-

The facility has expanded to cover construction and renewable energy risks.

-

Justin Camara was EVP and portfolio director for financial and professional liability.

-

A district court judge had dismissed the case in September, with prejudice.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

The change was made on December 2 and was effective immediately.

-

Canopius will continue to be one of several capacity providers to the MGA.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The executive said maintaining capacity is the main challenge in a soft market.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The MGA said payments to affected customers began shortly after the event.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

The executives are based in Seattle and New York.

-

The London-based MGA will begin underwriting its international book next month.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

The company announced four key leadership appointments on Wednesday.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Existing facilities and carrier partners will be transferring from K2.

-

The MGA began offering US commercial E&S property products in December.

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

HNW family offices are now among investors considering the US MGA segment.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

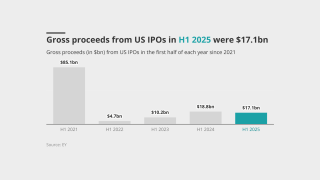

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

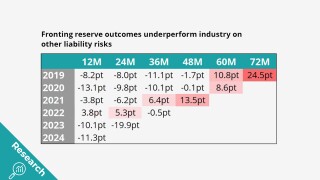

Fronting doesn’t look any better when it’s broken down by segment.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The company will continue its capacity partnership with the MGA until 2030.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The company is estimating its IPO price at $18-$20 per share.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

Onex is making the investment alongside PSP, Ardian and others.

-

The case is now headed to appellate court.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The program, expected to start doing business next month, will be wholesale-only.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The business said it was experiencing strong momentum on the Island.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

The company generated $71.4mn in revenue for H1 2025.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Lisa Binnie will succeed him as president of the company’s specialty admitted segment effective September 1.

-

The likes of Genstar, Leonard Green and Bain also looked at the program manager.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

The executive succeeds current CEO Petway, who is retiring.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The MGA will expand its US reach in apartments, condo associations and single-family rentals.

-

The company has also expanded its relationships with US and UK MGAs.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

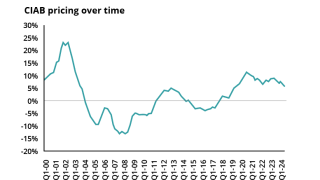

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

Morgan Stanley first invested in Cover Whale in May 2024 with structured debt.

-

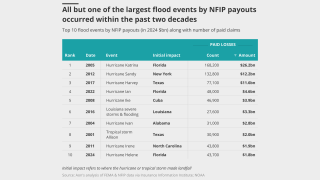

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

Commercial property poses the most intense competition due to rates dropping, terms and conditions, and line size.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Shares opened at $28.50 each, well above the $21 offer price.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

This is the New York-based firm’s first acquisition since launching in 2024.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The PE-backed MGA lined up Morgan Stanley, JP Morgan and Bank of America to advise.

-

Michael Mora was appointed North America CEO just over a year ago.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

The Inflation Reduction Act 2022 established new tax credits to incentivize investment in renewables.

-

-

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

A London wholesaler broker would be a compelling second move.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

With the added capacity, the MGA can offer up to $35mn per risk.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

In March, this publication revealed that Pinnacle was considering a sale.

-

Holschneider co-founded the firm and is currently executive chairman.

-

Volante’s syndicate may still support select transactional liability risks, but it will not have an in-house team.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

DUAEs are increasingly leveraging specialized expertise to address underserved risk.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The executive said he left the company in September.

-

Sam Wylie has been appointed portfolio manager.

-

Bredahl has been appointed CEO and Bonneau as chairman.

-

Starr and Axon also are among those on the Marsh USA-placed $40mn line.

-

The executive has been with the firm since its inception in 2023.

-

He will also invest in the company.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The executive has experience across both insurance and banking.

-

Permanence and independence of a public company would be valuable, he told this publication.

-

The executive joined the MGA in January 2024 and has spent his entire insurance career within the TL space.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

Sources said that the program manager is being advised by Dowling Hales.

-

The executive joins forces with executive chairman and co-founder Erik Matson.

-

They cover environment, political violence, equipment and cannabis.

-

The executive has previously held roles at CRC Group, Allianz and Nationwide.

