-

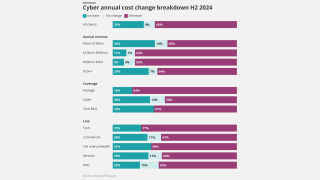

Lower rates, more favorable policies and improved public cyber infrastructure are all contributing to the trend.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Trump’s shadow loomed over the beachside sessions.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The CEO said that new funding will be used to expand its underwriting capabilities.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

The MGA said payments to affected customers began shortly after the event.

-

The executive was previously the cyber practice lead for Ryan Financial.

-

The city said it was self-insured at the time of the attack.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

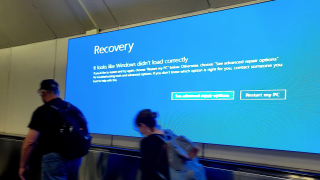

The tech error, now resolved, halted traffic to sites like X and ChatGPT.

-

The executive joined the company from Zurich last year.

-

The executive most recently served as the company’s chief broking officer.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

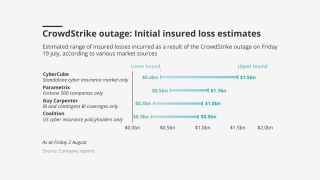

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

Growth concerns were top of mind at this year’s conference.

-

Insurers continue to compete on price, especially in the SME sector.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Global pricing is now 22% below the mid-2022 peak.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

Average incident costs for SMEs were up nearly 30%.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

It is understood that CyberCube has been considering a sale of the business.

-

Growth in the SME sector could help stabilize the market, however.

-

The company was hit with a data breach on July 16.

-

The executive joins from Coalition and brings more than 30 years of experience.

-

The program is set to begin binding this month.

-

The executive joins from At-Bay and brings more than 25 years of experience.

-

The group has hit multiple industries since March, including a raft of insurance companies.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The executive formerly held roles at At-Bay, AIG and Hiscox.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The executive has been with the company for roughly one year.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The executive said the claims industry is going to “be transformed”.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

But June was the busiest month of the year on the back of recent broker churn.

-

The cyber business will continue to operate as a standalone entity.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

The outages began around 07:00 ET on Tuesday.

-

The insurer’s system has now been out of commission for over two weeks.

-

The decrease in premiums aligns with price cuts across the market.

-

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

The insurer first noticed “unusual network activity” on June 7.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly head of cyber solutions, North America.

-

The carrier has scaled up its international insurance offering in recent years.

-

The company first experienced system disruptions on June 7.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The executive has experience across both insurance and banking.

-

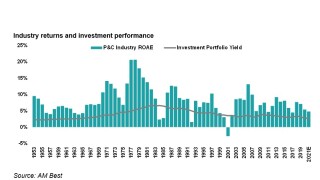

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The broker said the burgeoning class of business was still finding its stride.

-

The deal is expected to close in the second quarter.

-

The only major product line to see rate increases was casualty.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

The company is expanding availability of its large enterprise offerings.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

K2 Cyber is entering an increasingly crowded cyber market.

-

While significant, the fires are expected to be an earnings rather than a capital event for the industry, John Huff, CEO of the Association of Bermuda Insurers & Reinsurers, said.

-

Tactics underwriters employ to manage cyber risk are maturing, as well.

-

The investment supports Coalition’s goals for its active insurance offerings.

-

Other digital distribution platforms, including ProWriters and SportsInsurance, are also exploring a sale.

-

A quick roundup of our best journalism for the week.

-

Insureds, however, are often reinvesting savings into purchasing increased limit.

-

The MGA’s US clients will now have access to London market capacity.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

This year's modelled outputs have increased across all return periods.

-

CEO Tom Kang said Converge will now be able to deploy a total of $10mn in limit in certain segments.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

Jason Hart, head of proactive cyber, was also promoted to managing director.

-

The carrier also grew TL written premiums by 11% in Q4 and 24% for the full year.

-

The December 28 breach involved millions of sensitive individual records.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

Regilio will lead a sales team to “expand market share and forge strategic partnerships”.

-

The cyber MGA also named Sarah Thompson global head of sales strategy and Jack Jenner to managing director.

-

Challenges in claims frequency and carrier competition are likely to remain.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

The biggest riser in this year’s Allianz Risk Barometer was climate change.

-

Groeber joined CFC as EVP in 2020 before becoming US CEO in 2023.

-

The move comes after Burke’s five years as EVP of cyber and technology.

-

Old Republic Cyber will focus on providing specialized cyber and technology-related coverage.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

After recording triple digit growth in 2020-2022, the US cyber market grew just 1.6% in 2023.

-

Maria Long joins the cyber insurer from Munich Re as the company's deputy CUO.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

The firm laid off senior leaders this month, weeks after it began pursuing a sale, this publication can reveal.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Businesses exceeding $50mn in revenue are 2.5 times more likely to face cyber incidents, the report found.

-

The construction industry remains a top target for attackers and was the most impacted sector in Q3.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

D&O and D&F are also facing increased competition, but property remains price adequate.

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

The Hartford will assume a quota share of Coalition’s UK cyber program.

-

Sinclair had $50mn in coverage through five separate cyber policies.

-

The airline says the crash resulted in over $500mn in losses.

-

Coverages include missed bid reimbursement, contingent bodily and property damage, and drone use violations.

-

Underwriting remains disciplined as insurers target profitable growth.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Business email compromise was up 9%, comprising nearly one-third of claims.

