-

The Florida portion of the program provides $1bn in protection.

-

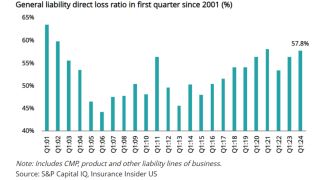

Loss picks for other liability are at a 23-year high, but that still may not be enough.

-

CNA has been part of Euclid’s panel in EMEA since early 2022.

-

The company writes roughly $300mn with Ebitda of roughly $30mn.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

The two join the company from Navigators, a subsidiary of The Hartford.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

This is Chubb’s second MGA deal in the past few months.

-

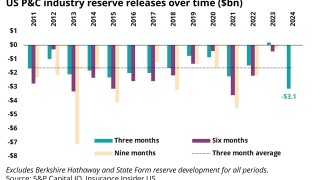

The discrepancy between rising claim counts and favorable reserves is cause for concern.

-

The move comes as the wait for a deal for the whole group passes the six-month mark.

-

Business written in California, Florida and Texas averaged a 15.2% YoY gain.

-

He will oversee management of the P&C loss adjusting business.