Personal E&S

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The company plans to launch in New York and New Jersey next year.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The transition will be implemented starting October 15.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

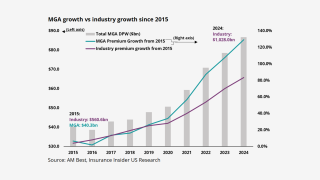

MGA growth is still strong but has passed its 2022 peak.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

The carrier has received 12,300 claims as of 28 March.

-

Surplus lines are still strong, but not the standout they used to be.

-

Shift to growth includes all geographies in which the company does business.

-

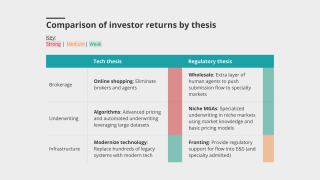

Insurers and distributors must adapt or risk irrelevance.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

Insurance Insider US chats with Kevin Doyle on the state of the E&S market during WSIA.