-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The market is expected to seek additional exclusions around systemic events.

-

The first RICO complaint targeted medical providers and training centers.

-

Loss cost inflation remains an unknown and is sustaining price discipline.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

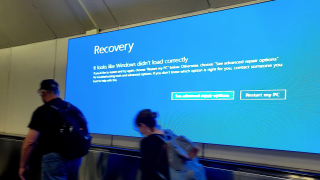

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

Insured losses in the single-digit billions would not translate into a material impact for (re)insurers.