-

It also reported that severity increased by 17% in the same period.

-

At the conference, industry pros identified issues in modeling systemic risks due to a lack of historical data.

-

Elixir has an initial focus on cyber but will look to expand into other lines, including E&O and D&O.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

In Q2, median property price increases decelerated to 2.3%.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

SMEs represented 98% of cyber claims from 2019-2023 totaling $1.9bn.

-

The MGA noted a 17%-20% price decline last year and expects similar for 2024.

-

Amwins anticipates market softening will continue, absent loss ratio concerns.

-

Improved profitability has led some insurers to increase their own retentions.

-

Expansion of the middle-market book is an ongoing focus.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

The report predicts a 1-in-250-year cyber event could see over $100bn in losses.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Small and medium businesses now comprise 45% of cyber market exposure.

-

Predicted market pricing corrections have yet to be seen broadly.

-

The figure represents a quarterly increase of 102%.

-

Sanchez will report to Carolina Carmona, LSM’s head of financial lines in south Florida.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

Manufacturing now accounts for 41.7% of all claims, from 15.2% previously.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

He will continue to act in his role as COO, global insurance operations.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The investment will be used to scale operations and extend Cowbell's presence in key international markets.

-

Axa's newly formed teams join the company's "complex cyber" unit.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The market is expected to seek additional exclusions around systemic events.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

Insured losses in the single-digit billions would not translate into a material impact for (re)insurers.

-

The airlines, healthcare and financial services industries were some of the sectors affected by the outage.

-

The broker warned that D&O and P&C policies could also be impacted by the outage.

-

CrowdStrike has an estimated 15%-25% market share among large companies.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

The incident highlights the aggregation risk around cloud service reliance.

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

The promotions will help TransRe strengthens its cyber focus.

-

It is understood that the shutdown will impact about 25 employees.

-

Worsening claims activity, privacy concerns and emerging threat actors have yet to reflect in pricing.

-

Gangu will likely take a gardening leave after vacating his post to consider future steps.

-

Gittler joined Axa XL in 2012 and had led the cyber underwriting team since 2021.

-

The capacity increase follows the debut of new cyber risk management capabilities.

-

Improved cyber hygiene and strong insurer competition has driven rate reductions.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

It said improvements in cyber hygiene, underwriting and policy language were contributing factors.

-

From a buyer and underwriter perspective, managing top risks needs fresh approaches.

-

Kinsale CEO Mike Kehoe said social inflation is unabating, but losses fuel the industry.

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

He joins the Munich Re company after almost four years at Cowbell.

-

Vantage will underwrite up to $10mn in capacity through its US subsidiaries.

-

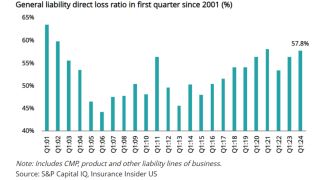

Loss picks for other liability are at a 23-year high, but that still may not be enough.

-

The firm’s underwriting performance is hard to piece together from the limited available data.

-

The cyber underwriter also raised the annual revenue to $5bn for companies it will offer coverage to.

-

Regulatory compliance risks were listed as the third-greatest concern.

-

The Incyde Risk facility will provide up to $25mn in capacity on a primary and first-excess basis.

-

Beazley has tapped Melissa Carmichael as head of US cyber, effective immediately.

-

Some see flat renewals this year, while others report deployment of larger lines.

-

Global attacks hit a record high in 2023 and show no sign of slowing in 2024.

-

Executives are seeing 5%-15% rate declines on intense competition but in excess layers pricing is down as much as 40%.

-

Despite a smaller number of claims, ransomware payments hit all-time highs last year.

-

The hire comes after the company’s recent rebrand from Capitola Insurance.

-

Global commercial insurance rates rose 1% in Q1, down from a 2% increase in Q4 2023.

-

The broker used a consensus-based hypothetical cat event type to analyse its global impact.

-

The executive has been with Zurich since 2018.

-

The cyber market faces significant claim notifications from Change Healthcare clients.

-

Cyber Quoting will connect global cyber insurers and US distributors.

-

The average rate increase in the cyber market stands at 1.6%.

-

TMHCC said the appointments underline its "commitment to innovation, market expansion and customer service".

-

CyberCube expects ransomware attack to impact both large and SME accounts.

-

Participating members can purchase up to $10mn in (re)insurance.

-

The project is not immediately moving forward due to lack of client demand.

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

Many carriers’ views on cyber are mixed, the agency said.

-

The MGA will be offering $10mn limits for $300mn-$10bn companies.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

He was most recently cyber product leader at Zurich NA.

-

It’s unsurprising, following the Corvus-Travelers transaction.

-

In September 2023, Cowbell made the same number of staff cuts.

-

The Coalition Cyber Threat Index predicts a jump in exploit-based cybercrime this year.

-

The MGA will target small and mid-market firms and will also offer tech E&O products.

-

Shannan Fort was a partner in McGill’s FI and cyber team.

-

Laxner has prior experience at Ambridge, Converge, Axis, Markel and Chubb.

-

-

She has over 15 years’ experience managing PL and cyber portfolios.

-

Corvus reported a 34% rise in the number of active ransomware gangs.

-

Expanded underwriting capacity comes after a year of strong growth.

-

Partnerships can address growing cyber threats such as DDoS attacks and ransomware, as well as AI.

-

It is understood that the cyber InsurTech has ~$100mn of excess delegated authority capacity and around 20 backers.

