-

The facility has expanded to cover construction and renewable energy risks.

-

Justin Camara was EVP and portfolio director for financial and professional liability.

-

A district court judge had dismissed the case in September, with prejudice.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

The change was made on December 2 and was effective immediately.

-

Canopius will continue to be one of several capacity providers to the MGA.

-

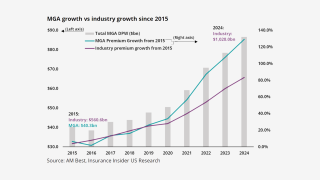

MGAs going public is now a viable option, but dominating a market comes first.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The executive said maintaining capacity is the main challenge in a soft market.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The MGA said payments to affected customers began shortly after the event.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

The executives are based in Seattle and New York.

-

The London-based MGA will begin underwriting its international book next month.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

The company announced four key leadership appointments on Wednesday.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Existing facilities and carrier partners will be transferring from K2.

-

The MGA began offering US commercial E&S property products in December.

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

HNW family offices are now among investors considering the US MGA segment.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

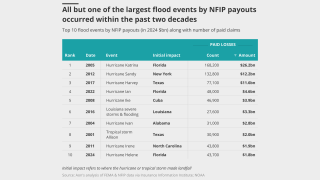

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

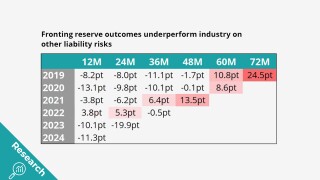

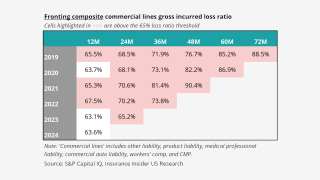

Fronting doesn’t look any better when it’s broken down by segment.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

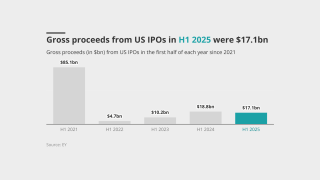

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The company will continue its capacity partnership with the MGA until 2030.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The company is estimating its IPO price at $18-$20 per share.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

Onex is making the investment alongside PSP, Ardian and others.

-

The case is now headed to appellate court.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The program, expected to start doing business next month, will be wholesale-only.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The business said it was experiencing strong momentum on the Island.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

The company generated $71.4mn in revenue for H1 2025.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Lisa Binnie will succeed him as president of the company’s specialty admitted segment effective September 1.

-

The likes of Genstar, Leonard Green and Bain also looked at the program manager.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

The executive succeeds current CEO Petway, who is retiring.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The MGA will expand its US reach in apartments, condo associations and single-family rentals.

-

The company has also expanded its relationships with US and UK MGAs.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

Morgan Stanley first invested in Cover Whale in May 2024 with structured debt.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

Commercial property poses the most intense competition due to rates dropping, terms and conditions, and line size.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Shares opened at $28.50 each, well above the $21 offer price.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

This is the New York-based firm’s first acquisition since launching in 2024.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The PE-backed MGA lined up Morgan Stanley, JP Morgan and Bank of America to advise.

-

Michael Mora was appointed North America CEO just over a year ago.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

The Inflation Reduction Act 2022 established new tax credits to incentivize investment in renewables.

-

-

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

A London wholesaler broker would be a compelling second move.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

With the added capacity, the MGA can offer up to $35mn per risk.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

In March, this publication revealed that Pinnacle was considering a sale.

-

Holschneider co-founded the firm and is currently executive chairman.

-

Volante’s syndicate may still support select transactional liability risks, but it will not have an in-house team.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

DUAEs are increasingly leveraging specialized expertise to address underserved risk.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The executive said he left the company in September.

-

Sam Wylie has been appointed portfolio manager.

-

Bredahl has been appointed CEO and Bonneau as chairman.

-

Starr and Axon also are among those on the Marsh USA-placed $40mn line.

-

The executive has been with the firm since its inception in 2023.

-

He will also invest in the company.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The executive has experience across both insurance and banking.

-

Permanence and independence of a public company would be valuable, he told this publication.

-

The executive joined the MGA in January 2024 and has spent his entire insurance career within the TL space.