-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

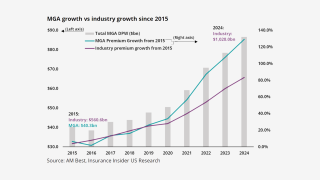

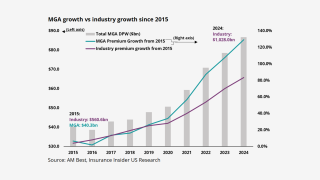

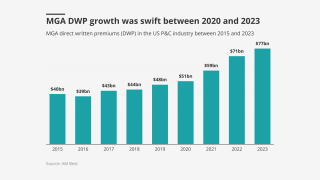

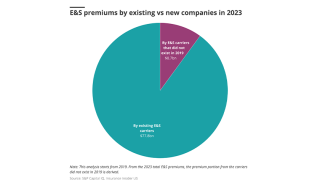

The MGA market now makes up 10% of the overall P&C market.

-

The executive also spoke about growing organically and via M&A.

-

The move will allow clients to take on larger and more complex projects

-

The appointment follows the recent exits of CUO Chatterjee and SVP Dharma-Wardana.

-

MGA platforms, however, are seeing higher multiples than those in retail.

-

The program is designed to address a changing risk environment.

-

The platform will focus on acquiring MGAS across lines of coverage.

-

The company completed the acquisition yesterday.

-

The MGA also appointed CNA’s Matthew Schardt as head of casualty.

-

Planning for the carrier was halted in January due to the CEO’s health issues.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The company also hired Beazley’s Tracy Holm as general counsel.

-

The deal is expected to close in the second quarter.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

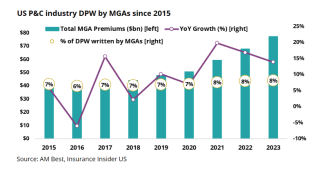

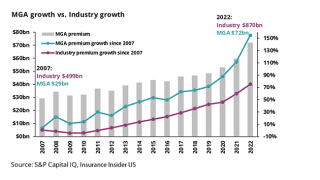

MGA growth is still strong but has passed its 2022 peak.

-

The program will offer liability coverage up to $5mn per occurrence.

-

The MGA will focus on insurance for agents, carrier partners and clients.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

Sources said Morgan Stanley has been drafted in to run the auction later this year.

-

The program will provide excess casualty coverage across a broad range of industries.

-

Meco's 2024 gross written premiums totaled $63mn.

-

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

Rouse was promoted to co-global placement leader last October.

-

Alex Amezquita will fill Cahill’s previous position as CFO.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

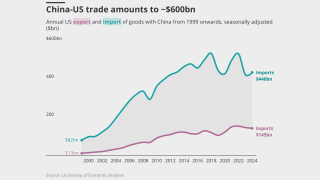

Business hates uncertainty and geopolitical tensions are off the charts.

-

The broker adds a new EVP and new president to its benefits practice.

-

The coverage will only be available in Illinois and Michigan at first.

-

This publication revealed last year that Brownyard was considering a sale.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

The program is being launched through subsidiary Southern Marine.

-

The package comprises a $100mn cat bond and a $70mn sidecar.

-

The company is expanding availability of its large enterprise offerings.

-

The 12 insurers together have $418mn in policyholder surplus.

-

Data, technology and telematics could turn the struggling sector profitable.

-

Carriers surveyed cited access to niche markets as a key strength.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

K2 Cyber is entering an increasingly crowded cyber market.

-

The costs of accident/casualty-related claims continue to rise.

-

The MGA will grow in specialty lines via talent recruitment and M&A coupled with technology enablement.

-

Allianz has previously entered several capacity arrangements with the MGA.

-

The company is on a five-year growth plan, aiming to hit $100mn in premiums by 2029.

-

AIG veteran Kevin Bidney will focus on North American marine.

-

The start-up is closing a Series A fundraise.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

SiriusPoint will provide capacity for a new construction liability program.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

Sources said that Insurance Advisory Partners is advising the fac MGA on the strategic process.

-

In January, Archer expanded its capacity with Lloyd’s backing.

-

The partnership will launch a new umbrella excess insurance product.

-

The new CEO hints at expansion into MGA markets.

-

Evercore has reached out to a combination of strategics and private equity houses.

-

The MGA recently secured capacity to write HNW homes in California.

