-

The parties now have 60 days to file a stipulation to dismiss the action.

-

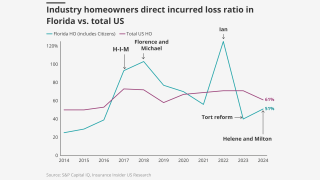

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

Sources said the Floridian insurer has been working with Deutsche Bank on the listing preparations.

-

The executive joins from RenaissanceRe.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The company sees itself in a “very strong position” in the state.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Founder Chad King will transition to chairman but continue leading M&A efforts.

-

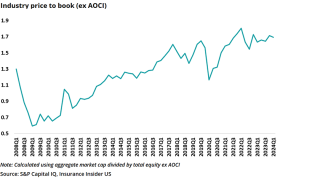

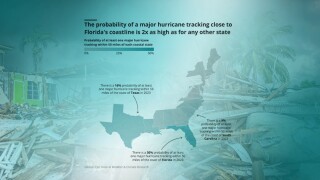

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

New home sales could be impacted by a prolonged stalemate.

-

She previously served as Hub’s North American casualty practice leader.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The company is estimating its IPO price at $18-$20 per share.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

A report by the ratings agency challenges current industry wisdom.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The broker posted a 6.5% drop in organic growth YoY.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

At least 14 new companies have opened up shop in the state in recent years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The segment is also seeing double-digit loss cost inflation.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

Florida recorded premium growth in June after declines in May and April.

-

The program’s total limit this year is down $594mn to $1.36bn.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The insurer intends to take on up to 81,040 policies this year.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

An active hurricane season threatens to weigh on hard-fought capital and underwriting margins.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The Floridian is the third insurance company to go public in 2025.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

This publication revealed back in February that Itel was being prepared for a sale.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

The $2.59bn renewal is up 45% from last year.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

This publication reported earlier today that the S-1 filing was imminent.

-

This publication reported earlier this year that the carrier is targeting a $250mn-$350mn raise.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

The sale process was first reported by this publication three months ago.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The assumption date for the combined 16,250 policies is August 19.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

The Tampa-based insurer says it will use the capital for general corporate purposes.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The total cost for the program increased 1.8% from last year’s.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The initial offering includes 6,875,000 shares of common stock.

-

The offering launched last week with a valuation between $103mn and $116.8mn.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Planning for the carrier was halted in January due to the CEO’s health issues.

-

The executive will oversee Howden Re’s treaty and fac business in Miami as well as the firm’s specialty insurance unit.

-

Q1 rates in most lines were consistent with prior quarters but slightly down on 2024.

-

The initial offering will include 6,875,000 shares of common stock.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The deal echoes Lightyear’s earlier investment in Inszone Insurance.

-

Howard and Moore were among a group to receive letters over links to prior insurance insolvencies.

-

In operation since 1991, Pearl represents Ocean Harbor and Equity insurance companies.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The insurer achieved an 86.4% acceptance rate of the policies selected.

-

The release followed the filing of an updated Plan of Operation.

-

The Floridian company applied to be traded on the NYSE.

-

The 12 insurers together have $418mn in policyholder surplus.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The bill being considered would effectively eliminate personal injury protection.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

Mangrove can take out up to 81,040 polices while Slide’s limit is 15,000.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

Shift to growth includes all geographies in which the company does business.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The MGA is offering lines of $25mn, up from the $10mn limit it was providing until late last year.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

Enacting SB 360 may have created a spike in construction claims in Florida.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The policies represent approximately $35mn of in-force premium.

-

Slide lined up Morgan Stanley, Barclays and JP Morgan as lead bookrunners.

-

The news comes around three months after GTCR agreed to sell AssuredPartners to AJ Gallagher for nearly $13.5bn.

-

At the first Insurance Insider US Miami Forum, Floridian industry players pointed to signs of stability.

-

The bill seeks prompt claims payments and settlements, and greater transparency.

-

His predecessor Peed remains with the firm as executive chairman.

-

The spillover impact from the LA wildfires will play a major role in how much reinsurance capacity will be available.

-

Citizens approved an average 8.6% rate hike and decreases for one-fifth of policyholders.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

The Florida of 2022 lacked stability and saw many carrier insolvencies.

-

The new Floridian carrier plans to write homeowners’ insurance in Q1.

-

The bill would put new restrictions on bad faith claims, close loopholes.

-

The homeowners’ carrier has secured Floir approval.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

California’s crisis spurred the biggest reforms in decades.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

The insurer will conduct an audit to ensure “transparency and accountability.”

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Weiss Ratings has claimed that insurers are short on reserves and deny legitimate claims.

-

The loss figure has increased 200% from the initial number provided in October.

-

The last time Citizens had fewer than 1 million policies was in 2022.

-

The company said Helene claims have surpassed those of Hurricane Ian.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

A total of $2.1bn in Fema money has been approved for the state.

-

Heritage’s Q3 combined ratio improved 10.2 points to 100.6% driven by lower losses and expenses.