-

The mid-market build-out comes in response to trading partners' needs for more on-the-ground-support for more complex risks and the constraints of a digital-only product.

-

The uptake on war exclusions, which was followed by other reinsurers, could signal the end of "endless" discussions on the topic.

-

Political violence rose up the agenda, with conflict raging globally, and key elections due this year.

-

The brokerage reported that polled carriers, however, have pointed to ransomware activity reverting to 2019 levels to argue current pricing is unsustainable.

-

Prior to his new role, which Matt Prevost began this month, the exec spent nearly 10 years as Chubb’s SVP, cyber and product line manager.

-

Carriers will be taking more risk net this year – which may arrest the speed of decline in cyber pricing.

-

The 11th hour settlement came just days before the case was scheduled to be heard by the New Jersey Supreme Court.

-

Salvatore Sama has been named global product head for casualty, while Jane Farren has been named global head of financial professional lines.

-

Chris Bruno was most recently a vice president in Lockton’s Midwest cyber broking practice.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Aidan Flynn said that although different markets are expected to move at different speeds, the underlying trend is clear.

-

The two insurers have achieved AWS cyber insurance competency and will become part of a new Amazon effort to provide quotes for cyber coverage within two days.

-

Resilience CEO and co-founder Vishaal Hariprasad said cyber rates are expected to even out, and possibly creep back up, in the near term.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Clearer wordings for cyber cat risk would also help foster the development of the more capital-efficient event XoL reinsurance market in cyber, Kessler said.

-

The challenging funding environment has left InsurTechs with limited options for capital raising and liquidity.

-

The Bermudian also revealed a $29mn restructuring charge for Q3.

-

The new financing builds on the $148mn raised to date and follows recent belt-tightening measures that included layoffs.

-

At a point when cyber rates are falling and capacity is plentiful in high excess layers, the mutual plans have the wider cyber market somewhat perplexed.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

There is a “confluence of factors” making the current raising environment more challenging for companies, the CEO said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive said that NA financial lines rates and pricing in aggregate were down 4.8% and 3.8%, respectively, in Q3 as Chubb is trending financial lines loss costs at 4.7%.

-

The report said that, to date, ransomware victim numbers for 2023 have already surpassed those for the entirety of either 2021 or 2022.

-

Current cyber brokerage leader for the US and Canada, Meredith Schnur, will succeed Reagan as cyber practice leader, US and Canada.

-

Parent Cowbell Cyber launched the E&S carrier a little over a year ago as part of Cowbell’s transition from an MGA to a full-stack insurance carrier.

-

The International Underwriting Association has urged cyber insurers, brokers and clients to focus on risk management to help better respond to claims.

-

Two studies have found that, while almost a third of back-up attempts fail to restore system data after a ransomware attack, cybercriminals are refining their methods.

-

Pera is launching as a division of Desq — USQRisk’s managing general agent accelerator/incubator — and is the first program Desq has brought to market.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

The company’s Las Vegas casinos were hit by a cyberattack last month where employee login details were stolen.

-

The survey found that a majority of Canadian businesses consider cyber threats their top concern and also believe they will eventually fall victim to a cyberattack.

-

Q2 marked the 23rd consecutive quarter of year-over-year property rate increases, with rates rising 21% on average and further increases expected for the rest of the year.

-

Despite “strong” policy growth and a successful culling of discretionary expenses, "more substantial” action was needed to reduce costs at the cyber InsurTech, its CEO said.

-

Head of underwriting Matthew Waller welcomed an FCA letter that called for policy wordings that are clear and that customers understand the coverage they are buying.

-

Bianconi joined Aspen in 2016 and has held a number of roles including, most recently, as head of US cyber.

-

Inside P&C’s news team brings you all the top news from the week.

-

Coalition also announced the formation of a dedicated $300mn reinsurer, Ferian Re, in partnership with BDT Capital Partners.

-

The carrier has also added 40 new classes of business to its miscellaneous professional liability product and raised the eligible revenue limit for businesses to $50mn.

-

She will oversee the strategic direction and execution of all At-Bay’s underwriting, partnerships and field operations

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Cyber is another market Axis is watching closely, given new MGA entrants as well as the recent rise of ransomware activity, with the carrier expecting more “undulation” as a result.

-

At-Bay acquired the InsurTech marketplace in August 2020 for an undisclosed sum, noting that the platform would continue to operate as an independent entity.

-

The 2023 Travelers Risk Index has put concern over cyber threats among the top three worries for small, medium-sized and large businesses for the ninth straight year.

-

The average loss for the six-month period was $365,000, which represents a 117% increase year on year and a 61% increase from H2 2022.

-

The capacity deal is slated for deals with 10/1 effective dates and beyond.

-

A recent Microsoft/Rackspace Technology survey on cybersecurity has insurers expressing less concern over security risks posed by artificial intelligence than other respondents.

-

Based in New York, the executive will report to Axa XL CUO Libby Benet.

-

The founding members include Munich Re, Gallagher Re, and BitSight.

-

Rate fluctuations are expected in the market, due to the emergence of new risk-differentiation models and cyber security standards.

-

In late May, this publication revealed the appointment along with Mauro Signorelli’s, who served as head of international cyber at Aspen Insurance.

-

Some carriers have already hit GWP targets for this year and are refraining from writing any new cat risks unless it fits a very favorable profile, the firm said.

