-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Trump’s shadow loomed over the beachside sessions.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

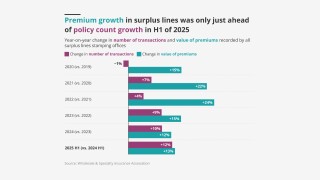

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The CEO said that new funding will be used to expand its underwriting capabilities.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

The transaction is expected to close early in the first quarter of 2026.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

The MGA said payments to affected customers began shortly after the event.

-

Texas was up over 25%, though California and Florida both recorded reductions.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The executives are based in Seattle and New York.

-

The executive was previously the cyber practice lead for Ryan Financial.

-

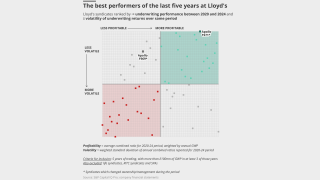

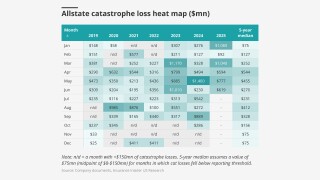

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The PE firm held 3.1% of the company’s shares, but will now hold none.

-

The city said it was self-insured at the time of the attack.

-

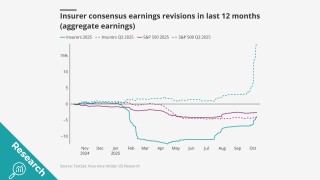

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The move comes after the company posted 52% YoY top-line growth in Q3.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The tech error, now resolved, halted traffic to sites like X and ChatGPT.

-

The executive joined the company from Zurich last year.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the revision.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

Bryant has spent over 30 years with the specialty carrier.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

Longbrook Insurance will write multiple lines of business.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The executive most recently served as the company’s chief broking officer.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The loss would be one of the largest ever for mining underwriters.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

The company is also prepared for potential M&A activity.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Marsh is also suing a second tier of former Florida leaders.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

HNW family offices are now among investors considering the US MGA segment.

-

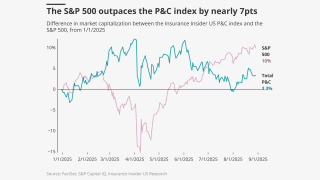

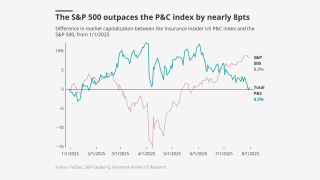

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The search for a CFO had been underway since last July.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The executive joined the Dallas-based insurer as CUO in 2023.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

Haney will remain on board as a senior adviser.

-

The appointments are aimed at offering a clearer team structure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Old Republic said the acquisition is expected to close in 2026.

-

The company saw growth accelerate in its property and casualty segments.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

A quiet wind season is also expected to further soften the property market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

There’s nothing medical about SAM claims.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company is looking to grow through its new MGA incubator program.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The hire comes a few months after Nick Greggains was promoted to CEO.

-

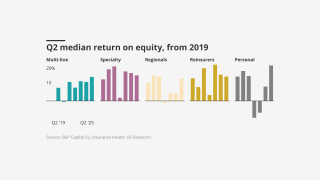

Early Q3 earnings reports point to worsening market conditions.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

MGAs that are good operators will stick out compared to the rest.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

An average of 81% of property accounts renewed flat or down.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

Brian Church has spent 20 years at Chubb.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

Growth concerns were top of mind at this year’s conference.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Moretti has relocated to California from London.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

The move marks Acrisure Re’s first investment in Latin America.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

The two executives join from Markel and Arch, respectively.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Insurers continue to compete on price, especially in the SME sector.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

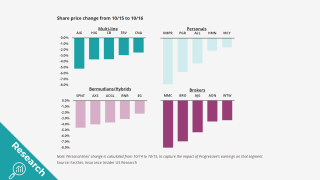

Industry stocks were firmly behind the S&P 500 in Q3.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

Superintendent Harris is stepping down this month after four years of service.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Cyberattack/data breach remains in the top slot.

-

The specialty insurer posted $800mn in GWP for the first six months of the year.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The subsidiary will offer primary and excess liability.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Getting that message across is key to bettering the industry.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

Global pricing is now 22% below the mid-2022 peak.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

Onex is making the investment alongside PSP, Ardian and others.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

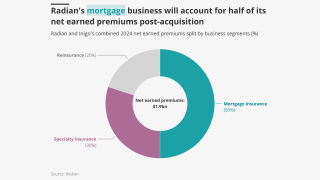

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

-

Average incident costs for SMEs were up nearly 30%.

