-

Attendees noted the increased presence of service providers and carriers.

-

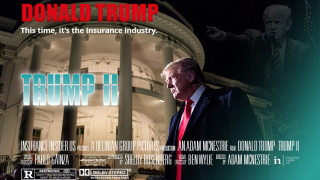

A more business-friendly approach will be offset by increased uncertainty.

-

Long-term confidence in the market depends on the details of the new tax rule.

-

Reinsurers are reporting stellar 2023 results – what they do with the earnings will be crucial.

-

It’s unsurprising, following the Corvus-Travelers transaction.

-

The firm took a major reserve charge and has gone into remediation mode.

-

Sources said Stone Point and CD&R will each have stakes of around 35%.

-

A minority view gaining currency is that 2016-19 will not be the only problem.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

Putting together two “show me” stories risks investor skepticism.

-

The firm may be a victim of its own success and size but a challenging macro landscape is also presenting obstacles for levered brokers as The Squeeze 2.0 looms.

-

Organic growth will slow from historically elevated levels and the increased cost of debt will take its toll.