-

In contrast, cyber pricing continued slowing down as Q2 rates increased 3.6%, compared with 8.4% in Q1 and 15% in Q4 as the space was hit by increased competition.

-

With the acquisition, Zurich will expand its cyber risk mitigation services provided by Zurich Resilience Solutions unit.

-

The policies are issued by At-Bay Specialty Insurance Company, the Delaware-based E&S insurer the InsurTech acquired from XL America in January.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Sources expect to have a clearer picture of the impact of higher ransomware and lower rates by Q4 or early next year as pricing decreases 5%-15%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

As part of the financing round, which closed last week, Tom Kang was elevated to Converge’s CEO from his prior role as the MGA’s chief insurance officer.

-

The US and Europe have shown concerns over Lloyd’s of London war exclusion wording, the report shows.

-

The program will be broken down into two separate distribution structures, each with a distinct revenue focus and cyber security data access formation.

-

CyberCube found 2,890 vulnerable MoveIt managed file transfer (MFT) deployments mapped to companies in 75 countries at the end of June.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Adam Kembrooke said some markets would struggle to maintain the results they’ve posted historically, after the point of pricing equilibrium in the cyber class.

-

A recent report from Howden shows ransomware activity is up 48% year-on-year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Stephens hired Green from brokerage McGriff, Seibels & Williams, where he focused on cyber, energy and marine.

-

Cyber GWP could exceed $50bn by 2030, the broker predicts.

-

The broker used three major cyber models to analyse the drivers of model variability, with revenue coming top as the most prominent driver of loss variability.

-

Based in New York, the executive will report to Lockton cyber and tech practice leader Michelle Faylo.

-

The executive joins from Crum and Forster, with 20 years’ cyber experience.

-

The cyber MGA can now serve clients in Italy, Spain, Ireland, Sweden and Denmark.

-

The broker named Matthew McCabe as MD of cyber broking with a brief to tackle complex cyber issues.

-

Boeck will be IMA’s primary contact for cyber insurers concerning the development and distribution of cyber and related policies.

-

He was previously North America Cyber Growth leader and before that Midwest Regional Leader - FINEX Cyber/E&O.

-

New language has been introduced by some insurers to limit exposures to cyber risks.

-

Uncertainty around war exclusions and systemic risks and the potential impact of the spike in ransomware on the profitability of the class were discussed at the event.

-

Analysis showed a modelled loss range of between $15.6bn and $33.4bn for a 1:200-year global loss event.

-

Capital markets are "likely to become a key ingredient of a healthier and sustainable (re)insurance market".

-

The company is raising a sidecar through JP Morgan for additional capacity from outside investors.

-

Based in Stamford, Connecticut, the executive will oversee the carrier’s cyber fac and treaty operations reporting to NA CEO Brian Quinn.

-

The executive will oversee the development of cyber and tech products reporting to Hiscox US SVP head of specialty risks Doug Karpp.

-

Blount is taking over from Rob Rosenzweig, cyber practice leader, who recently assumed a leadership role at Risk Strategies

-

Strong rhetoric from Munich Re means the US market will sooner or later have to take a position on cyber war wordings.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In addition, the mutual promoted Jelmer Andela to head of cyber underwriting within its London-based subsidiary Liberty Specialty Markets (LSM).

-

A memo from the reinsurer raises concerns for cyber insurers over whether they could face a coverage gap after renewals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The average increase in commercial property premiums was 20.4% during the quarter due to inflation, natural catastrophes and persisting supply chain issues.

-

Last week, the company disclosed an ultimate loss ratio of 36% for 2022, as the market softened after a period of dramatic hardening in 2020/21.

-

The cyber MGA reported that claims severity increased by 7% to an average loss of nearly $169,000, fueled by business email compromise and other types of attacks.

-

He will be charged with driving CFC’s cyber underwriting strategy and broker development in the US with a specific focus on the company’s admitted cyber product.

-

The Boston-based cyber MGA also reported premium growth of 80% last year compared with 2021.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

Spectra has in-principle approval for a Bermuda broker license but believes cyber ILS solutions will be a game of “slow progress”.

-

The underwriter will be based in southern California and lead global strategy in cyber for the insurer.

-

He will also join the board of At-Bay Specialty Insurance Company.

-

The appointment comes after a slew of cyber reinsurance brokers left Aon to join Howden.

-

AM Best is confident in At-Bay's 5-year business outlook, partly due to the rapid growth seen in the cyber insurance market.

-

The new programme marks Core Specialty’s first offering in the tech E&O and cyber market and offers up to $5mn of coverage.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

Gangu was previously president of the insurance and services division and COO at SiriusPoint.

-

The new product is being developed to meet client demand for the coverage as the Lloyd’s market prepares to exclude cyber war as a peril from 31 March.

-

The US continues to experience catastrophic flash flooding and heavy rainfall events that are impacting “inland” areas across the country, as well as coastal areas.

-

Based in Boston, Wilson will report to Newfront’s head of executive risk, Deirdre Finn.

-

Carriers will address exposure to catastrophe losses, higher reinsurance costs, macroeconomic factors and inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the company has mandated Nomura to raise the risk capital.

-

Fenix24 plans to use the war chest to transform the post-breach restoration process in cyber, and to secure more partnerships with brokers and carriers.

-

The push for pricing will continue to be strong as at 1.1, but some sources suggest that the upcoming mid-year renewals could be more orderly.