-

The Chicago-based executive was previously Everest’s CUO of excess casualty.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The executive joins from MSIG USA.

-

The program, expected to start doing business next month, will be wholesale-only.

-

It represents the platform’s formal entry into the commercial E&S market and will be led by EVP Neil Lipuma.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

The team previously operated with Sheerin and Woodruff but will grow to five brokers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Ransomware claims have made up the majority of recent large losses.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Growth in the SME sector could help stabilize the market, however.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The executive has been serving as COO since February.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

The executive said claims can be a differentiator in a softening market.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Lisa Binnie will succeed him as president of the company’s specialty admitted segment effective September 1.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Parrish, now CEO of Howden US, and his colleagues said they didn’t violate contracts.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

A key hearing in the poaching case is set for September 4 in New York.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The executive was previously Navigators’ head of excess casualty.

-

The company was hit with a data breach on July 16.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

The move is a retaliation to Howden’s US retail launch.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Profitability improves, even as growth stagnates.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The executive joins from Coalition and brings more than 30 years of experience.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The announcement comes a week after the institutional investor said it would accelerate its pivot to an insurance-led strategy.

-

July’s medical care increase was up from June’s o.6%.

-

Appointments include leadership in transportation, energy, marine and others.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

Teresa Black will succeed him as division president of North American surety.

-

The executive said the floor on D&O pricing is in sight.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The program is set to begin binding this month.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The carrier reported an increase of 82% in pre-tax income.

-

The move will impact around $50mn of gross written premiums in total.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive joins from At-Bay and brings more than 25 years of experience.

-

The professional lines market remains ‘challenging’ overall, however.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The carrier’s US redomicile is expected for later this year and brings a one-time $10mn-$13mn benefit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The group has hit multiple industries since March, including a raft of insurance companies.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has also expanded its relationships with US and UK MGAs.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The company has also appointed David Tran as head of programs, Canada.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

An industry veteran of 34 years, the executive is known for placing US healthcare business in London.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

The president expects to see benefits from the deal in H2 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

The executive formerly held roles at At-Bay, AIG and Hiscox.

-

CEO Roche said that “significant price increases” are still to come, however.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

New business written premiums were up in the commercial and E&S segments, but decreased in personal lines.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Matthew Flynn joins from RenaissanceRe.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive has been with the company for roughly one year.

-

The executive had previously worked four years as head of trade credit for AIG.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

The former Everest executive has more than 30 years of A&H experience.

-

Shares opened at $28.50 each, well above the $21 offer price.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

The executive said the claims industry is going to “be transformed”.

-

The carrier has been steadily increasing loss trend estimates.

-

Softer market conditions are likely to create a wave of consolidation favoring large brokers.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Jim Franson joins from Validus Re, where he was US president.

-

The IPO was priced at $21 per share, up from the previous target range of $18-$20.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

This is the New York-based firm’s first acquisition since launching in 2024.

-

The carrier’s top line grew to $890m in the first half of 2025.

-

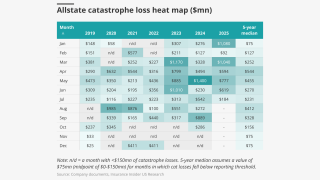

The research team presents the June cat heatmap.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Michael Mora was appointed North America CEO just over a year ago.

-

CEO Jeff Consolino will undertake CFO duties on an interim basis.

-

PL coverage is being stripped out of admitted, packaged policies and increasingly purchased in the E&S market.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

June’s increase was up from May’s 0.2%.

-

The IPO price is expected to be $18-$20 per share.

-

The Inflation Reduction Act 2022 established new tax credits to incentivize investment in renewables.

-

-

The executive has spent 13 years in the broker’s marine division.

-

The MGA is expected to launch a product-recall portfolio in September.

-

The global carrier plans to hire around 300 people in the next several years in the Americas and has already filled 60 roles thus far.

-

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

A London wholesaler broker would be a compelling second move.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

But June was the busiest month of the year on the back of recent broker churn.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The cyber business will continue to operate as a standalone entity.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Last month, Insurance Insider US revealed that former GTS Americas head Scott Pegram had left the company.

-

The unit will include both ocean and inland marine coverage.