-

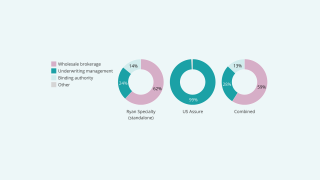

The wholesaler is shifting its business mix towards delegated underwriting, which should help sustain growth.

-

Lea is responsible for Embroker’s underwriting practices, including paper and reinsurance relationships.

-

In tandem, Mike Falvey will transition to executive chairman, effective January 1.

-

-

The acquisition includes up to $400mn of performance-based contingent considerations measured through 2026.

-

The announcement confirms news this publication revealed in July.

-

This expansion will protect against risks faced by transportation and logistics businesses.

-

The executive brings 24 years of experience to the role.

-

This publication revealed in March that ISO was exploring strategic alternatives.

-

The carrier is expanding its MGA partnerships and has invested in its marine team.

-

He will continue to act in his role as COO, global insurance operations.

-

The carrier recognized a goodwill of $256mn and intangible assets of $39mn from the transaction.