-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Drummond had asked the state’s insurance commissioner to help him combat rising rates.

-

California and Florida were up significantly, but premium growth slowed in Texas.

-

The president and CEO will also be eligible for up to $50mn in shares.

-

The first round of 2026 renewals was largely favorable for buyers.

-

Tom Wakefield says there is scope for opportunistic reinsurance purchases in 2026.

-

The market was unphased by January’s record wildfire loss in Los Angeles.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

The ratings agency maintained a neutral sector outlook.

-

The pricing battle has been played out but the extent of new demand will only show up in 2026.

-

The former EVP and head of annuity solutions will replace Schaefer upon retirement.

-

Jim Hays outlined $90mn in stock losses as Howden called Brown & Brown’s narrative “false and inflammatory”.

-

Verisk entered the agreement to purchase the SaaS platform in July this year.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

This year, Brown & Brown, WTW and Baldwin emerged as major acquirers in the latest consolidation cycle.

-

Based in San Francisco, the executive specializes in venture capital and AI companies.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

In a state prone to SCS, wind, floods and freezes, carriers are still fighting for market share.

-

Cedants are opting to bank double-digit savings as reinsurers fight for market share.

-

Sources said hundreds of Brown & Brown staff across various offices have left to join Howden US.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

In casualty, the executive is seeing an acceleration of flight to quality both from cedants and reinsurers.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

Ackman will need leaders like Ajit Jain behind him and make the right bets at the right price at the right time.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The company named two execs to head global wholesale and commercial.

-

Valor Equity led the raise, which included Lightspeed and General Catalyst.

-

Ackman is targeting high-teens RoE at Vantage via underwriting gains and equity investing.

-

Inflation was down from the 3% recorded for the 12 months ending in September.

-

Lower rates, more favorable policies and improved public cyber infrastructure are all contributing to the trend.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

The federal judge said South has direct knowledge about a previous raid involving Aon.

-

The National Council of Insurance Legislators said insurance oversight should be left to states.

-

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

Justin Camara was EVP and portfolio director for financial and professional liability.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

A district court judge had dismissed the case in September, with prejudice.

-

The company also promoted Zulma Suarez to CEO of Colombia and Venezuela.

-

Sources said the auction launched after Thanksgiving with Relation marketed off adjusted Ebitda of around $130mn.

-

HSB CEO Greg Barats and American Modern CEO Andreas Kleiner will retire at the end of Q1 2026.

-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

The deal valued the tech-driven broker at over ~21x 2025 adjusted Ebitda, suggesting a hefty premium.

-

Insurance deals leader Mark Friedman said there is a backlog of companies looking to go public.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Attorneys and doctors targeted by the case claim Uber has no standing to bring a Rico suit.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

He served as SVP of transportation at ISC since mid-2024.

-

The carrier combined its E&S primary and excess casualty units into a single group.

-

This publication revealed earlier Everest could sell its LatAm and Canadian units.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

A motion to dismiss argues the case should not have been filed in federal court.

-

The trucking carrier has been building out its executive team this year.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

Fleming Re bought the James River Re legacy book in 2024.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

Sources said the Floridian insurer has been working with Deutsche Bank on the listing preparations.

-

The legal setback came as publication of a Fema reform report was postponed.

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

The change was made on December 2 and was effective immediately.

-

The company announced four internal promotions this week.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Trump’s shadow loomed over the beachside sessions.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

The highest portion of losses was experienced in Alberta.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The CEO said that new funding will be used to expand its underwriting capabilities.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

The Republican said his office has launched an investigation into the denials.

-

Ford had purchased a builder’s risk policy from the insurer.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The years-long legal battle was brought on by a former employee alleging wrongful termination.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

Earlier this week, The Baldwin Group said it will merge with CAC Group in a deal valued at $1.026bn.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

The executive said maintaining capacity is the main challenge in a soft market.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

The transaction is expected to close early in the first quarter of 2026.

-

The company had argued the judge missed key info when dismissing the case.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

The hire advances Howden’s growth push in the US.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Next year will mark five consecutive years of insolvency increases.

-

The deal is slated to close in the first quarter of 2026.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Former chief growth officer Michael Anderson has taken on the CEO role.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Last month, Insurance Insider US revealed that MMA was set to buy Atlas following a sale process.

-

The MGA said payments to affected customers began shortly after the event.

-

Texas was up over 25%, though California and Florida both recorded reductions.

-

In September, Insurance Insider US revealed that the firm had instructed a recruiter to search for Kinney’s successor.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

The executive was previously the cyber practice lead for Ryan Financial.

-

The London-based MGA will begin underwriting its international book next month.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The carrier said it anticipates a better market due to recent reforms.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The PE firm held 3.1% of the company’s shares, but will now hold none.

-

The industry veteran retired from AIG at the end of last year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

-

The city said it was self-insured at the time of the attack.

-

The peril has been historically difficult to model compared to others.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Habayeb will start next May following Kociancic's retirement.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

GC continues to pursue Willis Re and individuals in court.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

The move comes after the company posted 52% YoY top-line growth in Q3.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Senators asked for data on fraud but weren’t given any.

-

The company announced four key leadership appointments on Wednesday.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

The plaintiffs' bar has been playing out the same rulebook for 15 years. It’s time the defense catches up.

-

The tech error, now resolved, halted traffic to sites like X and ChatGPT.

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The executive joined the company from Zurich last year.

-

He will be replaced at a time when Fema is considering structural reforms.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the revision.

-

The executive joins from RenaissanceRe.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

Existing facilities and carrier partners will be transferring from K2.

-

Finance and insurance hiring is 27% below 2022’s peak, compared with 37% nationwide.

-

MassMutual will retain an 82% stake in the $470bn asset manager.

-

A motion by defendants to dismiss the case was also denied.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Bryant has spent over 30 years with the specialty carrier.

-

The deal to reopen the government also extended the NFIP.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The company expects to have $415mn to $430mn of third-party written premium in Q4.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

Many nuclear verdicts become much less radioactive on appeal.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The executive most recently served as the company’s chief broking officer.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The defendant held a $1mn general liability policy with Kinsale.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Sources said that the platform drafted in Ardea Partners to advise on the recap.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The credit can now be applied to mitigation against operational losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The company is also prepared for potential M&A activity.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider US’s comprehensive deal database.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Marsh is also suing a second tier of former Florida leaders.

-

This publication exclusively reported the executive’s plans last month.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

HNW family offices are now among investors considering the US MGA segment.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

The search for a CFO had been underway since last July.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

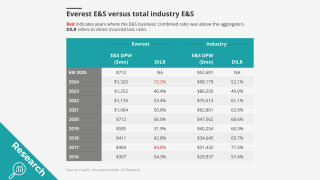

A re-focus on reinsurance nearly brings Everest back where it started.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

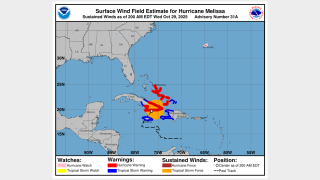

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

Opportunities for growth remain in small and medium commercial accounts.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

The executive joined the Dallas-based insurer as CUO in 2023.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.