-

The MGA is offering lines of $25mn, up from the $10mn limit it was providing until late last year.

-

The company is seeking to promote growth in its US excess casualty book.

-

The offering includes GA, aviation GL and airport and product manufacturers liability.

-

Wows will offer coverage tailored to high-value properties, written on non-admitted paper.

-

As of February 14, the company received 405 claims.

-

The MGA will be trying to replace the transactional liability capacity in the coming weeks.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

Ryan Specialty National Programs consolidates several RSUM business units.

-

Gibbs will oversee delegated underwriting authorities and facilities.

-

This is the second acquisition Amwins has announced this year.

-

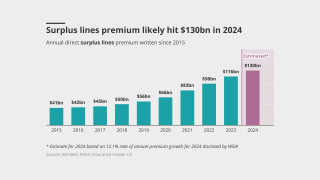

The first round of the E&S boom has already played out, but this is a long game.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

Sources noted that Dowling Hales is advising the MGA.

-

Other digital distribution platforms, including ProWriters and SportsInsurance, are also exploring a sale.

-

Last October, this publication revealed that NSM was considering a carve-out of its B2B programs.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

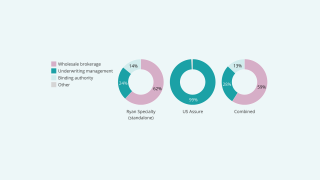

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The company stopped writing new business last September and lost capacity from SiriusPoint.

-

The MGA’s US clients will now have access to London market capacity.

-

The traditional R&W product is seeing an increasing number of large losses.

-

The company is on target to write around $700mn in premiums this year.

-

Sources said that Waller Helms/Houlihan Lokey is working with the firm as financial adviser.

-

Regulators have been keeping a close watch on the market, however.

-

Other backers include Arch Specialty, Allianz, Allied World and HDI.

-

Interest in maintaining current DUAE relationships outweighs forging new ones.

-

Sources said the MGA secured support from MS Transverse, Axis, AmTrust and Summit for TL business.

-

The program will offer limits up to $5mn.

-

Regilio will lead a sales team to “expand market share and forge strategic partnerships”.

-

The homeowners’ MGA CEO said the wildfires could spur a re-evaluation of models.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

The review follows Velocity’s acquisition by FM Group.

-

Flatt will remain on the company’s board of directors.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Former COO Jack Falvey’s appointment as CEO was reported last August.

-

The transaction comes after Kestrel explored a deal last quarter to raise ~$150mn of capital.

-

The MGA will become part of binding authority unit Amwins Access.

-

Insurance Insider US dissects the largest and hottest deals of the year across segments.

-

The new, publicly listed specialty program group will be led by Luke Ledbetter.

-

The program was developed in collaboration with Allianz Commercial.

-

The business will operate as a full-service MGU under Amynta Risk Solutions.

-

Shawn Parker takes up Gatt’s previous role as COO of Westchester Programs.

-

Florida is a state where the company is seeing more capacity in the market, especially admitted availability.

-

IAP served as financial adviser to Atri in the transaction.

-

Sources said that Archer Transactional and BlueChip Underwriting will continue operating with existing paper providers.

-

Sources said Berkshire will move from the largest single capacity provider to a single-digit percentage line size.

-

The Bermudian's MGA will be based out of Miami, New York and Pennsylvania.

-

The move was led by ex-Icat CEO Gregory Butler.

-

Richard Winborn joins as president, while Patrick Mitchell takes on the COO role.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

The firm said the UK hub demonstrates its commitment to expanding in Europe.

-

In March, Insurance Insider US revealed that Arden had retained Dowling Hales to find an investor.

-

The MGU also announced a string of promotions to leadership, including RWI CUOs and a new head of Europe.

-

The AIG and Stone Point-owned MGU will also look to move up-market, increase its weighting to E&S and add third-party paper.

-

Castel founder Mark Birrell will take the role of executive chairman.

-

The hybrid fronting carrier was launched last year and is led by Talbot alumnus Sam Reeder.

-

The deal follows Bishop Street’s acquisition of Ethos’ TL operations from Ascot.

-

The distribution channel has sustained growth and resilience globally.

-

Sources said that the underwriter has been working with Houlihan Lokey to find a potential backer.

