Progressive

-

The carrier had renewed its catastrophe XoL private market reinsurance for its property business, effective June 1.

-

Personal auto loss severity rose about 12% year-over-year. The carrier also experienced a “modest” year-over-year increase in frequency of about 1%.

-

Progressive has now reported three consecutive months of adverse development. The Inside P&C Research team takes a closer look.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company added that prior and current accident year increases were related to a higher ultimate severity on previously closed claims in its property damage coverages.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

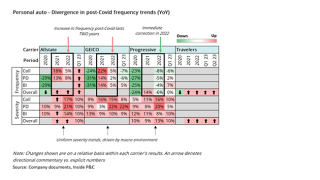

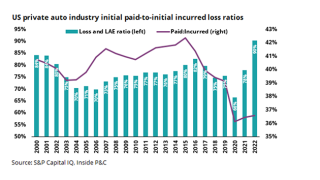

An uneven loss environment in personal lines calls for a cautious reading of reserves.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company booked another 4.6 points of adverse reserve development during the quarter, with 85% attributed to personal auto and 20% to commercial auto.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024