-

The carrier could be the first tech-enabled underwriting business to test public investor appetite since the heady days of 2020.

-

A recent report from Howden shows ransomware activity is up 48% year-on-year.

-

The first signs of limit expansion, growing appetite in the admitted market, and retail brokers' impatience with wholesalers are all evident.

-

The group’s returns have been driven by Two Sigma, but the total return model is perceived as toxic.

-

Right now firms pursuing this strategy are winning, although there are some potential slow-burn issues to watch.

-

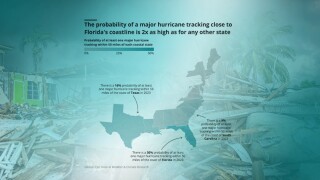

It’s unclear how long some insurers will be able to sustain the cost of doing business in Florida, whether the question is making it through another quarter, another hurricane season or another renewal.

-

The pivot from the industry’s arch decentralizer underscores the opportunities brokers are chasing in a deteriorating operating environment.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

Strong rhetoric from Munich Re means the US market will sooner or later have to take a position on cyber war wordings.

-

The company has been weakened somewhat, and the base case now is a return to grinding out new CEO Scott Egan’s refined strategy.

-

When a Grade A franchise like Hub refis at this kind of valuation, the read across to other assets is highly negative.

-

Senior departures, the Corebridge stock price and the arrival of Dan Loeb all throw up additional obstacles.