-

Respondents attributed this increase to inflation’s effect on property valuations and the cost of goods, as well as to the natural catastrophe losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The unit will be led by GRS insurance solutions president Liz Geary, until the appointment of a global head of cyber, who will report to her.

-

Scott Bailey previously spent 12 years at CFC managing the technology and media division.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Cyber rates in excess layers saw decreases of mid-single digits to low double digits in the last quarter while primary layers remained flat or experienced low rate rises.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Backed by Coalition’s platform, CIC will begin quoting its admitted cyber products in some states starting March, with a national roll-out expected throughout 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that most of the cuts affected employees in the sales and marketing division.

-

In tandem, Gregg Davis and Rob Glanville will join the cyber InsurTech as independent directors.

-

InsurTech Cygnvs, eight months after closing its $55mn Series A funding round, has come out of stealth mode.

-

As insurers grow more comfortable with retaining attritional cyber risk they are altering reinsurance placements.

-

The energy crisis came in as a top-four concern, with 44% of respondents expressing worries over fuel costs, supply disruptions, inflation and the effects of Russia’s invasion of Ukraine.

-

The syndicate will access first excess – and eventually primary – business for US large corporates which typically does not make it to Lloyd’s, the CEO said.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

It is understood the rationale around Coalition’s desire to sell Attune involved refocusing its story on cyber, where valuations have held up.

-

The CEO called for the formation of public-private partnerships, akin to those in place for terrorism or earthquakes, to tackle systemic cyber risks.

-

Joining from Stroz Friedberg, an Aon company, the executive will be focused on business development, strategy and execution at the organization.

-

Based in New York, the executive will oversee the newly created Alliant Cyber, one of the retailer’s 14 industry verticals.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The executives will report to AGCS regional head of cyber, tech & media, Tresa Stephens.

-

While Canopius has been in the US for 10 years, the insurer has been building “a multi-platform approach” in which underwriters can write business on several different types of paper.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The business line’s premium increases this year were less pronounced than in 2021, when quarterly renewals were in the 50%-200% range.

-

The operation will be led by global product VP Mitesh Chauhan, who joined the cyber risk modeling firm from Entrust.

-

The cyber MGA promoted Dan Law to chief commercial officer, Theresa Le to chief claims officer and Neeraj Juneja to chief risk offer and finance SVP.

-

Global cyber premiums are expected to reach $23bn by 2025 but, with predicted global annual losses of around $945bn, roughly 90% of the risk remains uninsured.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

RPS said ransomware attacks are more sophisticated, with ransomware-as-a-service expected to become one of the biggest threats in the coming months.

-

The MGA will write the cyber business out of its recently opened Frankfurt office.

-

The intention to potentially sell Attune illustrates Coalition’s desire to refocus its story on cyber – where valuations have held best in harsh market conditions for InsurTechs.

-

Sources are expecting average rate increases between 20%-30% for accounts with standard controls in place and which have already seen double or triple digit rises.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The proceeds will be used to drive business growth across broker networks and evolve product features.

-

Only 27% cited coverage being too expensive at renewal as their reason for changing carrier.

-

Sources said that rival MGAs on the platform were “concerned” following the At-Bay acquisition, which contributed to the exodus.

-

Cyber threats were the top overall concern for business decision-makers (59%) ahead of broad economic uncertainty (57%) and fluctuations in oil and energy costs (56%).

-

The capacity deal was brokered by Lockton Re.

-

Themes from this year’s ITC conference in Las Vegas also included the exit of less educated investors, increased appetite for venture debt and the allure of cyber.

-

Cowbell Specialty will augment the InsurTech’s existing panel of 15 reinsurance partners, without replacing any of the current programs.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The InsurTech said small businesses remain highly targeted, and having a remote workforce makes clients more vulnerable to cyberattack.

-

Cyber continued to register the largest increase in the period, while D&O saw a small price drop compared to a moderate increase in the previous quarter.

-

In the newly created position, Rudow will report to Everest North America reinsurance head Jill Beggs.

-

The executive pointed at cyber and excess and surplus carrier Lexington as businesses that AIG was seeing rapid growth.

-

The appointment marks an expansion of the agency’s financial lines portfolio, which already includes D&O, E&O, EPL, fiduciary, fidelity, and related lines.

-

The program provides up to $15mn in capacity per account and is underwritten by Ryan Specialty-owned MGU EmergIn Risk.

-

Sean Park is joining the board of directors, while Matthew Jones is the company's new chief strategy officer.

-

Claims rates also increased, with standalone policies seeing a greater increase than package policies.

-

The executive will also serve as senior underwriter of professional liability.

-

The company expanded its cyber team in LA with senior underwriter Marisa Vero and in Minnesota with underwriter Hanna Baker.

-

Tadikonda will join the Corvus board of directors and will report directly to the board.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Odyssey Group cyber chief Robert O’Connell is looking to raise up to $1bn of capital to launch a monoline cyber reinsurer, this publication can reveal.

-

The broker sees rising costs pushing more careful underwriting and rate rises across multiple business lines for the rest of 2022.

-

Beazley and Chubb are working on different approaches as the market tries to get its arms around the aggregation risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Vern Suckerman has been named head of US complex accounts while Rachel Rossini has been appointed product manager for cyber and technology E&O.

-

The firm has been actively building out its team with industry expertise in 2022.

-

The cyber InsurTech sits at the top of the pyramid with a $5bn valuation, but it plays in a risky sphere.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The round closed in June with participation from Allianz X, Valor Equity Partners, Kinetic Partners, and other existing investors.

