-

The bill would also mandate guaranteed replacement cost coverage.

-

This is lower than some estimates, which had put insured losses at over $30bn.

-

Based in San Francisco, the executive specializes in venture capital and AI companies.

-

The deal valued the tech-driven broker at over ~21x 2025 adjusted Ebitda, suggesting a hefty premium.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The carrier said it anticipates a better market due to recent reforms.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

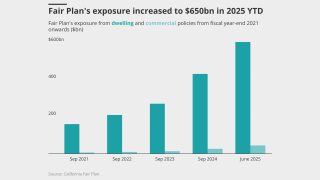

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

JP Morgan and RBC are advising the brokerage on its options ahead of an eventual IPO.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

This is the first rate filing to use the recently approved Verisk model.

-

In an interview, the firm’s CEO spoke about the CV deal, growth and its M&A pipeline.

-

The company plans to launch in New York and New Jersey next year.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

New business written premiums were up in the commercial and E&S segments, but decreased in personal lines.

-

The company adjusts its rate options to expand California business under the new cat model.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The class can collectively challenge State Farm’s property claims calculations.

-

But June was the busiest month of the year on the back of recent broker churn.

-

Florida recorded premium growth in June after declines in May and April.

-

The transition will be implemented starting October 15.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Few claims have been filed thus far, as damages have been highly localized.

-

The ongoing demonstrations could have law enforcement liability implications.

-

Lara approved an interim rate increase for the company just weeks ago.

-

GCP retains a controlling interest in the Californian retail brokerage.

-

Up to nine million acres of US land are considered likely to burn.

-

The company seeks the full 30% homeowners’ rate request it made last June.