriting remains disciplined as insurers target profitable growth.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Business email compromise was up 9%, comprising nearly one-third of claims.

-

It also reported that severity increased by 17% in the same period.

-

At the conference, industry pros identified issues in modeling systemic risks due to a lack of historical data.

-

Elixir has an initial focus on cyber but will look to expand into other lines, including E&O and D&O.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

In Q2, median property price increases decelerated to 2.3%.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

SMEs represented 98% of cyber claims from 2019-2023 totaling $1.9bn.

-

The MGA noted a 17%-20% price decline last year and expects similar for 2024.

-

Amwins anticipates market softening will continue, absent loss ratio concerns.

-

Improved profitability has led some insurers to increase their own retentions.

-

Expansion of the middle-market book is an ongoing focus.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

The report predicts a 1-in-250-year cyber event could see over $100bn in losses.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Small and medium businesses now comprise 45% of cyber market exposure.

-

Predicted market pricing corrections have yet to be seen broadly.

-

The figure represents a quarterly increase of 102%.

-

Sanchez will report to Carolina Carmona, LSM’s head of financial lines in south Florida.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

Manufacturing now accounts for 41.7% of all claims, from 15.2% previously.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

He will continue to act in his role as COO, global insurance operations.