-

The cyber MGA InsurTech today announced the expansion of its relationship with Palomar through a multi-year program deal with the carrier’s E&S operation.

-

The deal enables its retail brokers to offer cyber liability coverage for small and medium-sized businesses with fewer security tools in place.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

On the property side, the costs for rebuilding a structure continue to climb and could prove to be prohibitive.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The capital raise included additional support from existing investors at MTech Capital and individuals from Stone Point Capital.

-

Around 16% of the wholesaler’s accounts absorbed rate rises above 20% in March and the other 31% saw rate increases between 10% and 19%.

-

Key focuses at the event included staff shortages, a slowdown in cyber attacks and the expectation of cooling market conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The global damage related to cyber crime will reach $10tn by 2025, according to current estimates.

-

A reduction in incidents linked to better resilience and the Ukraine war may temper cyber price increases, the broker said.

-

Surefire Cyber will support insurers and insureds in their responses to cyber incidents, such as ransomware attacks.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Rate increases in the hard-market cyber class came in at 27.5%, down from 34.3% in the previous quarter.

-

According to a joint Marsh-Microsoft report, 75% of 660 companies surveyed said they have suffered a cyber attack of some form.

-

Companies that had easily lured investors with major premium growth are now scrambling to prove their fundamentals work, and are sitting out fundraising to avoid a down round.

-

Based in Boston, the executive will report to AGCS’ NA regional head of financial lines Joe Caruso.

-

Ho has focused in recent years on working with brokers to find cyber insurance solutions for clients facing complex risks.

-

First Connect will offer a cyber protection insurance product underwritten by BlinkSM.

-

Based in Chicago, the executive will report to NFP’s cyber senior vice president Rick Cavaliere.

-

The broker said that increased cyberattacks in Ukraine have not resulted in major insurance losses to date.

-

The executive joined AIG in early 2010 and has held myriad positions since then, including financial lines assistant underwriter and cyber specialist.

-

Cyber and M&A insurance are the emerging trends in the region fueled by increased jackpotting attacks and deal activity.

-

The executive will oversee Blackpoint Risk, the company’s cyber liability insurance offering geared for managed service providers.

-

Resilience lures Aon cyber executive Thompson as SVP of underwriting.

-

ea was previously head of commercial E&O, cyber and media liability at CNA Insurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Lea was previously head of commercial E&O, cyber and media liability at CNA Insurance for a little over five years.

-

Cyberattacks and data losses were the top risks with 65% and 63%, respectively, followed by cyber extortion and regulatory threats with 59% and 49%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Cyber trends were driven by increased policyholder risk awareness and greater demand for coverage.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Corvus said Russia’s invasion in Ukraine “caused a divide in the cyber underground” as Ukraine-based actors had to relocate along with their IT operations.

-

A report from the Bermuda Monetary Authority shows how the island’s carriers have raised their worst-case estimate of cyber losses in recent years.

-

Discussions around rates remained amicable despite years of compound rises.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The conglomerate looks to step into the role of insurer of last resort amid capacity constraints and surging client demand.

-

Cyber and risk management specialist Sou Ford will move from WTW to lead Lockton’s Southeast cyber practice.

-

Aon’s E&O and Cyber Market Review found that between Q1 2019 and Q4 2021, ransomware attacks surged 323%.

-

Cyber policies already include war exclusions, but market participants now expect more explicit language and tighter terms and conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

WTW forecasts that cyber rates could increase by 100% to 200% for heavily exposed industries.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The MGA’s gross written premium now surpasses $650mn.

-

The executive joins Lockton after almost 16 years working at AIG, where until recently she served as North America head of cyber.

-

Roger Francis will lead a team of incident responders and cyber security specialists across the US, London and Australia.

-

Losses from comprised business email accounts leaped 28% to $2.4bn last year, as work-related attacks remained by far the costliest type of cybercrime reported to the FBI.

-

The appointment will be essential in digitizing broad distribution networks, refining risk assessment models and increasing underwriting innovation.

-

The executive will lead the modeling of attritional and catastrophe exposures at At-Bay and create the first aggregation risk view.

-

Inside P&C’s news team runs you through the key developments from the week.

-

The insurer has transferred cyber underwriter George Cole from London to its Bermuda HQ.

-

CEO Jack Kudale said his company was likely to transition to full-stack carrier by January 2023.

-

The executive will oversee the cyber-MGA’s long-term strategy and scaling operations.

-

Aon took a top five spot in the independent magazine’s list of the top 10 most innovative finance companies.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Aggregation was still an issue during January 1 renewals, as some risks in cyber remain “very difficult” to model.

-

The executive will oversee reinsurance partnerships, risk and portfolio management and drive new product development and innovation.

-

The cyber MGA also revealed it has reached a $650mn run-rate GWP.

-

Legal costs relating to the breach have been described as “astronomical” and sources say it is now all but certain that it would result in a full payout.

-

Sources told this publication Tom Draper would become head of insurance at the expansive MGA’s European operation.

-

The program will operate with $1mn in limit, but the firms said limits up to $5mn may be available for selected insureds subject to an underwriting review.

-

Panelists note rising importance of cyber BI as risks grow of system shutdowns outside of ransomware threat.

-

In his new role, Petrone will oversee the strategic deployment of insurance operations and underwriting resources to drive growth.

-

Cyber insurance clients need to provide all the domains they use for business, not just the public facing ones, if they hope to be fully protected, according to Michael Carr, head of risk engineering at Coalition.