-

The executive will focus on securing reinsurance capacity for new programs.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

The deal is the latest in a string of investments by the MGA platform.

-

Multiple reinsurance brokers have pitched the firm for sidecars.

-

The business will trade via London, the US and Canada.

-

Sources said that the AmTrust-backed fronting carrier has retained Evercore to run the process.

-

The MGA platform will become part of Ryan Specialty Underwriting Managers.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

The wholesaler also paid $11.7mn in cash to Alera for the acquisition of Greenhill Underwriting.

-

It is understood that the business-to-consumer programs are not included in the potential transaction.

-

It is understood that the company has retained the services of Dowling Hales as adviser.

-

The binding authority facility targets smaller commercial property and general liability E&S risks.

-

Capacity conversations centered around comp, trucking and cat, while new names emerged in collateralized re.

-

It is understood that the cut programs include Yachtinsure, Rhino, Paramount, Pinpoint and NTA.

-

Backers and CEOs may be wary of falling into the same trap as larger PE-backed retail brokers.

-

Sources said that Piper Sandler is running the sale process for the ~$50mn Ebitda business.

-

Sources said that a deal between the two sides could be reached in the next couple of weeks.

-

Milton and Helene, casualty reserves and growth will be some of this year’s topics.

-

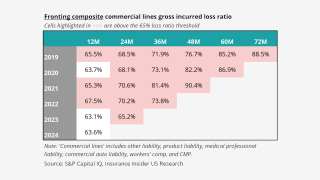

Current rates at 2% to 2.5% translate to an 86% incurred loss ratio.

-

Nationwide vet Mike Miller is launching the MGA, which focuses on the E&S market.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

He replaces Richard Goldfarb, who will remain as head of strategy.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

The executive has over 20 years’ worth of actuarial and analytics experience.

-

This follows a spate of program manager deals Ryan Specialty has made.

-

The change comes after the firm hit $1bn of in-force written premium.

-

He was most recently head of excess casualty, east zone, at Axa XL.

-

Elixir has an initial focus on cyber but will look to expand into other lines, including E&O and D&O.

-

A large number of new entrants and the growth of litigation finance challenge E&S enthusiasm.

-

Bishop Street acquired Conifer Insurance earlier this month.

-

Casualty will likely fuel some of the E&S growth, the executive said.

-

Andrew Rowland will oversee the portfolio, offering up to $7mn per risk.

-

The firm will specialize in professional liability insurance for SMEs.

-

Howard Siegel remains CEO of the MGU.

-

The deal provides Honeycomb with up to $24mn of capacity.

-

-

PVT business has been attracting new capacity after recent rate increases.

-

The MGA noted a 17%-20% price decline last year and expects similar for 2024.

-

Ethos’ transactional liability MGU is not included in the deal.

-

The acquisition marks Bishop Street’s entry into commercial lines.

-

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

The underwriting units produced revenue of $11mn in the year to June 30.

-

Geo Europe CEO Walter Craft will remain with the financial lines business.

-

Negotiations come after Insurance Insider US revealed that the Bermudian was running an auction.

-

Deal sizes also remain high, with EVs in July averaging over $440mn.

-

The company still has ambitions to sell the business.

-

Mexico City-based Ant was founded in 2019 by Alejandro Cabrera.

-

House Bill 672 adds regulation to the Louisiana MGA market.

-

The Houston, Texas-based program manager will join Ryan Specialty’s healthcare MGU Sapphire Blue.

-

Previously, Fishl held underwriting roles with Munich Re and Chubb.

-

The consortium backing the MGA is led by Axa XL Syndicate 2003.

-

Ascot will evaluate other options for its ~$140mn-premium transactional liability unit.

-

The executive will report to London-based BMS director Alex Shephard.

-

Earlier this year, this publication reported that Jetty was looking for capacity to replace Farmers.

-

The wholesaler is shifting its business mix towards delegated underwriting, which should help sustain growth.

-

Lea is responsible for Embroker’s underwriting practices, including paper and reinsurance relationships.

-

In tandem, Mike Falvey will transition to executive chairman, effective January 1.

-

-

The acquisition includes up to $400mn of performance-based contingent considerations measured through 2026.

-

The announcement confirms news this publication revealed in July.

-

This expansion will protect against risks faced by transportation and logistics businesses.