-

The firm will provide an update on November 22 to avoid holiday season.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Richard Mangion spent almost two years as CFO at Bridgehaven.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

Sources said that Milton may slow the pace of rate deceleration.

-

The firm still expects to deliver positive net income for Q3 2024.

-

The Floridian insurer has $80mn in surplus, with retention sitting at less than 10%.

-

The company said $13bn-$22bn will come from wind damage.

-

Hurricane Helene was blamed for $92mn of those losses.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

RMS will issue its final loss estimates for Milton later this week.

-

Milton’s significant but less-than-expected hit shifts our expectations for industry recovery.

-

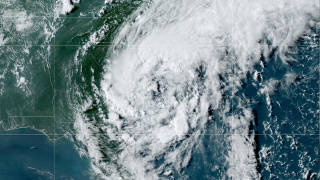

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Over the past several months, Floir approved nearly one million policies for takeout from Citizens.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

Florida insurers averted a crisis, but reinsurers will still see damages.

-

Shares gained after Hurricane Milton did less damage than anticipated.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

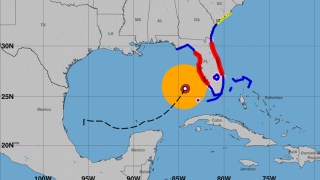

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

Florida domestics, reinsurance rates and the NFIP are all under watch.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

American Integrity will take the largest chunk, out of six insurers total.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Milton stole the limelight from slightly stuck PE-backed brokers, acquisitive globals and the casualty conundrum.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Industry sources widely expect the storm to wipe out Q3 earnings progress for domestics.

-

Potential for rate cuts at the upcoming Fed meeting should be an addressable event for P&C insurers.

-

The underwriting venture, Florida Re, will target both US and LatAm markets.

-

Eight Floridians will take on personal residential multi-peril and wind-only policies.

-

Citizens’ auto-renewal controls were down from February 2023 to August 2023.

-

The ruling only applies to a Florida retirement community.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

CFO Lusk said the company is about 99.2% closed on claims from the 2017 storm.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

Comparatively, in November 2023, the regulator had consented to 202,399 policies to be taken from Citizens.

-

The CEO noted that the tort reforms have not led to rate pressure yet.

-

Both admitted and non-admitted markets grew by more than 42% last year.

-

It is understood that the company expects to launch its Florida reciprocal in Q4.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

The $1.6bn of cat bond limit on-risk includes $1.1bn Everglades Re mega-bond.

-

The proposal now goes to the Florida Office of Insurance Regulation for review.

-

Excess capacity rebounded in June 2023 after hitting a decade-low just 12 months earlier.

-

The program includes all perils coverage and third-event protection.

-

Spreads on all tranches of notes settled above the initially guided range.

-

The CEO is one of more than 20 executives who received letters from Floir citing Statute 624.4073.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

The loss ratio in the business that HCI assumed was also better than anticipated.

-

The carrier has completed its 2024-25 reinsurance renewal.

-

Formed in 2006, Centauri is a Demotech A-rated firm headquartered in Sarasota.

-

Tim Cerio also credited litigation reforms for the current market recovery.

-

The carrier of last resort is proposing total risk transfer of $5.5bn.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

It is understood that the company aims to launch in Q3 or Q4 of this year.

-

AM Best recently downgraded the insurer after Gallatin Point acquired a majority stake last January.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

May and June takeout requests for Citizens are exceeding expectations.

-

Overall rate expectations are flattish to single digit increases.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

Sources said preparations for a 2024 IPO were halted, but work could resume later this year.

-

The downgrades reflect Gallatin Point’s recent acquisition of a majority stake in TRUE.

-

A hearing with the Florida Office of Insurance is scheduled for February 21.

-

The increase in limit reflects the carrier’s growing exposure.

-

The company is aiming for a 2024 Florida rollout, offering HO-3 and DP-3 policies.

-

The reciprocal will write homeowners’ insurance primarily in Florida.

-

The carrier expects to re-emerge after operating as going-concern Anchor.

-

As last year’s reforms shake out, only a few changes are pending for 2024.

-

Dan Galbraith, BRP Group’s COO, and Jim Roche, the firm’s chief insurance innovation officer, will serve as co-presidents.

-

The legislation would make all residences with dwelling replacement costs between $700,000 and $1mn eligible for coverage through the state insurer if denied by the private market.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

If the Floridian goes through with a listing, it will be a true test of whether the public markets believe that the state’s fragmented insurance market is fixed, or on its way to being so.

-

Sources said the fast-growing homeowners' Floridian is finalizing the process to retain investment banks with the aim for an equity event to take place in the first half of the year.

-

In November, CORE received its certificate of authority from the Florida Office of Insurance Regulation to transact insurance in the state.

-

December premiums were up for all three of the top E&S states, with California posting the largest percentage increase at 44.2% YoY.

-

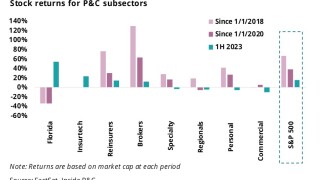

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The assumption brings TypTap’s total in-force premium to $1bn.