-

While the report categorized auto as “challenging” overall, cyber remains the most problematic, with Aon predicting that rate pressure will continue for at least the first half of 2022.

-

In the past year, criminals held more than $600mn in ransom, stole millions of citizen records, compromised a billion airline-passenger details and threatened the IT operations of 40,000 businesses.

-

The protracted firming phase of the cycle continues, with E&S firmer than the admitted market.

-

The broker reported that only 2% of family offices and “very few” individual households in the high-net-worth market carry comprehensive cyber coverage.

-

Rates rocketed in the two most challenged areas of the market, while price deceleration continued in P&C, the broker’s index showed.

-

Mosaic said the partnership marked an expansion of its syndicated programme launched last December.

-

In the most recent episode of a Marsh podcast, president and CEO Martin South interviewed Carolina Klint on the key findings from the 2022 Global Risks Report.

-

Cyber rates continue to spike globally, along with financial and professional lines, Marsh data shows.

-

The Hartford cyber chief Jacob Ingerslev said improved cyber resilience of private sector companies should help reduce ransomware threats and malware events.

-

Rates across Axis’s insurance book rose by 14% in 2021, roughly matching the 14% rate increases Axis said it achieved across its insurance portfolio in 2020.

-

The carrier purchased $100mn of additional catastrophe reinsurance, effective January 1, to support its property business growth.

-

Oliver Delvos will lead Corvus’s office in Frankfurt, Germany, which is slated to open later in 2022.

-

The fast-growing InsurTech MGA inked a partnership agreement with private insurance broker Leavitt Group’s subsidiary ComTech-Leavitt Insurance to offer its risk-mitigation products.

-

The analytics company said healthcare, education, manufacturing and utilities sectors could face ransomware attacks.

-

The new cyber business will offer risk assessments in real time, insurance broking services, security & antivirus products and recovery infrastructure.

-

The carrier’s head of bond and specialty said better security postures were leading to a reduction of claims across the industry.

-

Hotel operators’ increased use of shared digital platforms and ‘smart technologies’ has widened the cyber threat landscape, the broker said.

-

Liz Kim is joining Gallagher Re’s 40-plus-strong cyber team from Hiscox, where she has spent more than 12 years.

-

International CUO Kyle Bryant declined to specify when the company would be up and running but said it was in advanced discussions and “quite confident” of landing a deal soon.

-

The hire comes as At-Bay rapidly grows headcount and looks to expand its product suite beyond cyber.

-

Another pandemic outbreak came in fourth place, with 22% of respondents saying they were worried about further health and workforce issues and movement restrictions in 2022.

-

Inside P&C’s news team runs you through the key developments from the last week.

-

The broker urged cyber insurance buyers to factor in terms and conditions such as restrictive coverage and exclusionary language in sizing up their purchases, as rates climb higher.

-

The InsurTech founder said Cowbell Re would allow the MGA to capture upside in underwriting results, while also serving as an additional capacity source.

-

The InsurTech is the latest MGA to begin assuming risk, following similar moves by rivals Coalition and Corvus, in what is likely to be a step in its evolution towards becoming a full-stack carrier.

-

The vulnerability is difficult to attack at scale, but flags the supply chain risk in the class.

-

A panel of Aon experts discussed cyber, ESG, cat risk and consumer behavior in 2022.

-

Edmundson said that Corvus would go public when it's large and stable enough to warrant a public base of shareholders.

-

The jump in reported ransomware attacks capped a year that saw an ever-hardening market, push to tighten cyber underwriting criteria.

-

Negotiations were dragged out by decisions being referred for sign-off at senior levels.

-

With this deal, Corvus said it becomes the first cyber InsurTech to acquire a London underwriting platform.

-

Continued disruption in cyber, emerging risks like at-home care and return to work are joining the industry’s need for new faces as being among the biggest issues for the coming year.

-

Growing frequency and severity of ransomware attacks tested the young cyber market’s resilience and adaptability.

-

Throughout the year, Inside P&C spoke to prominent voices from all corners of the insurance industry, here are some highlights.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

The UK National Cyber Security Centre has described the flaw as potentially “the most severe computer vulnerability in years”.

-

Insurance chief Lori Bailey says Corvus has looked at going full stack, but there are still opportunities in the MGA/program for cyber InsurTechs to leverage their capital.

-

Recently appointed head of insurance infrastructure and actuarial science, Dovid Tkatch, will support the captive’s development.

-

Aon’s cyber chief said capacity will be available to insurers who perform well on profitability, rate change and underwriting strategy.

-

The partnership will allow Corvus to provide its clients with a comprehensive analysis of cyber risk exposure, the company said in a statement.

-

The investment comes as Resilience plans for middle-market expansion and international growth, bringing the company’s valuation to $650mn.

-

Ryan Specialty Group MGU EmergIn Risk renews cyber binder with RenaissanceRe and names a cyber expert to lead its London team.

-

Cyber has surpassed D&O and natural catastrophe risk to become the most strained class of business for insurers, according to Aon’s Global Market Insights report for Q3 2021.

-

Executives from Munich Re, Aon, Willis Re and Guy Carp cited cyber, inflation and climate change as among the biggest risks facing the industry heading into 2022.

-

The business, whose valuation exceeds $3.5bn after a recent funding round, has backing from Zurich North America.

-

The CEO spoke to this publication in a wide-ranging interview, covering the still “daunting” loss inflation in commercial auto and the importance of good cycle management.