-

The executive brings 24 years of experience to the role.

-

This publication revealed in March that ISO was exploring strategic alternatives.

-

The carrier is expanding its MGA partnerships and has invested in its marine team.

-

He will continue to act in his role as COO, global insurance operations.

-

The carrier recognized a goodwill of $256mn and intangible assets of $39mn from the transaction.

-

The arrangement enables PCS to expedite growth.

-

The investment will be used to scale operations and extend Cowbell's presence in key international markets.

-

House Bill 672 will take effect on August 1.

-

The first RICO complaint targeted medical providers and training centers.

-

The news follows a string of deals that the stop-loss segment has seen in recent months.

-

Romel Salam, former Validus Re CRO, will also join Solis as an advisor.

-

US Assure has been exploring a potential sale through a narrow process run by Dowling Hales.

-

Markel executive Alan Rodrigues will lead the unit.

-

The Irish MGA will be able to underwrite commercial property risk up to EUR10mn.

-

She will oversee Vantage's specialty insurance distribution strategy.

-

-

The operation will be led by Stephen Saunders, with Jawad Ghunaim from AIG as CUO.

-

It is understood that the shutdown will impact about 25 employees.

-

Gangu will likely take a gardening leave after vacating his post to consider future steps.

-

SiriusPoint becomes sole carrier partner for Euclid’s liability program.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

The transaction with Enstar covers $234mn of net Accredited reserves.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

The lineslip will focus on coverage for the energy transition space.

-

The executive gave his view on the (re)insurance landscape and the impact of PE on the sector.

-

AmCoastal also cut its board down to five members, including two new appointments.

-

Industry veteran Peter McKeegan will lead the firm.

-

Ryan Specialty CEO Pat Ryan opened the event, which was held last week in New York.

-

Scale, diversity and specialization are three main reasons brokers consolidate.

-

This is Emerald’s second facility, after its earthquake deal with Arrowhead.

-

Kinsale CEO Mike Kehoe said social inflation is unabating, but losses fuel the industry.

-

The deal adds capacity to Fusion’s R&W, tax and contingency insurance businesses.

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

This publication had reported the program manager’s plans in April.

-

The acquisition allows AM Specialty to expand its E&S offerings.

-

The carrier said the office in Belgium “doubled down” on its commitment to Europe.

-

The acquisition expands Doxa’s mental health and wellness presence.

-

Ex-PartnerRe executive Joe Hissong will serve as the underwriter’s COO.

-

CNA has been part of Euclid’s panel in EMEA since early 2022.

-

It will offer over $250mn in capacity targeting clients in California and the Pacific Northwest.

-

The company writes roughly $300mn with Ebitda of roughly $30mn.

-

This is Chubb’s second MGA deal in the past few months.

-

Ambac also announced it was selling its financial lines book to Oaktree for $420mn.

-

The move comes as the wait for a deal for the whole group passes the six-month mark.

-

Sentry launched its specialty lines division in 2022.

-

With the additional capacity, the MGA can now write over $100bn in business.

-

The Howden-owned MGA lost ~$250mn in cat capacity in September.

-

He previously helmed Plymouth Rock Assurance's direct and partner group.

-

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The company went public Thursday at a price of $17 per share.

-

Hallmark’s commercial business will be fronted by HDI subsidiaries.

-

The K2 subsidiary will be Atain's first non-affiliated MGA partner in a program across seven states.

-

The distribution model itself prioritizes the need for due diligence.

-

She brings 19 years of industry experience to the newly created role.

-

Ascot is supporting Trident, Paragon’s public entity casualty insurance program.

-

The former Everest executive will look to roll out a range of new product lines at the MGA.

-

The suit also names CEO William Spiegel and CFO Tom Solomon as defendants.

-

The company said Matson’s transition to vice chairman is voluntary.

-

The carrier’s goal for its specialty arm is to achieve $10bn in written premiums and a sub-90% CoR by 2030.

-

Across three offerings, Victor increased coverage maximums by $33mn.

-

The partnership will increase K2's capacity for US hurricane and earthquake exposure.

-

The consideration in this deal will also include $2.2mn of Ryan Specialty Class A common stock.

-

Sources said Federer will assume the executive director role at Atlantic later this month.

-

This publication revealed that the firm is working with Jefferies on the sale of its A&H MGA Armada.