-

The reforms are working for claims filed after December 2022, but attorneys are still litigating claims filed prior to the legislation.

-

The limit on the reinsurance Citizens will look to buy from the private markets will stretch to $14.35bn, up 2% on prior-year coverage.

-

November premiums were up for all three of the top E&S states, with Florida posting the largest percentage increase at 21.8% YoY.

-

The Senate Budget Committee, chaired by Democratic Senator Sheldon Whitehouse, is seeking information on plans to address increased underwriting losses from extreme weather events.

-

A quick roundup of this week’s biggest stories.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Cedeño Camacho will expand his insurance carrier holdings to North America.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The office also said it has approved the assumption of 650,399 policies from Florida Citizens so far this year, a more than 800% increase from the previous year.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

The rating reflects Orange's low underwriting leverage and significant surplus relative to projected premiums written

-

The bill would spur development of a crop insurance policy to cover losses caused by cold exposure and freezes.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The company targets specialty markets that it believes are underserved by larger insurers and focuses on niche business lines and fee-oriented services.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Following reforms enacted by the state, the insurer will seek to provide new insurance coverage options to property insurance policyholders.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

Pricing, reserves and uneven catastrophe losses will be the theme this quarter.

-

In a presentation before Florida lawmakers, Cerio noted recent success in Citizens’ efforts to move policyholders to private insurers and reduce risk exposure.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

HCI subsidiary TypTap Insurance Company has received approval from Floir to assume up to 25,000 policies from Florida’s state-owned insurance company.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The first non-renewals are scheduled for May 2024 in what is expected to be an 18-month process.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

“They’re playing Moneyball,” Petrelli told attendees during the Inside P&C conference in New York, decrying the increasingly sophisticated ability of law firms to attract clients and parse effective litigation strategies.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Panelists at Inside P&C New York highlighted the changing role of MGAs, as legacy carriers pull back from cat-prone areas to combat growing losses from hurricanes, SCS and other secondary perils, such as wildfires.

-

A number of the largest hurricanes have come post-peak, but the industry remains well capitalized.

-

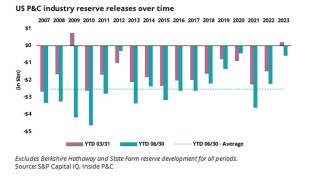

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Hale Partnership CEO Steve Hale added that the policies in the area where Idalia hit represent less than 5% of the carrier’s book.

-

The insurance company had set out plans last summer to expand its market share in Florida.

-

The reciprocal exchange received a consent order on Friday and is expected to begin underwriting in December

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The hurricane, now a Category 1, is tracking around 100 miles west of Savannah, Georgia and is expected to pass through the Charleston area of South Carolina.

-

Industry loss estimates range from $3bn to $10bn, but loss figures will become clearer in the days to come.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

More than 800,000 houses could be affected by the hurricane’s storm surge.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

-

The storm is now forecast to become a major hurricane by Tuesday night. This morning’s advisory update had estimated that Idalia would reach major hurricane status by early Wednesday.

-

A major hurricane in any section of Florida that extends into the Southeast states is likely a “multi-billion-dollar” insurance industry event, according to the broker.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

The nod follows that of Mainsail Insurance Company, owned by Hippo subsidiary Spinnaker, in August and HCI-owned Tailrow Insurance Company in April.

-

The start-up was previously targeting a $75mn raise. Investor meetings started last week and will continue into next week.

-

AJ Gallagher has recruited a pair of executives from Howden to boost its Latin American treaty footprint, this publication has learned.

-

The domestic carrier will write homeowners’ multi-peril business, according to filings which also detailed that $300,000 of the initial capital will be used to complete the statutory deposit requirement.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The executive said that the company reduced its consolidated retention and ceded premium ratio for its 2023 and 2024 treaty program.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The number of policies being requested in the first half of 2023 is larger than the total number of policies requested for 2022.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Following media reports last week that AAA had plans to pull out of the Florida insurance market entirely, the home and auto carrier "set the record straight” on Monday.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision applies only to policies issued through the company’s exclusive agency distribution channel.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

Bruce Lucas added that the company is no longer pursuing a Series B round.

-

Recent tort reforms, carrier capital and reinsurance relationships will determine the future for Floridians.

-

Considering recent reforms, Citizens’ rates, on average, are still 58.6% below actuarially sound levels, but the inadequacy would have been 88.3% without them.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

It’s unclear how long some insurers will be able to sustain the cost of doing business in Florida, whether the question is making it through another quarter, another hurricane season or another renewal.

-

Tower Hill Insurance Exchange has completed its 2023 Florida reinsurance program, which offers nearly $2bn for catastrophe cover, including all perils.

-

The bills place additional requirements on insurers in the state and expand consumer protections.

-

The program “exceeds regulatory and rating agency requirements and provides coverage for multiple catastrophic events”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.