-

The executive also said that leadership in cyber would not come from traditional players, and that the segment currently faced a supply, rather than demand problem.

-

The executive has more than two decades of underwriting experience, most recently serving as a senior vice president at Argo Group.

-

Deputy Attorney General Lisa Monaco told the Associated Press to expect arrests, seizures of ransom payments and additional law enforcement operations in the days to come.

-

A trend of “double extortion” and exploiting victims who do not use multi-factor authentication has contributed to the surge in attacks in the last 18 months.

-

Despite the steady decrease in frequency of attacks, the costs associated with ransomware claims continue to shift as recovery remains a priority for businesses, according to a report by InsurTech MGA Corvus.

-

Marsh McLennan has launched a cyber risk analytics center that will offer tools to help provide clients with insights into cyber threats.

-

The carrier noted that claims on its cyber book had risen significantly since 2016, when it registered only 80 claims.

-

The partnership aims to encourage stronger SMB security and protect Microsoft customers from increasing cyber risks.

-

AM Best sees accumulating cyber risk in the US property market downgrading 18 US property carriers, considering Best’s Capital Adequacy Ratio.

-

As carriers seek to stabilize the cyber market amid skyrocketing loss ratios, more demands for tech controls are placed on insureds.

-

Speaking at InsureTech Connect, the CEO also said that while advancing the use of technology was important, the idea that InsurTechs would fundamentally change underwriting was “just hype”.

-

The deal is the first Palomar has done under its PLMR-FRONT business unit.

-

By moving a business from AIG's ecosystem into Coalition's, the perception of its value is transformed.

-

The combined firms will form what Coalition said will be the "world’s largest commercial InsurTech".

-

Toronto-based cyber InsurTech Boxx names former RSA exec Hilario Itriago its US president amid its expansion into US market.

-

The explosive growth in the cyber market over the past year has created a capacity crunch for MGAs, according to a panel of experts at the Inside P&C North America conference.

-

Panels presented optimistic views on the cyber market, reinsurance pricing and how inflation could affect the industry.

-

Tadikonda will work with policyholders, brokers and reinsurers to face the rapidly evolving threats and cyber risks.

-

Durable Capital, T Rowe Price Associates and Whale Rock Capital led the InsurTech’s latest round.

-

Gittler most recently served as the practice leader and head of cyber claims in the Americas region for Axa XL.

-

Ariel Re hires its first cyber head as the Bermudian seeks a deeper role in the evolving sector.

-

New investors Cyber Mentor Fund, Zurich Insurance Group and SixThirty Ventures participated in the fundraise.

-

A NetDiligence study has found that ransomware has been the top cause of cyber incidents over the last five years.

-

The deal will allow Corvus to write up to $100mn in new business over the next 12 months, with SiriusPoint initially providing all the program’s reinsurance capacity.

-

In its 2021 captives report, Aon found that both cyber captive premiums and environmental captive premiums have skyrocketed in tandem with emerging ESG and cybersecurity priorities.

-

In a post Covid-19 world, cyber-attacks have become increasingly frequent and more severe, with automated bot attacks surging specifically.

-

Nazir boasts 20 years of industry experience, and has served at Chubb for nearly four years.

-

The San Francisco-based InsurTech is targeting international expansion, with plans to write business in the UK and Continental Europe beginning in 2022.

-

The broker warned that the risk of a systemic cyber loss “is beginning to feel more like an inevitability.”

-

After an initial rush to cover large-scale attacks following 9/11, the terror insurance market has been slow to catch up with changing threats.

-

The cyber MGA has rolled out a platform to provide capacity providers with more real-time portfolio detail, as it aims to secure underwriting backing in a tougher market.

-

Coletti takes the role previously held by Anthony Cordonnier, who recently joined reinsurance broker Guy Carpenter.

-

The cyber market is going through a needed maturation process to ensure the long-term viability of coverage offerings, the wholesale broker said.

-

The increase in loss ratio was much more modest for package policies, growing by four basis points to 1%.

-

At the White House cyber summit, Resilience also said it would demand best cyber hygiene practices at clients before writing cover.

-

The company’s CEO met with the US president and various CEOs from Apple, Amazon, Google, Microsoft and more to discuss protecting major entities from cyberattacks.

-

Respondents said that cyber underwriters were responding to the growth of ransomware attacks and poor risk management.

-

The cyber MGA is using API integration to accelerate cyber insurance distribution and adoption in a time of increased ransomware attacks.

-

The ransomware surge is likely to lead to changes in the product, a shake-up in market share and challenges for MGAs.

-

The specialty insurer has brought in the underwriter following the departure of Kristen Dauphinais at the end of May.

-

The broker said it was possible that certain personal details were accessed during the hack.

-

The NFP Ventures-back SaaS platform will now offer brokers and agents cyber insurance from Cowbell Cyber via Cowbell Prime 100.

-

Corvus said that the deal was a key milestone in the company’s growth.

-

The carrier has restructured its cyber business with stringent underwriting conditions.

-

The CEO called for the US Treasury to require insureds to seek permission before paying ransoms, underscoring the importance of “unmasking” malicious actors.

-

Coalition said that claims frequency among insureds with more than $100mn in revenue jumped more than 40% since the first half of last year.

-

“The way it's underwritten, the way it's priced, the way it's purchased by clients and the way clients want to purchase it,” are all rapidly evolving, the executive said of the cyber insurance market.