-

Former NTUM president Justin Joyce will lead the ANTU binding unit.

-

The company is understood to be working with Ardea Partners.

-

It is understood that the company needs to secure cash within less than 30 days.

-

Farmers is working with Jetty to help ensure a smooth transition.

-

The front has lined up its first 10 programs and is confident it will get at least seven or eight of them.

-

Flexpoint secured a higher sum-of-the-parts valuation by facilitating the break-up.

-

The filing comes four months after Insurance Insider US revealed Bowhead’s intentions to launch an IPO this year.

-

Beckham will succeed Ben Francavilla, who is retiring.

-

The MGA’s underwriting capacity for casualty programs now totals $17mn.

-

Earlier this week, this publication revealed that Axis and Accelerant will support the recently launched MGA.

-

Blue Signing Re CEO Velasquez will be XS Global's head of casualty motor, L&H and benefits.

-

Tim McDougald most recently served eight years as Marsh’s New England operations leader.

-

The MGA platform has been under auction since last year.

-

The M&A insurance MGA also secured support from Accelerant.

-

GeoVera’s UW operations go to SageSure, while its insurance companies merge with SafePort.

-

The acquisition announcement is Doxa’s second this week.

-

The executive will be responsible for scaling USQRisk's structured casualty portfolio.

-

The segment represents approximately 11% of the overall P&C market.

-

Specialty reinsurance MGU Waypoint has formed a strategic partnership with workers compensation carrier CompSource Mutual.

-

RLL offers a fully insured and captive program to multifamily owners and managers.

-

Colin Addy and Greg Conroy, former Vale and Chubb executives, co-head the new operation.

-

In a post-Vesttoo world, vulnerabilities still exist in the collateralized reinsurance market.

-

Westchester’s Kyle Garrett was named VP, executive underwriter for property.

-

The oversubscription may signal additional capacity waiting on the sidelines.

-

Sources said the Bermuda carrier has been working with Jefferies on the sale.

-

The announcement confirms earlier reports from this publication.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

The leadership team includes Spinnaker co-founders Dave and Ken Ingrey and ex-CUO Miles Allkins.

-

The Ahoy! deal marks the first acquisition for the RedBird-backed MGA.

-

Previously, Grace Meek was CEO and president of Homesite Underwriting.

-

Joy had previously set up the casualty practice at Global Indemnity.

-

Sure is the first Demotech-rated insurer to offer surplus lines homeowners.

-

Dowling Partners is advising the company.

-

Glatfelter CEO Chris Flatt will become interim chief executive.

-

After the 2007-17 decade of “bad underwriting” carriers are recovering from “past sins”.

-

The facility will target operators across the US, onshore and offshore.

-

It is backed by paper from MS Transverse, this publication understands.

-

The MGA’s capacity provider is Berkshire Hathaway Specialty Insurance.

-

This publication revealed that the company was raising capital earlier this year.

-

The Truist-owned cat MGA had reduced its line size to $50mn last year.

-

It’s unsurprising, following the Corvus-Travelers transaction.

-

Ryan entered into a £200mn currency forward to manage the appreciation risk of the Castel deal.

-

The latest development comes on the heels of the Corvus-Travelers deal.

-

The executive left OdysseyRe last August, as this publication revealed at the time.

-

In September 2023, Cowbell made the same number of staff cuts.

-

Bill Fahrner most recently served as CUO at Joyn Insurance.

-

The company’s book is being run off by Boost Insurance.

-

The company would ideally like to target a minority investment.

-

The new product provides coverage above the NFIP’s maximum limits.

-

-

The MGA will target small and mid-market firms and will also offer tech E&O products.

-

Arris Property Underwriters will offer $2.5mn in excess capacity.

-

Justin Ward will lead the firm’s production efforts in the expanding MGA market.

-

This follows a string of promotions dating back to last August.

-

The team will be led by Alejandra Hernandez Irizarry and Courtney Alonzo.

-

Aon approved Embrace as wholesaler late last year.

-

Founder Chris Leo has 20 years of experience running DBA programs.

-

The executive will split his time between San Francisco and New York.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

Laxner has prior experience at Ambridge, Converge, Axis, Markel and Chubb.

-

Koffie began work on a sale earlier this month following major layoffs.

