Progressive

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive added that Progressive is not open for new business in home, dwelling fire and condo coverages.

-

Meanwhile, Tricia Griffith said the commercial lines business experienced minimal impact from Ian, as physical damage and comprehensive cover are smaller parts of its premium.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

The carrier reported that $585mn was recorded from auto losses incurred, including boats and recreational vehicles.

-

Auto insurers look set to generate a larger share of losses than with most US wind events.

-

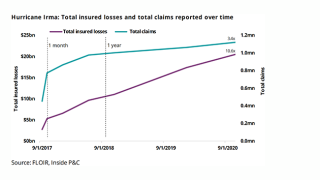

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

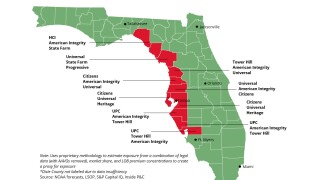

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

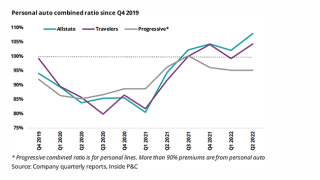

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

On an investor call with analysts, Pratt added that the challenges of the Florida property market have greatly impacted Progressive.

-

Chubb pushed its loss trend assumptions higher as it seeks to stay ahead of inflationary pressures.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024