Operations/tech

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The plaintiffs' bar has been playing out the same rulebook for 15 years. It’s time the defense catches up.

-

Finance and insurance hiring is 27% below 2022’s peak, compared with 37% nationwide.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

A former NOAA climatologist who left the agency is running the new operation.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The layoffs will mostly affect workers in Michigan.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

Getting that message across is key to bettering the industry.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

The executive has been with ASG since it was formed in 2016.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

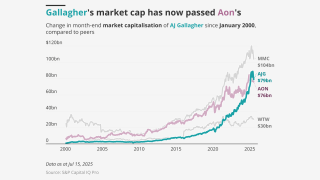

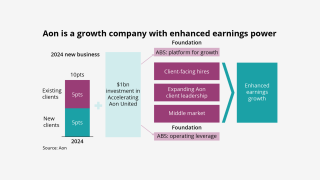

The deal’s benefits headlined AJG’s investor day presentation.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The program, expected to start doing business next month, will be wholesale-only.

-

It is understood that CyberCube has been considering a sale of the business.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Sales velocity ticked up to 12.2% in Q2 but has remained steady in the past five years.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

The 127-acre corporate campus has been the reinsurer’s North America headquarters since 1999.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

The executive said the claims industry is going to “be transformed”.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

The technology will help analyze growing and emerging risks, especially climate change.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

While official return to office mandates have gathered steam, what they look like in practice can vary widely.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The insurer’s system has now been out of commission for over two weeks.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

The insurer first noticed “unusual network activity” on June 7.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The Series C brings the company's valuation to $2.1bn, its highest to date.

-

This publication revealed back in February that Itel was being prepared for a sale.

-

Ed Short was previously VP, digital partners, at Arch.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The Floridian brokerage expects to bring its leverage levels below 4x later this year.

-

The program will succeed the previous buyback launched in 2023.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

Specialty insurer’s global chief of claims warns others about the allure of AI.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

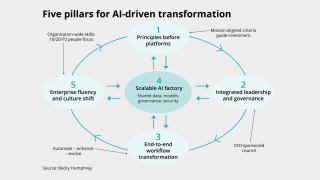

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

-

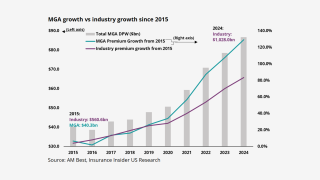

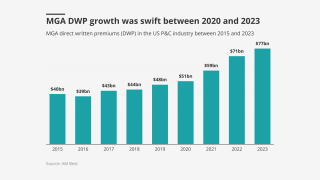

MGA growth is still strong but has passed its 2022 peak.

-

In an interview, Blue spoke about integration, organic growth, M&A and current market uncertainty.

-

Of the $170mn cat losses outside LA wildfires, US cat activity accounted for 74% and international cats 26%.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

The BRIC program helped fund local resiliency programs, which can reduce loss costs.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

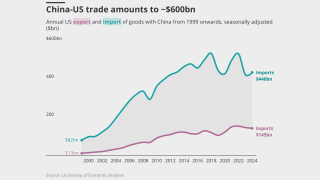

Business hates uncertainty and geopolitical tensions are off the charts.

-

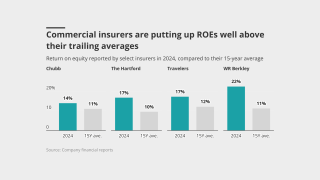

Despite elevated ROEs, insurers have remained disciplined.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

The amount of change over the past year falls short versus the discourse.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

Colorado and New York have already passed regulations regarding insurer AI use.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

Shareholders say the stock has declined around 59% in the past year while book value has dropped ~30%.

-

The company is seeking to expand in the reinsurance and retrocession markets.

-

He also joined Everest’s board last week as an independent director.

-

The move combines two units in the North America middle market division.

-

Tactics underwriters employ to manage cyber risk are maturing, as well.

-

The market is up against emerging risks and a whole heap of uncertainty.

-

Customers will keep their agent relationship and policies will not be impacted.

-

The carrier is looking to accelerate E&S growth after 7% expansion in 2024.

-

The group will house a segment for specialty and benefits and another for underwriting.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

A quick roundup of our best journalism for the week.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

The firm laid off senior leaders this month, weeks after it began pursuing a sale, this publication can reveal.

-

The broker will be using Verisk US agricultural risk models.

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

The insurer will move its Atlanta-area assets to a new "innovation hub".

-

The chief executive will also receive a yearly bonus of 200% of base salary.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

Last week, the insurer placed ~450 staff at risk of redundancy in its international business.

-

The move is the latest phase of the operational transformation program, AIG Next.

-

Reinsurers continued to diversify into primary and specialty business.

-

The unit will support Ascot’s third-party capital business.

-

-

Axa's newly formed teams join the company's "complex cyber" unit.

-

Trade, technology, weather and workforce were identified as the main megatrends.

-

-

The operation will be led by Stephen Saunders, with Jawad Ghunaim from AIG as CUO.

-

The Oxbow report found that AI use cases span the entire (re)insurance capability model.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

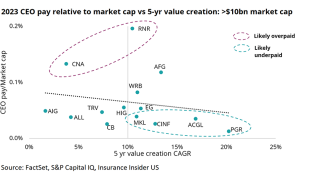

Analysis shows several CEOs with pay diverging from the trendline.

-

From a buyer and underwriter perspective, managing top risks needs fresh approaches.

-

The company will now focus on its better-positioned businesses.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

He will oversee management of the P&C loss adjusting business.

-

Mexico is Everest’s second office in LatAm after the (re)insurer opened its regional headquarters in Chile.

-

The shares are being sold by select shareholders in the group.

-

The FTC issued a final rule on April 23 banning the use of non-competes nationwide.

-

The carrier is also seeing growth opportunities across the West.

-

-

The technology will drive hyperspecialization, panelists said.

-

The MGA will be offering $10mn limits for $300mn-$10bn companies.

-

The Coalition Cyber Threat Index predicts a jump in exploit-based cybercrime this year.

-

The carrier laid off approximately 850 staff late last year.

-

Putting together two “show me” stories risks investor skepticism.

-

CEO Joseph Brown’s compensation will continue at $1mn with a minimum annual bonus opportunity of $2mn.

-

In his first interview as CEO of the private brokerage, Zimmer said he will not change the DNA of the firm and that legislation around non-competes may help Alliant.

-

In addition, the executive is eligible to receive an annual bonus of $262,000 for threshold performance, and up to $437,500 for maximum performance.

-

Its confederation of insurance subsidiaries will have to operate with fewer strategic advantages than they do today.

-

The programme services carrier will serve UK MGAs from 1 January.

-

Insurers should reserve as conservatively as possible, maximize their product set, and decide if they are buyers or sellers.

-

The reduction in force amounts to less than 10% of the company’s total headcount of approximately 500, a spokesperson told this publication.

-

The reorganization reflects the carrier’s prioritization of customer service and use of digital tools to help customers and partners.

-

The 3x3 plan takes the things about the firm over the last decade that have been distinctive and intensifies them.

-

The cuts amount to roughly 2% of the insurer’s US workforce.

-

The broker’s share price fell by around 4% after the announcement of its Q3 results and extended restructuring program.

-

New risk transfer platform will allow MGA, InsurTech, embedded insurance customers cost-effective path to building “full-stack” insurance operations

-

The report said that, to date, ransomware victim numbers for 2023 have already surpassed those for the entirety of either 2021 or 2022.