-

Expanded underwriting capacity comes after a year of strong growth.

-

It is understood that the InsurTech began fundraising late last year.

-

The executive most recently served as qualified solutions group leader at Marsh

-

The parties also signed a release of claims arising from the Vesttoo fraud.

-

The executive added that he expects “some level of consolidation” in the fronting space, estimating that there are 24 players in the US market.

-

The MGA is led by CEO Dennis Kearns, a 25-year industry veteran who founded the transaction solutions program at DUAL, producing total gross written premium exceeding $600mn.

-

It is understood that the cyber InsurTech has ~$100mn of excess delegated authority capacity and around 20 backers.

-

The mid-market build-out comes in response to trading partners' needs for more on-the-ground-support for more complex risks and the constraints of a digital-only product.

-

Ohio-based Rokstone Farm Risks secured $15mn capacity for farm property, $5mn for farm excess and $1mn for auto liability.

-

The firm’s primary coverage includes general liability, workers’ comp, professional liability, umbrella and inland marine, according to its website.

-

The program offers professional liability, general liability and more for medical professionals in the healthcare industry.

-

Blandford noted that there is more willingness to deploy capacity compared to last year, a function of orderly January 1 renewals bringing in more capital and the absence of a major hurricane or wildfire in 2023.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

The trio includes AIG’s Carson Lyons, Starr’s Jeffrey Tippins and Lockton’s Chris Latta.

-

Kearns and his former employer recently settled a legal dispute following his departure along with two other colleagues last year.

-

Rokstone Underwriting has announced a $25mn North American marine facility backed by Allianz Commercial.

-

The announcement closes the $435mn-deal which was announced in early November.

-

Underwriting, finance and technology veteran Shaun Shenouda will oversee continued growth and expansion of the real-estate-focused MGU.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

Sources said that the New York-based underwriter lined up JP Morgan and Morgan Stanley as lead bookrunners for the process.

-

The capacity expansion addresses a gap in current limit options, the MGA noted in its Tuesday announcement.

-

The executive expects the Bermudian to start onboarding programs later in 2024 or early in 2025.

-

It is understood that AUB’s investment in Mexbrit includes the broker’s marine-focused MGA subsidiary Forte Underwriters.

-

The subsidiary will offer clients and capital providers a wide-ranging, single platform of financial lines products, with operations across the US, Europe, LatAm and London.

-

InsurTech Nirvana plans to expand its offerings with a program designed for fleets with fewer than 10 units.

-

Sources said the Gemspring Capital-backed group retained investment bank Baird earlier this year as adviser in the sale process.

-

The CEO said the strong performance of MGAs during market dislocation has made it more challenging to accurately value future growth potential of M&A targets.

-

Based in Philadelphia, ProVerity provides specialty products to underserved areas of professional liability business.

-

Convergence Point Solutions, the new JV, includes identifying the collateral as credit risk on a portfolio basis and recognizing the regulatory protections for the true risk of default as part of its approach.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

He was previously president of Kelly Underwriting Services, now part of CorRisk.

-

The company has promoted CUO Sim Bridges to president, while retaining the CUO role, and Kim Bushong Petrillo to president and COO.

-

Distinguished will initially offer a true follow-form excess product covering D&O, employment practices and fiduciary liability for public, private and non-profit risks.

-

The programme services carrier will serve UK MGAs from 1 January.

-

AM Best’s decision to remove second-largest front Clear Blue from under review is a small positive development for the fronting sector, but caution is still needed.

-

The agency cited the segment’s sustained growth and performance on a global basis but noted tight capacity for certain risks and uncertainty looming over the fronting market as offsetting factors.

-

Sources agree that there are others that could follow a similar playbook, but there are three key considerations to keep in mind when pursuing a strategic-on-InsurTech transaction.

-

Clear Blue has successfully moved active programs to either new reinsurers or the reinsurers on its existing panels have taken higher percentages, the agency said.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

A quick roundup of this week’s biggest stories.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The executive estimated nearly 30 fronting carriers in the market right now and anticipates that condensing to 10 to 15 fronts.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company distributes insurance through leading national commercial broker partners and currently focuses on manufacturing, agriculture and the construction industry.

-

The specialist MGA has made senior hires to bolster its M&A segment and legal and operations support.