Progressive

-

Progressive’s combined ratio for the month deteriorates by 60 basis points.

-

Consumer Price Index data points to short-term and long-term risks to the P&C industry.

-

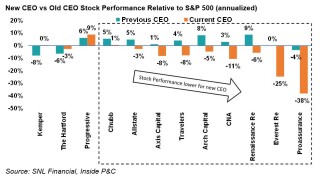

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

Progressive has hailed its rigorous approach to reserving and depth of experience in commercial auto as the secret to its success with insuring TNCs.

-

The transaction adds around $547mn of gross written premiums to Progressive’s $5.6bn commercial auto book.

-

Continued capital depletion could result in additional pressure on management teams with regard to executing their original business plans.

-

Any faster-than-anticipated re-opening could have a negative impact on loss cost trends.

-

The personal carrier reported highest MoM PIF growth in 60 months in direct auto.

-

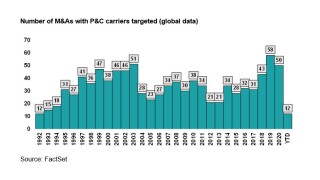

The next few years could prove to be more active in consolidation than normal for underwriters.

-

On a forward basis, frequency estimates could look high with base figures in 2020 being significantly impacted by initial lockdown measures.

-

Independent agency distribution remains incredibly robust, despite the Covid-19 pandemic and the emergence of direct-to-consumer InsurTechs.

-

Following a year of impressive results, benefits from low accident frequency appear to be fading based on the latest print.

Related

-

Progressive’s reinsurance coverage reached $2.2bn in Q2 2025

August 05, 2025 -

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024