-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

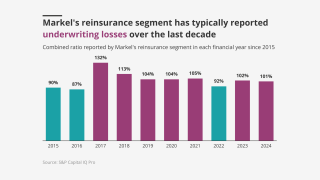

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

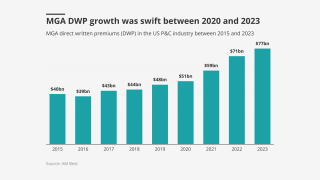

After a period of business building, MGAs will likely spend more time optimizing.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

The non-peak peril is not secondary anymore.

-

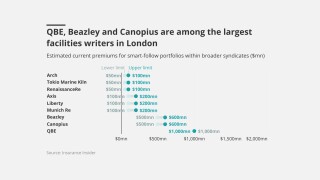

The big brokers are lining up London capacity to write follow lines on US risks.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

Insureds often just want cover in place at the lowest price possible, and insurers oblige under the skeptical eye of regulators.

-

The Florida of 2022 lacked stability and saw many carrier insolvencies.

-

Challenges will include boosting the target’s organic growth, Building the Machine, and prepping for an IPO.

-

After a period of re-assessing risk appetite, underwriters were signalling growth again – that was, before the fires.